Slowing Inflation Growth Points to More Upside in Crypto

The case for Federal Reserve rate cuts keeps growing.

This week holds another important economic growth clue for policymakers at our central bank. On Wednesday morning, the U.S. Bureau of Labor Statistics (“BLS”) released consumer price index (“CPI”) figures for August.

The number is important because it’s one of the last key growth readings the Fed receives before its September 17-18 monetary policy meeting. The CPI gauge comes on the heels of last Wednesday’s weak Beige Book survey and Friday’s disappointing employment growth numbers. In other words, if inflation growth is weak enough, it could entice an increasingly dovish (inclined to lower rates) stance from our central bank.

This morning, annualized headline inflation growth fell to 2.5% for August, compared to the 2.9% rate in July. This marked the weakest result since the 2.6% increase in March 2021. That means the Fed is closing in on its 2% target. The change will support rate cuts moving forward. That will underpin steady economic growth and a long-term rally in bitcoin and ethereum.

But don’t take my word for it, let’s look at what the data’s telling us…

Each month, the Federal Reserve Banks of Dallas, Kansas City, New York, and Philadelphia, reach out to manufacturers in their regions to gauge levels of business. They ask about things like new orders, backlog, inventories, delivery times, and employment. Survey respondents say whether business has increased, decreased, or stayed the same. The data is then compiled into a composite index.

The results are important because the districts those central banks cover make up roughly 25% of national economic output. So, by gauging what’s going on there, we can get a sense of what’s happening across the country.

The number we care about the most is the “prices received” reading. It tells us what customers are willing to pay manufacturers for their finished goods. So, it’s akin to CPI. Yet these numbers are out before the BLS releases its monthly gauge.

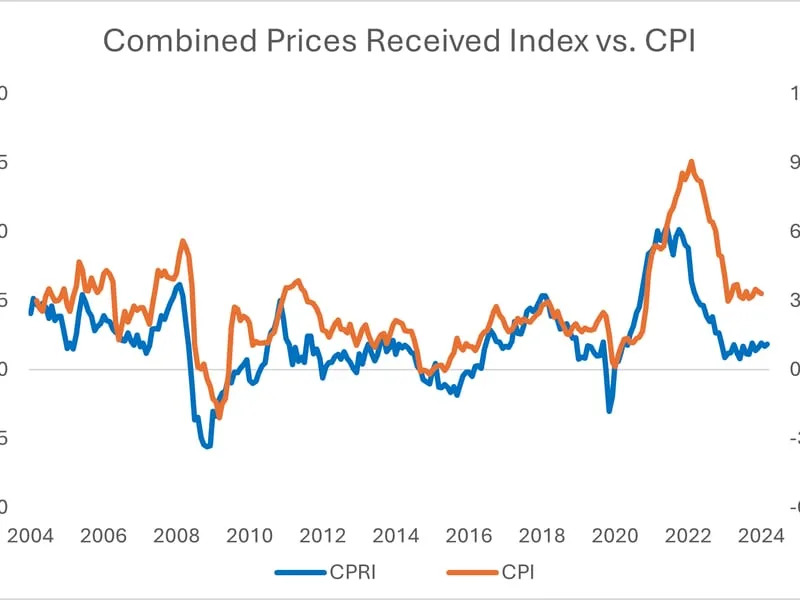

So, by looking at the regional manufacturing data, we can get an idea of what inflation growth looks like before the official numbers are released. Based on what I see, prices eased in August…

As you’ll notice in the above chart, my proprietary inflation gauge (“CPRI”) began to roll over in October 2021. That was about eight months before CPI. And then, as you can see on the right side of the graph, CPRI has stabilized just above breakeven since July of last year. The change has led CPI to gradually move lower.

