China vehicle market being supported by NEV incentives

In August 2024, China's automotive market exhibited a positive month-on-month (MoM) growth trajectory, spurred on by policy incentives and market demand. Despite year-on-year (YoY) declines in automobile production and sales due to seasonal factors and economic fluctuations, the market demonstrated considerable resilience.

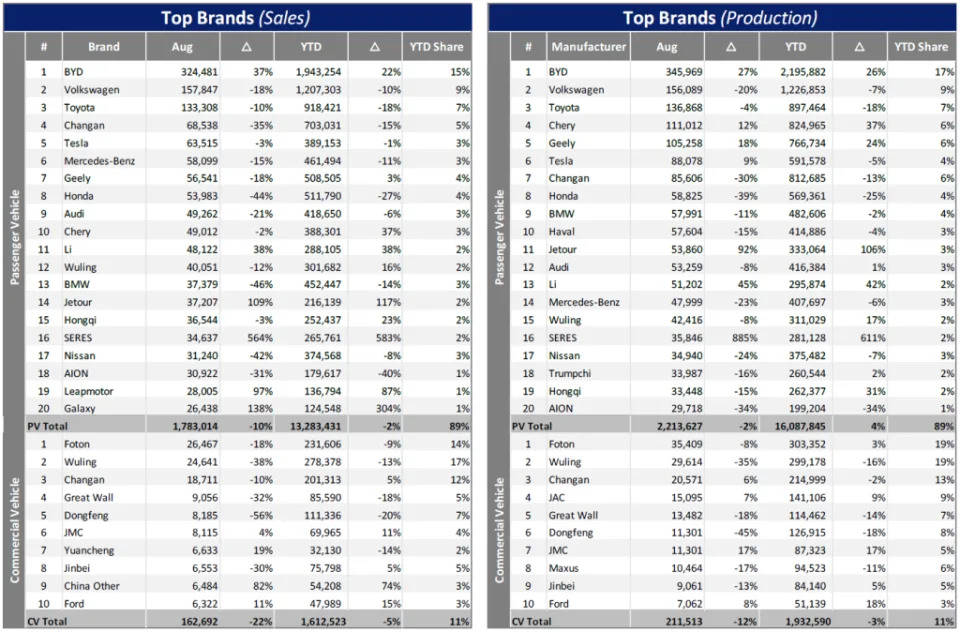

Domestic light vehicle (LV) sales, excluding exports, amounted to 1.9 mn units, showing a significant YoY decrease of 10.8% but a MoM increase of 7.9%, influenced by the high comparative base of the same period last year. In the passenger vehicle (PV) segment, sales volume shrank to 1.8 million units, with a 9.6% YoY decline but a substantial MoM increase of 8.6%. Light commercial vehicle (LCV) sales also saw a contraction, dropping to 163k units, with a significant YoY decline of 22.5% and a slight MoM increase of 0.7%.

From January to August of this year, LV sales reached 14.9 mn units, experiencing a YoY decrease of 2.3%. PV sales constituted most of this figure, totalling 13.3 million units with a 2.0% YoY decrease. Although the LCV market is significant, it also experienced a slight YoY downturn of 5.0%, with sales amounting to 1.6 million units.

