First Mover Americas: Bitcoin Pulls Back Before Probable Fed Rate Cut

This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day .

Latest Prices

CoinDesk 20 Index: 1,822.90 -3.32%

Bitcoin (BTC): $58,779.97 -1.93%

Ether (ETH): $2,302.66 -4.24%

S&P 500: 5,626.02 +0.54%

Gold: $2,580.54 +1.47%

Nikkei 225: 36,581.76 -0.68%

Top Stories

Bitcoin sank below $59,000 having spent much of the weekend above the $60,000 mark. BTC traded around $58,550 in the European morning, a drop of 2.4% over 24 hours at the start of a week in which traders worldwide expect the Federal Reserve to make its first interest-rate cut in more than four years. The broader digital asset market as measured by the CoinDesk 20 Index (CD20) is 3.6% lower. Crypto markets were buoyed by favorable U.S. economic data on Friday, which sparked a short-term rally. Bitcoin ETFs saw inflows of over $263 million, their highest since July 22, while the ether equivalents added around $1.5 million.

Ether led losses among major cryptocurrencies, sliding 4.5% in 24 hours . Cardano’s ADA fell 5% and Solana’s SOL declined 4%, while BNB Chain’s BNB was the best performer slipping just 1.1%. Futures traders betting on higher prices lost over $143 million amid the sudden drop, CoinGlass data shows. Elsewhere, the widely watched BTC/ETH ratio, which tracks the relative movements of the two largest tokens, fell to four-year lows. Ethereum as a protocol has had some serious competition in the last year with Solana looking to be the destination of choice to launch memecoins and new chains like Coinbase's Base and Telegram-affiliated TON capturing more mindshare, which has probably hit demand for the Ethereum blockchain's native token.

The Fed is widely expected to announce an interest-rate cut on Sept. 18 , kicking off the so-called easing cycle. Traders, however, are split on the size of the cut, setting the stage for a potential volatility explosion in financial markets after the decision. At press time, the Fed funds futures showed a 41% chance of the Fed reducing rates by 25 basis points (bps) to the 5%-5.25% range and a 59% probability of a bigger 50 bps reduction to the 4.7%-5% range. The stalling of bitcoin's upward momentum following its recovery from below $53,000 could be attributed to the uncertainty over the size of the impending rate cut.

Chart of the Day

-

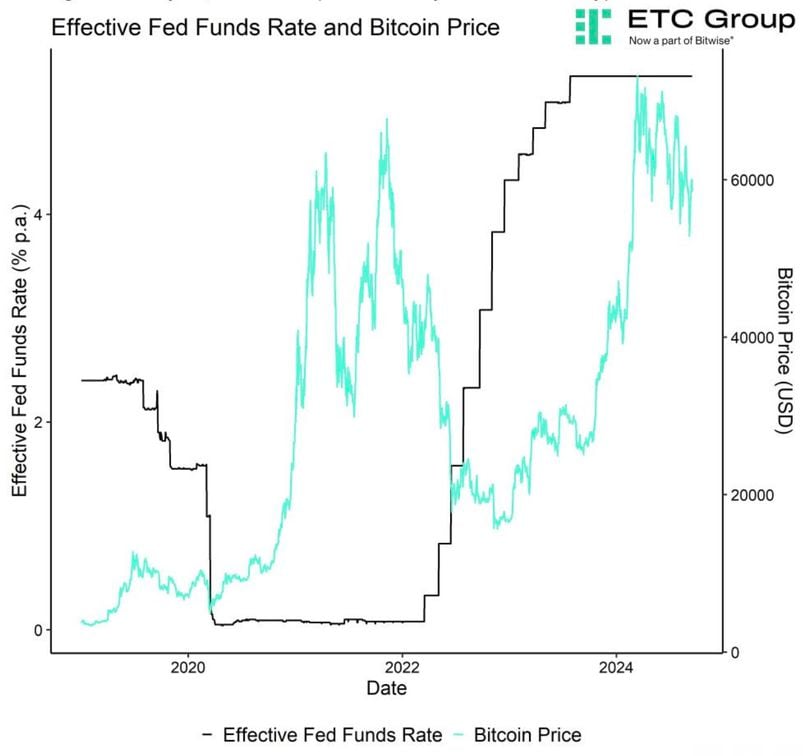

The chart illustrates how the last Fed rate-cutting cycle spurred a bitcoin surge to then all-time high levels around $70,000.

-

Its more recent bull market jump came after the Fed ceased increasing rates, since when BTC has trod water, seemingly awaiting the next rate-cutting cycle.

- Jamie Crawley

Trending Posts

-

SEC Places Heavier Scrutiny on Binance's Token Listing, Trading Process in Proposed Amended Complaint

-

Flappy Bird Creator Dong Nguyen Comes Out of Social Media Retirement to Take a Swing at GameFi

-

Crypto Broker DeltaPrime Drained of Over $6M Amid Apparent Private Key Leak