Matrix Service (NASDAQ:MTRX) Exceeds Q4 Expectations But Stock Drops 14.7%

Industrial construction and maintenance company Matrix Service (NASDAQ:MTRX) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 6.9% year on year to $187.2 million. On the other hand, the company’s full-year revenue guidance of $875 million at the midpoint came in 4.3% below analysts’ estimates. Its non-GAAP loss of $0.20 per share was 11.1% above analysts’ consensus estimates.

Is now the time to buy Matrix Service? Find out in our full research report .

Matrix Service (MTRX) Q4 CY2024 Highlights:

“We continued to execute on our diverse backlog of large, multi-year projects during the second quarter, culminating in sustained organic revenue growth in the period,” said John Hewitt, President and Chief Executive Officer of Matrix Service Company.

Company Overview

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

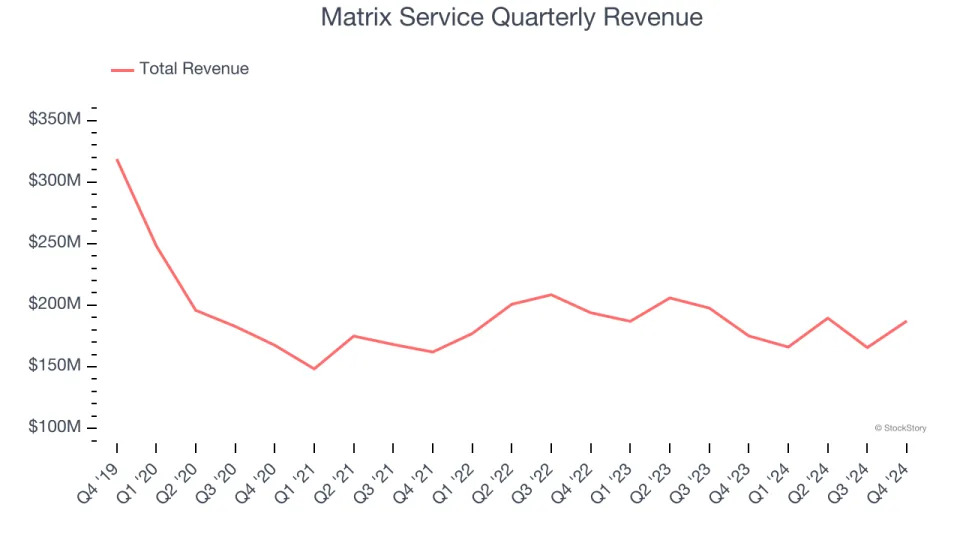

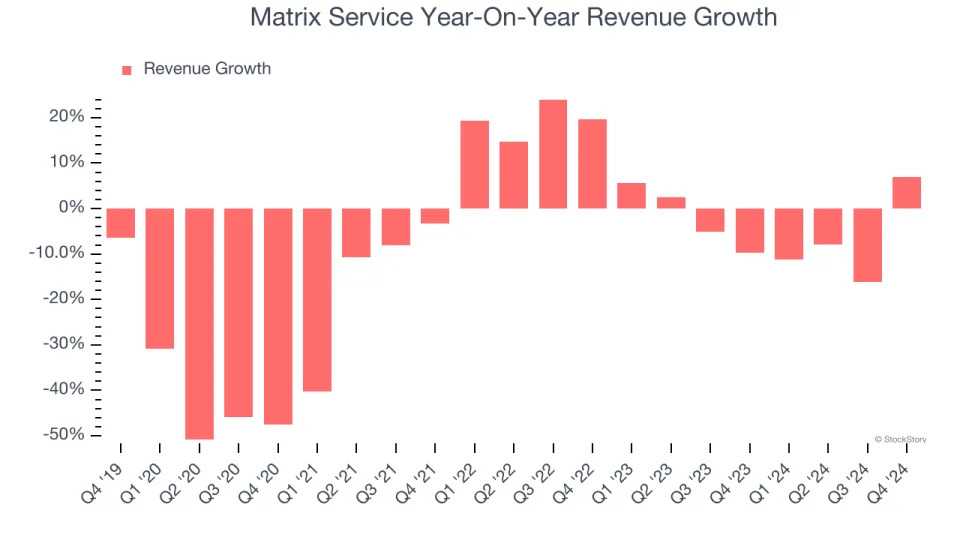

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Matrix Service’s demand was weak over the last five years as its sales fell at a 12.9% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Matrix Service’s annualized revenue declines of 4.7% over the last two years suggest its demand continued shrinking.

This quarter, Matrix Service reported year-on-year revenue growth of 6.9%, and its $187.2 million of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 38.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

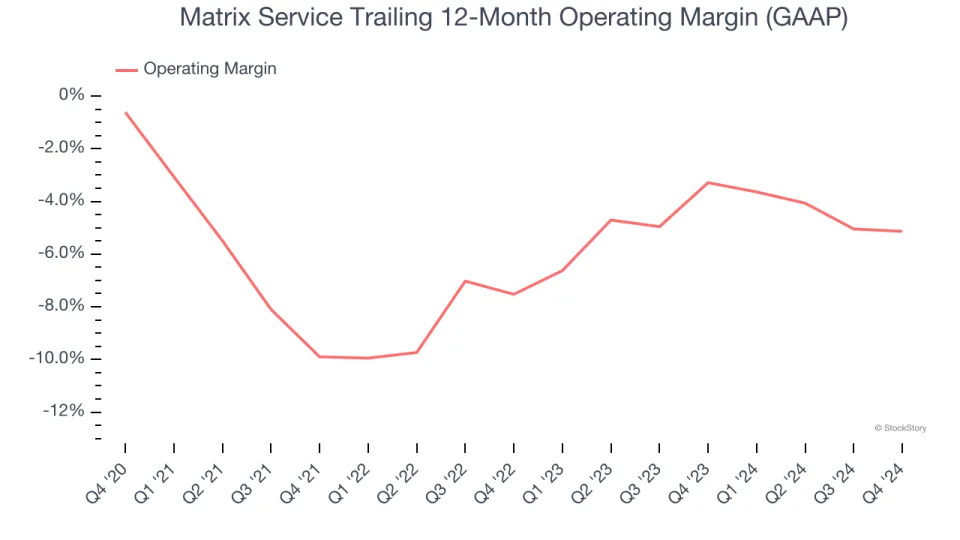

Matrix Service’s high expenses have contributed to an average operating margin of negative 5.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Matrix Service’s operating margin decreased by 4.5 percentage points over the last five years. The company’s performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Matrix Service generated a negative 3.4% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

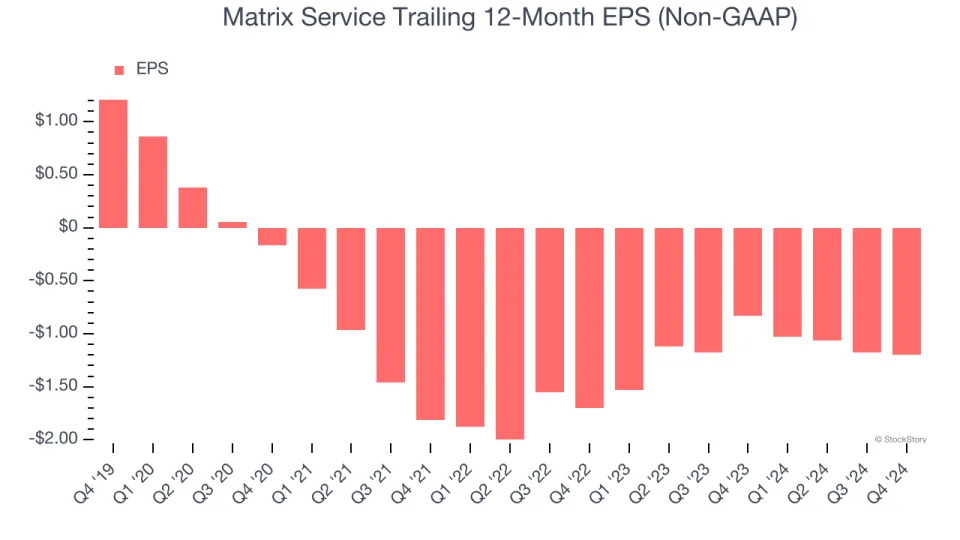

Sadly for Matrix Service, its EPS declined by more than its revenue over the last five years, dropping 24.5% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

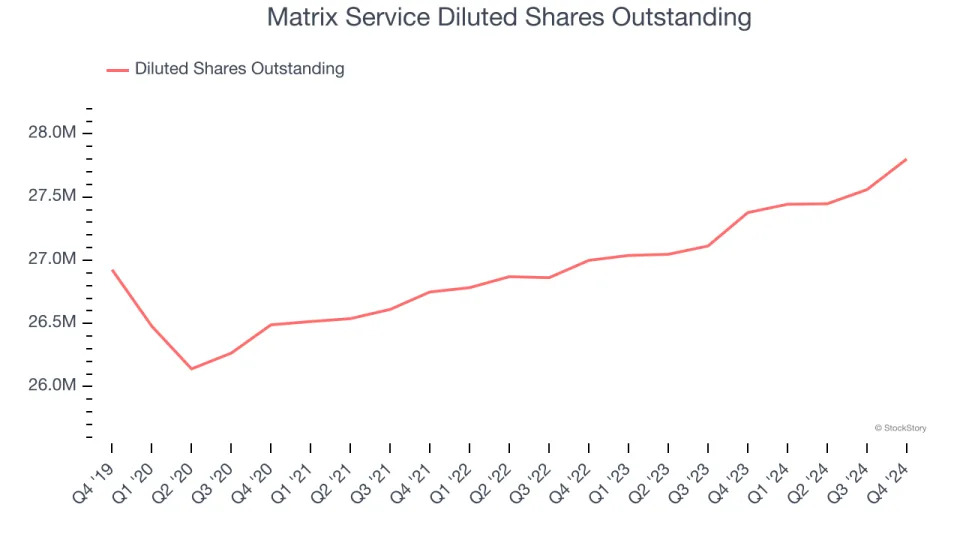

Diving into the nuances of Matrix Service’s earnings can give us a better understanding of its performance. As we mentioned earlier, Matrix Service’s operating margin was flat this quarter but declined by 4.5 percentage points over the last five years. Its share count also grew by 3.3%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Matrix Service, its two-year annual EPS growth of 16% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q4, Matrix Service reported EPS at negative $0.20, down from negative $0.18 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Matrix Service’s full-year EPS of negative $1.20 will flip to positive $0.68.

Key Takeaways from Matrix Service’s Q4 Results

We were impressed by how significantly Matrix Service blew past analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly, which seems to be weighing on shares. The stock traded down 14.7% to $11.98 immediately following the results.

So should you invest in Matrix Service right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .