Analysts reboot C3.ai stock price target on Microsoft deal

If you want to be the next Bill Gates, you'd better forget about the birthdays.

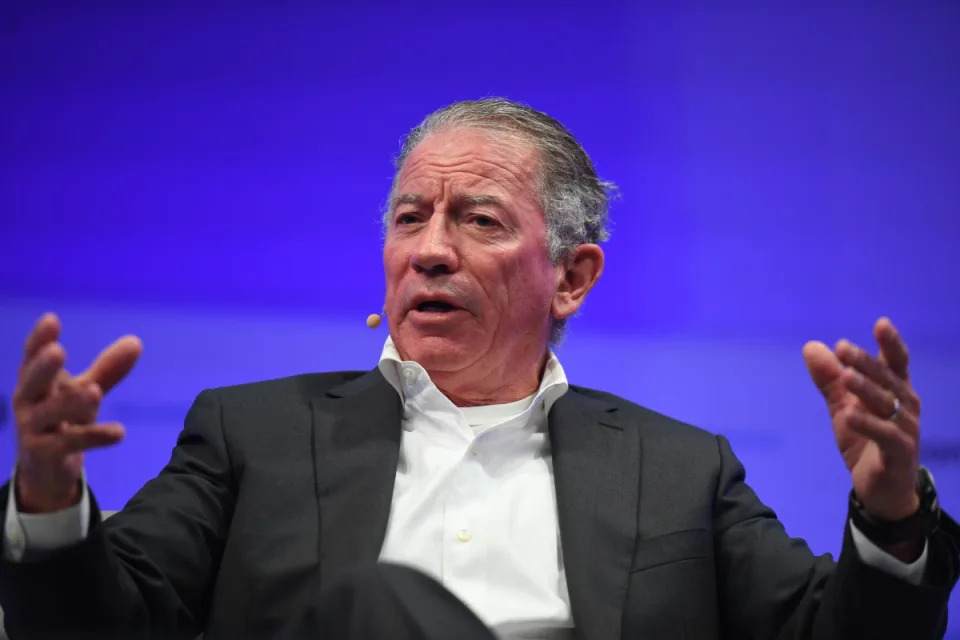

That little truth bomb comes to you courtesy of Tom Siebel, founder, chairman and chief executive of C3.ai ( AI ) , an artificial intelligence software platform and applications company.

Related: Analysts retool C3.ai stock price target after earnings

"If you want to be Steve Jobs, Bill Gates, Andy Grove, or Larry Ellison, you will pay a price, so you need to be willing to pay it," Siebel said on Oct. 18 when he visited his alma mater , the University of Illinois-Champaign.

"If you decide to be that person, you can be that person," the serial entrepreneur said, "but you're going to pay a price because you're not going to be there for birthdays and soccer practices; you're not going to be home for dinner, so be careful what you ask for."

🚨 Last Chance to Grab an Amazing Cyber Week Deal! Get 60% off TheStreet Pro. Act Now Before It’s Gone 😲

Siebel, who also founded enterprise software company Siebel Systems, which he sold to Oracle ( ORCL ) in 2005 for $5.8 billion, was attending the dedication of the Grainger College of Engineering’s Siebel School of Computing and Data Science.

"It's straight from where I've been," he said. "I've done and paid for it. I'm very fortunate. I've had my wife of 38 years, four wonderful children, and four great-grandchildren, so I am the luckiest person in the world. But you won't be there for the birthdays.”

C3.ai CEO: People should get a grip about AI

Siebel, who founded C3.ai in 2009, also shares his thoughts about the current state of the AI market.

"You ask, is there a bubble here?" he said. "Yes, holey moley! In generative AI it's just truly crazy out there right now. What we're seeing in generative AI is wild. ... Is this technology important? It is hugely important; it changes everything, but the company that makes Chat GPT loses about $5 billion annually."

Related: Tech heavyweight launches AI chips that can compete with Nvidia

"This company could disappear next Monday, and it wouldn't matter," Siebel added. "It wouldn't affect anybody."

He said that AI is "going to make us enormously more productive at what we do, and that's a good thing."

"Now, there's some dark side to this, too," Siebel said. "Supply chain, demand forecasting, fraud detection, production optimization and things like these are absolute job creators. This is going to be a big economic boost, and it'll boost the GDP. Some things will be automated that have to be automated, but it'll be a major job creator."

"That's what many of us believe," he added, "but there is this public concern around what will be automated.”

Siebel said he didn't understand why there is outrage about the problems associated with AI today.

"Let's get a grip here," he said. "All this conversation that we need to be worried about the sentient computing that's going to take over, that our smart refrigerator is going to take over your house like HAL in the movie (2001: A Space Odyssey), let's get over it. There are some real problems out there. How about social media?”

Bear in mind that this is a man who in 2009 survived an elephant attack during a walking safari in Tanzania. The animal gored his thigh, shattered his leg and blasted his iPhone into 200 pieces.

Analyst cites C3.ai's Microsoft deal

"It's a very surreal space and things move very very slowly," he said in a 2017 interview . "And then the elephant proceeds to knock me to the ground and roll me and punch me, and I took a tusk through one leg and the elephant stepped on my other leg."

"And meanwhile I'm just kind of holding my head when I'm being rolled and pushed and basically attacked by this raging elephant, which was not my best day."

More AI Stocks:

Siebel said he lost two-thirds of his blood and endured 16 surgeries to save his leg.

C3.ai, which went public in 2020, is scheduled to report fiscal-second-quarter results on Dec. 9. The company's shares are up nearly 35% year-to-date and up 28% from a year ago.

The company's name was originally "C3" with the "C" standing for "carbon" and the "3" standing for "measure, mitigate, and monetize"

The company's stock took a tumble on Sept. 4 after C3.ai beat Wall Street's fiscal-first-quarter earnings and sales expectations, but subscription revenue came at $73.5 million, missing analysts’ forecasts of $79.2 million.

But C3.ai shares skyrocketed last month after the company said it had expanded its strategic partnership with software giant Microsoft ( MSFT ) to accelerate the adoption of enterprise AI on the cloud-computing platform Microsoft Azure.

The companies first got together in 2018 and under their new agreement, Microsoft is the preferred cloud provider for C3.ai offerings and C3.ai is a preferred application software provider on Microsoft Azure.

Analysts at DA Davidson focused on the Microsoft partnership as they raised the investment firm's price target on C3.ai to $35 from $20 but kept a neutral rating on the shares, according to The Fly.

The stock has risen more than 50% in the past month, in part due to the Microsoft alliance, which will enhance C3.ai's go-to-market and product roadmap, DA Davidson said in a Dec. 5 research note.

The investment firm added, however, that while it saw potential benefits from this alliance over the long run, the runup is "creating a tricky setup" for the stock in the near term.

Related: Veteran fund manager delivers alarming S&P 500 forecast