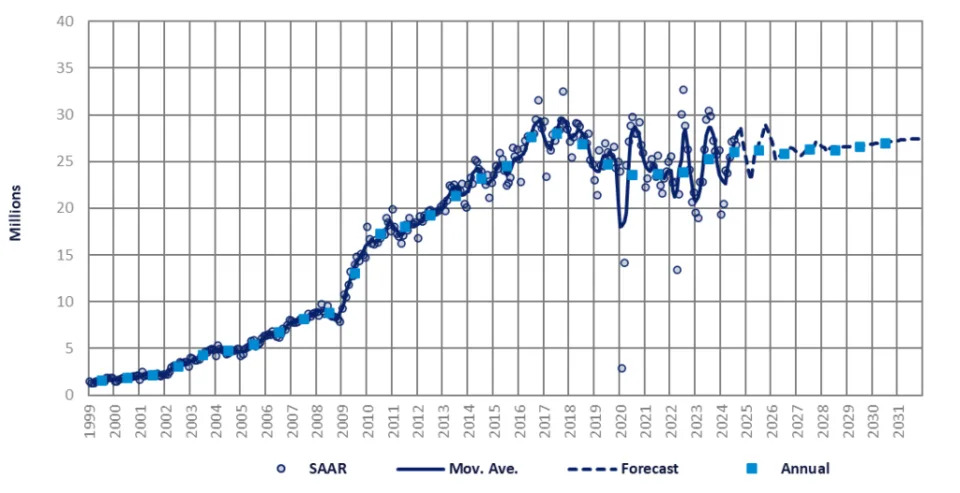

In China's domestic market, the sales rate for August hit an annualised pace of 27 million units, a slight 2% dip from the previous month's figures. The rate has been hovering around the 27 million units/year mark since June, after enjoying a steady climb from an average of 22.6 million units/year during the initial months of the year, January to May. Despite a nearly 10% YoY decline in August sales and a 2% dip YTD when compared to the robust figures of the previous year, there's a silver lining on the horizon. The government's recent move to double scrappage subsidies is anticipated to inject a strong dose of vitality into the market for the remainder of the year. The sales forecast remains largely positive, with only a minor downward tweak to the 2024 light commercial vehicle forecast. The market is projected to experience a 3% upswing, reaching an estimated 26 million units in sales by year-end, a testament to the sector's enduring potential for growth.

Although August's sales figures appeared somewhat lacklustre, this was primarily due to the faster-than-expected decline in the share of ICE and JV brands in China. However, NEVs, predominantly Chinese brands, have not only sustained their robust growth but also captured a significant 54% share of PV retail sales in August, following the trend of the previous month which also saw 50%+ NEV share. The market is on the cusp of a period of strong expansion in the coming months, largely due to the government's strategic intervention. The National Automobile Trade-in Platform has reported a surge in applications for temporary scrapping subsidies, reaching 800k units by the end of August. This increase has been helped by the government's decision to double subsidy amounts, aiming to stimulate the market and promote green transition in the auto industry.

According to preliminary statistics, nearly 3.8 million internal combustion engine vehicles and new energy vehicles meet the criteria for scrappage subsidies, suggesting that the replacement of these vehicles could bring additional growth to the market. To further stimulate the market, the government has implemented

additional measures, including reducing the minimum down payment requirements for auto finance loans and planning to gradually ease purchase restrictions on new energy vehicles in various regions. Currently, many major cities have certain restrictions on vehicle purchases based on traffic congestion and air pollution levels, however, these strategic measures are expected to be further relaxed in the context of boosting domestic consumption. Moreover, the promotional power of the price wars seems to have weakened. Many auto companies are exhausted from dealing with price wars and the damage done to their profitability. The intense price competition has also led consumers to adopt a wait-and-see attitude, hindering them from making timely decisions.

On the manufacturing front, LV production experienced a slight decline to 2.4 million units in August, marking a modest YoY reduction of 3.0%. However, there was a more significant MoM increase of 8.5%. For the first eight months of this year, the cumulative production has remained robust, reaching an impressive 18.0 million units. This illustrates a commendable YoY growth of 2.9%. In terms of segment performance, PV production held steady in August at 2.2 million units, with a minor YoY decrease of 2.0%. The YTD accumulated volume of PV production has reached 16.1 million units, maintaining a growth trajectory with a 3.6% YoY increase. Conversely, LCV production volumes for August were recorded at 203k units, indicating a modest YoY decrease of 12.2%. When examining the first eight months of 2024, the YTD volume for LCVs stands at 1.9 million units, reflecting a slight decrease of 2.8%.

In August, LV exports exhibited a strong performance, hitting 489k units with a significant YoY increase of 29%. The growth trend persisted throughout the month, with PV accounting for 439k units of exports, marking a 27% YoY rise, and LCV reaching 50k units, showing a substantial 47% YoY increase. Cumulatively, from January to August of 2024, LV exports have totalled 3.47 mn units, reflecting a 24% YoY growth. The primary factors driving this year's growth include the enhanced competitiveness of Chinese-made products, modest expansion in the Central and South American markets, and the significant substitution of international brands by Chinese vehicles in the Russian market amidst the Russia-Ukraine conflict. Besides the ongoing surge in NEV exports, the improved competitiveness of traditional ICE vehicle exports has also contributed to the overall increase in shipments.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"China vehicle market being supported by NEV incentives" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.