But it’s not just the lack of movement in prices received that has me convinced inflation’s still slowing. Look at this chart of gas prices…

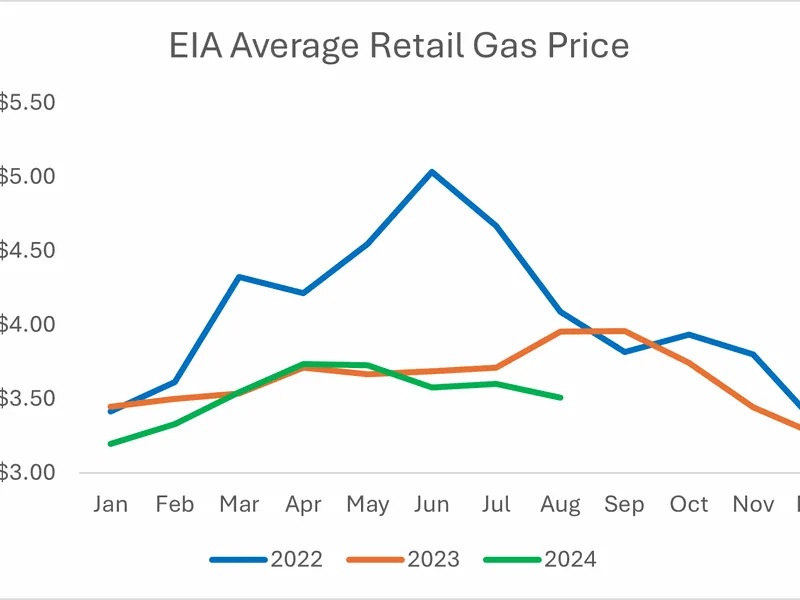

According to the U.S. Energy Information Administration (“EIA”), the average retail price for a gallon of gasoline was $3.51 in August compared to $3.60 in July. That’s a drop of about 3%. More importantly, the price in August 2023 was $3.95. In other words, you and I are paying 11% less at the pump than we were a year ago.

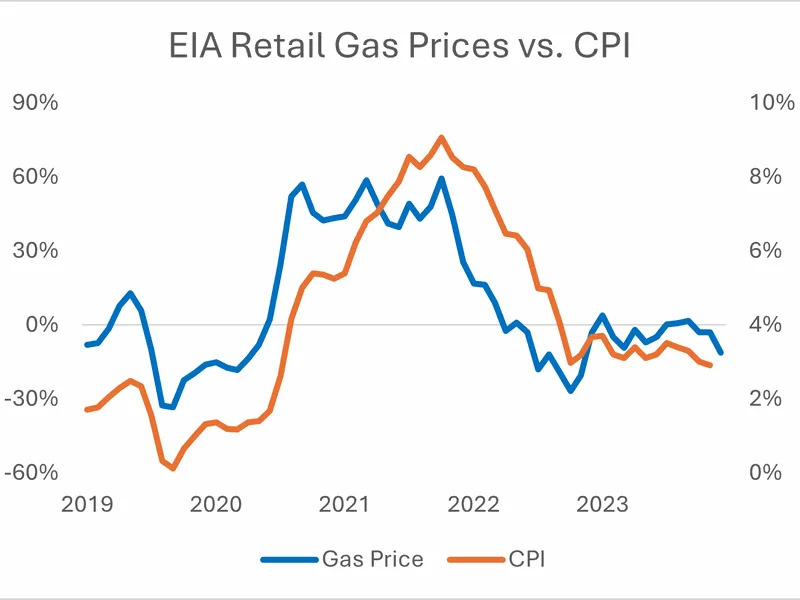

Now look at how closely inflation follows retail gas prices…

The price of gas accounts for about 4% of the headline CPI number. It can be viewed as a gauge of economic activity because it’s something many people use on a daily basis. In other words, if demand is high, prices should jump, while fewer purchases should lead to lower prices.

The annualized change in gas prices for August is even larger than the 3% drop in July. When the July CPI result was released, inflation growth fell below 3% for the first time since 2021. That implies gas prices should be a bigger drag on the headline inflation numbers when the August result comes out.

Now, while core personal consumption expenditures (out later this month) is the Fed’s preferred inflation gauge, CPI is still a driver of stock-market sentiment. Today’s result was in-line with Wall Street’s 2.5% expectation. The outcome supports the case for our central bank cutting rates, possibly by as much as 50 basis points.

The change will drive the value of our currency down, driving up the price of risk assets priced in dollar terms. That will support a steady long-term rally in crypto-based investments like bitcoin and ethereum.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.