Ether ETFs Break Four-Day Outflow Streak, Bitcoin ETFs Record $18M Outflows

U.S.-listed spot bitcoin {{BTC}} exchange-traded funds (ETFs) recorded outflows while ether {{ETH}} ETFs recorded inflows after a four-day losing streak on Tuesday as prices pared gains from last week’s run-up to Republican presidential candidate Donald Trump’s speech.

Spot bitcoin ETFs recorded $18 million in net outflows, breaking a four-day streak that saw inflows as high as $124 million.

SoSoValue data shows that Grayscale’s GBTC led outflows at $74 million. Products from Fidelity, Ark Invest, Bitwise, and VanEck saw outflows ranging from $2 million to $7 million. Blackrock’s IBIT was the only ETF that recorded inflows, almost $75 million.

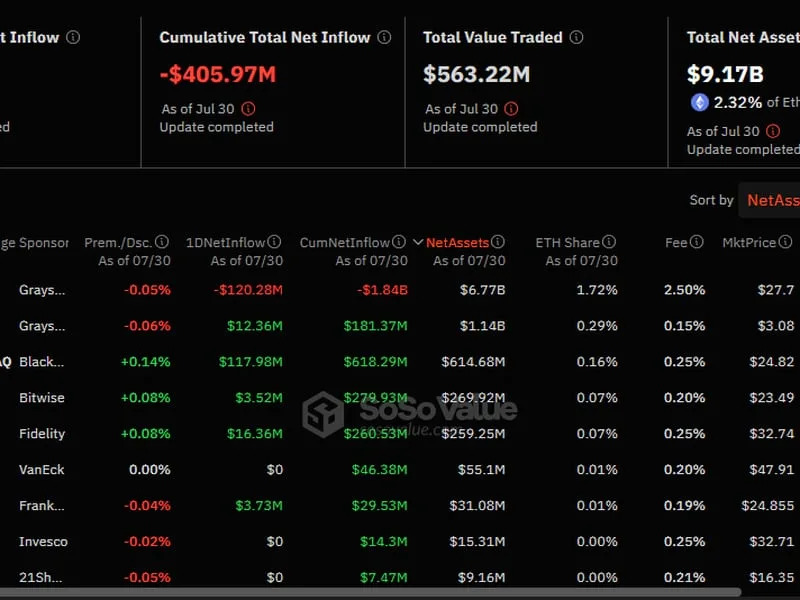

Eher-tracked ETFs recorded net inflows at $33 million after a four-day losing streak, only the second day of net inflows since they went live on July 23.

Ether ETFs have witnessed a cumulative net outflow of over $400 million. Grayscale’s ETHE has recorded the most losses at $1.84 billion, while BlackRock’s ETHA leads inflows at $618 million.

BTC surged to over $69,000 last week as Trump took the stage at the Bitcoin 2024 conference in Nashville, revealing plans to fire the U.S. SEC head Gary Gensler and create a strategic bitcoin reserve if elected.

However, the cryptocurrency lost as much as 5% on Monday as the U.S. Marshals Service shifted $2 billion worth of BTC to two new wallets, instilling fears of a looming liquidation.

Meanwhile, traders are largely cautioning of further price volatility as major U.S. technology firms are scheduled to release earnings this week – an event that tends to influence bitcoin prices.

“Election headlines will remain a major focus, but several key macroeconomic events are also on the horizon,” Singapore-based QCP Capital said in a Telegram broadcast Tuesday. “Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday.”

“We maintain a range-trading outlook for BTC,” the firm said.

UPDATE (July 31, 08:10 UTC): Changes headline, mentions latest ETH ETF inflow figures throughout.

CORRECTION (July 31, 08:43 UTC): Corrects ether ETF inflows in headline, first paragraph. An earlier version of this story said the ETFs experienced their first net inflows.

CORRECTION (July 31, 10:50 UTC): Corrects ticker for Grayscale's bitcoin ETF in third paragraph.