Why the stock market may sell off even more in January

The S&P 500 SPX is weighted by market capitalization, which means that the largest three holdings of the SPDR S&P 500 ETF Trust SPY — Apple Inc. AAPL, Microsoft Corp. MSFT and Nvidia Corp. NVDA — make up 20.5% of its portfolio. This has been a good year for the stock market overall, but it might be interesting to look deeper at the breadth of the market.

This year-to-date chart below shows total returns (with dividends reinvested) for the S&P 500 and for the S&P 500 Equal Weight Index XX:SP500EW through Thursday:

Through Thursday, the S&P 500 had pulled back 2.7% for December. That isn’t anything to complain about, considering that the U.S. large-cap benchmark index was still up 24.7% for 2024. But the S&P 500 Equal Weight Index was down 7.1% for the month, and its return for 2024 was less than half that of the cap-weighted index. One-third of stocks in the S&P 500 actually showed negative total returns for 2024 through Thursday.

And the December decline has been a broad one, with 89% of the S&P 500 showing negative returns.

On Wednesday, the Federal Open Market Committee reduced the federal-funds rate by another 25 basis points to a target range of 4.25% to 4.50%. Stock and bond markets typically are expected to react favorably to interest-rate cuts, but Christine Idzelis explained why stocks and bonds fell, and why volatility increased, on Wednesday after the Federal Reserve’s rate cut.

Michael Brush analyzed broad market patterns to conclude that the two-year stock-market party was nearing an end, and why the declines could accelerate in January .

And Vivien Lou Chen explained how the trading action in U.S. Treasury bonds has been signaling another leg down for stocks .

More pain: Nvidia stock is in a correction. Microsoft’s CEO may have just said something very worrying.

And hope: Hedge fund strategist flags biggest concern for markets in 2025 — and offers ideas for shelter

Year-end predictions and changes in your long-term plan

Over the past 30 years, the S&P 500’s average annual return (with dividends reinvested) has been 10.93%, according to FactSet. With annual gains at that rate, your money would double in seven years.

With the S&P 500 returning 24.7% so far this year, following a 26.3% return in 2023, you might already have forgotten that the index fell 18.1% in 2022. Its return since the end of 2021 has been 28.9%.

So what are you to think during a jittery December for the market, following two excellent years? Mark Hulbert took a much longer look at performance year by year, and came to this conclusion about what you should expect from the stock market in 2025 .

Another opinion: Investors haven’t been this optimistic in decades. Why that could spell trouble in 2025.

Related: Here’s how to make your investment adviser prove their stock picking skill

An alternative for investors seeking income

The Eaton Vance Enhanced Equity Income II Fund EOS makes monthly distributions for a yield higher than 7.5% based on its most recent payout. What is astonishing about this fund is how well it has performed over the long term. Despite the fund’s focus on providing income mainly by distributing gains from trading in call options, it has outperformed the S&P 500 over the past 10 years, with dividends reinvested. Doug Rogers, the fund’s portfolio manager, took us through his investment strategy in an interview.

Company results — a meating at the Longhorn

The restaurant business seems always to be in flux, especially since the COVID-19 pandemic crested in 2020. This week, Darden Restaurants Inc. DRI shared a fascinating set of operating numbers — including an overall 2.4% increase in same-restaurant sales from a year earlier, but a 7.5% increase at its LongHorn Steakhouse unit, and a 5.8% decline in sales for its fine-dining unit. Steve Gelsi covered the changes in consumers’ spending habits , which helped push Darden’s shares up 15% on Thursday.

More news from MarketWatch’s companies coverage:

Wall Street analysts react

The Ratings Game column includes daily coverage of analysts’ opinions about stocks. Here is a sampling of this week’s coverage:

Heading into the holidays with the Moneyist

Quentin Fottrell — the Moneyist — answers what might be considered to be an appropriate question at the year-end holiday season: How does a 71-year-old woman give money to her children, when their needs and habits differ, without upsetting any of them?

More from the Moneyist:

A bright view of the U.S. housing market

Even though the Fed has reduced the target range for the federal-funds rate by 1% since September, the average interest rate for a 30-year fixed-rate mortgage loan in the U.S. has increased to 6.72% from 6.09% over the past three months, according to the Federal Reserve Bank of St. Louis. Long-term rates don’t always move in tandem with short-term rates.

High mortgage-loan rates have clamped down on home sales all year. But United Wholesale Mortgage Chief Executive Mat Ishbia expects an “amazing purchase year in 2025” for homes in the U.S. A spike in refinancing amid an anticipated decline in long-term rates could spell an even greater opportunity for mortgage lenders, Ishbia said during an interview with Aarthi Swaminathan.

What to expect for meme stocks in 2025

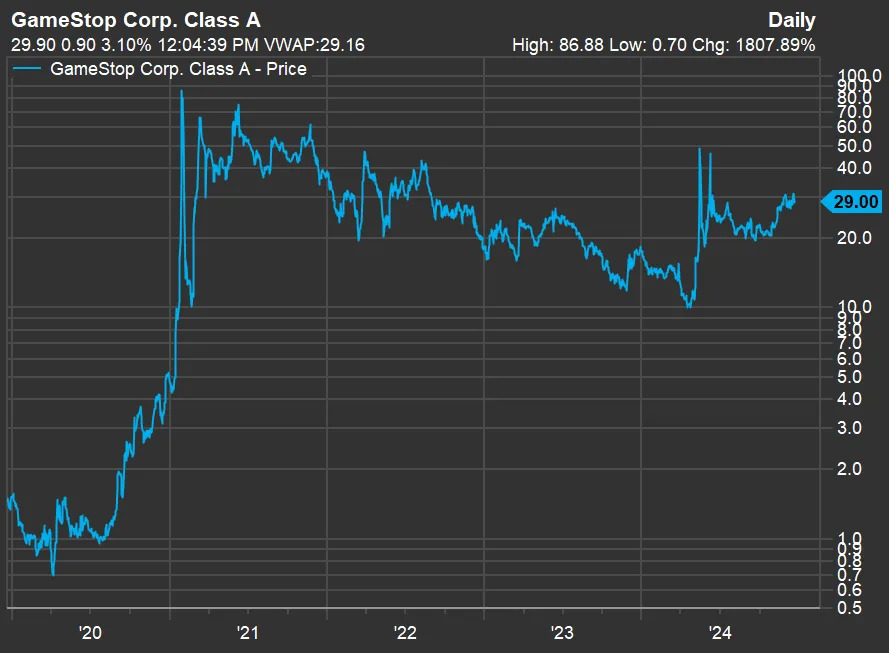

Faddish stocks can make you a lot of money very quickly if your timing is perfect. Or you can lose your shirt with trades based only on momentum, and not on companies’ success. The above five-year chart for GameStop Corp.’s GME share price through Thursday illustrates this phenomenon. The stock was up 65% for 2024, even though a week earlier Wedbush analyst Michael Pachter wrote that the company had “ virtually no chance of returning to profitability in its core business ” and an “utter lack of competitive advantage” in a new business it was entering: collectible trading cards.

James Rogers reviewed how meme trades worked out in 2024 and previewed the action for 2025 .

A “generational event” for whiskey

Charles Passy covers a “generational” civic event — the first federal designation of a new type of domestically produced whiskey since 1968 .