3 Reasons to Avoid HAIN and 1 Stock to Buy Instead

What a brutal six months it’s been for Hain Celestial. The stock has dropped 26.5% and now trades at $5.45, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Hain Celestial, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we don't have much confidence in Hain Celestial. Here are three reasons why you should be careful with HAIN and a stock we'd rather own.

Why Do We Think Hain Celestial Will Underperform?

Sold in over 75 countries around the world, Hain Celestial (NASDAQ:HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

1. Core Business Falling Behind as Demand Declines

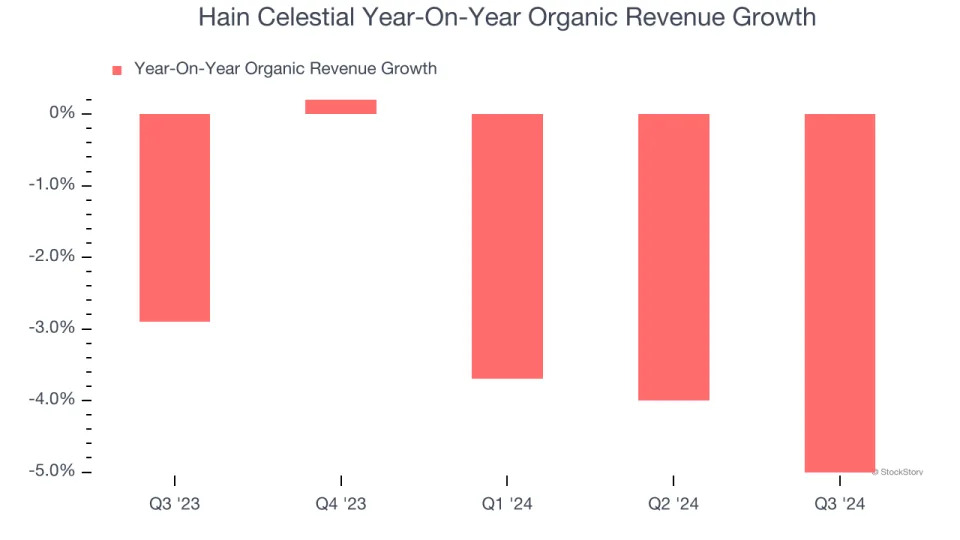

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Hain Celestial’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 3.1% year on year.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Hain Celestial’s revenue to stall. While this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

3. EPS Trending Down

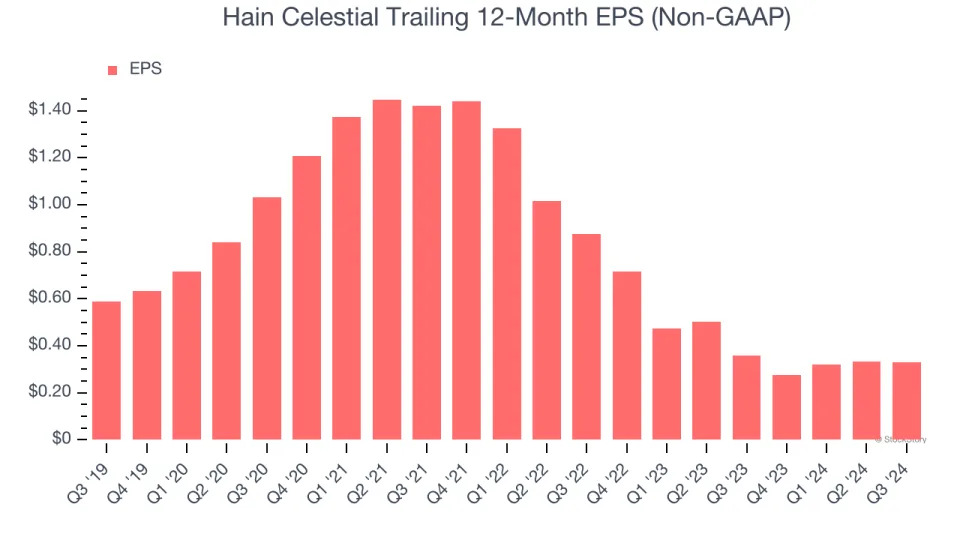

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Hain Celestial, its EPS declined by more than its revenue over the last three years, dropping 38.5% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We see the value of companies helping consumers, but in the case of Hain Celestial, we’re out. Following the recent decline, the stock trades at 11.2× forward price-to-earnings (or $5.45 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. Let us point you toward one of the fastest-growing restaurant franchises with an A+ ranch dressing sauce .

Stocks We Like More Than Hain Celestial

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .