First Mover Americas: BTC Slides Ahead of Busy Data Week

This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day .

Latest Prices

CoinDesk 20 Index: 1,925 −2.1% Bitcoin (BTC): $59,616 −1.9% Ether (ETH): $2,675 +0.5% S&P 500: 5,344.16 +0.5% Gold: $2,481 +2.0% Nikkei 225: 35,025 +0.56%

Top Stories

Bitcoin (BTC) slid toward $58,000 leading to a wider crypto market sell-off as traders looked for cues ahead of a busy data week. BTC is down around 2.15% in the last 24 hours, sitting just below $59,500, while the wider digital asset market has lost nearly 2.9%, as measured by the CoinDesk 20 Index (CD20). Solana's SOL led the losses, falling nearly 3% to $149. Data for U.S.-listed ETFs are also muted, with bitcoin funds seeing $89 million of outflows on Friday and their ether equivalents losing $15.7 million.

Some market watchers warned of a further BTC decline in the coming weeks citing technical weakness while pointing to forthcoming economic reports that could provide upward pressure. “Crypto prices will likely be rangebound with a bias to the weak side,” Augustine Fan, head of insights at SOFA.org told CoinDesk in a Telegram message. “Crypto markets lack a clear anchor and are susceptible to continued position adjustments. We continue to see muted ETF inflows for BTC and ETH over the past few sessions." Both the U.K. and the U.S. release July CPI readings on Wednesday. Australia’s consumer confidence, which tracks sentiment around family finances, and Japan’s PPI, a measure of price developments of goods traded within the corporate sector, are scheduled for a Tuesday release.

A former Bank of Japan official said the central bank will defer additional interest rate hikes to next year . "They won’t be able to hike again, at least for the rest of the year,” Makoto Sakurai said Friday, according to Bloomberg. “It’s a toss up whether they can do one hike by next March.” The BOJ raised its key interest rate to about 0.25% from a range around zero on July 31, the first increase in over a decade. The shift away from the zero interest rate policy pushed the yen higher, triggering an unwinding of the "risk-on" yen carry trades. The resulting slide in traditional risk assets weighed heavily over BTC, crashing the cryptocurrency from roughly $65,000 to $50,000 in less than seven days.

Chart of the Day

-

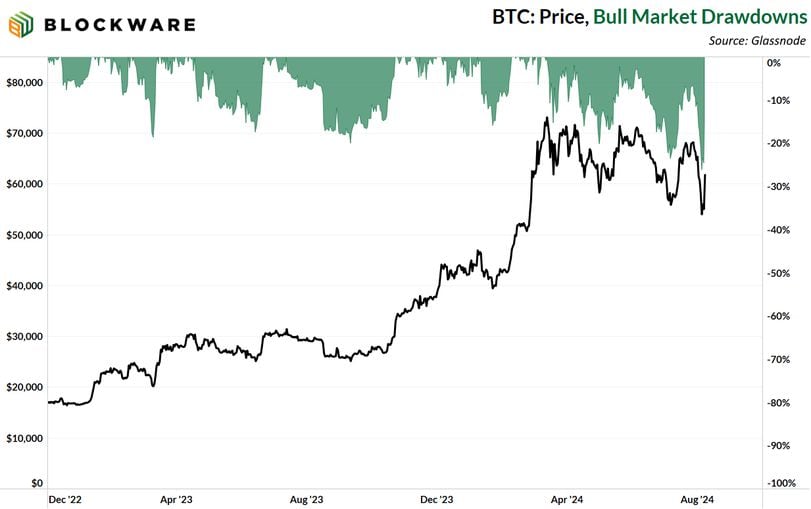

The chart shows bitcoin's price drawdowns in percentage terms since late 2022.

-

The recent decline from $70,000 to $50,000 was the largest.

-

"As is typical with these drawdowns: weak hands were shaken out, and seasoned veterans bought the dip," Blockware said in an email.

- Omkar Godbole

Trending Posts

-

Tether to Fight Celsius' $3.3 Billion 'Shakedown' Litigation

-

Dragonfly, Crypto.com Weigh in on CFTC's Proposed Prediction Market Rules

-

Canto Blockchain Suffers Two-Day Outage Amid Consensus Issue