What Happened in Crypto Today: Crypto Market’s Finally Learning To Ignore FUD

The crypto market's got nerves of steel...

Mt. Gox just moved $3B in Bitcoin, and prices barely flinched.

Is the crypto world finally growing up? Or have we all just become numb to the chaos?

It seems like the days of panic-selling at every headline are behind us (at least in this cycle). The market's showing some serious resilience lately.

So, let's dive into today's top crypto news. Here's the TLDR for those of you who like your info bite-sized:

Plus, we'll serve our analysis on what's really going on in the market and what might be coming next.

Let’s dive in!

Elon's Back, Talking About Crypto

Elon Musk is serving his unique brand of crypto commentary again.

At an X event, Musk gave Bitcoin a nod of approval, saying there's "some merit" there.

But let's be real, his heart still belongs to Dogecoin. "I sort of have a soft spot for Dogecoin because I just like dogs and memes," he quipped.

But Elon made one thing clear: "If you see me pumping crypto, it's not me."

So is it a bullish sign that Musk is publicly backing Bitcoin again? Read the full story !

Trump's Another Bullish Statement

The former president wants America to lead the global Bitcoin mining race.

AllianceBernstein analysts are predicting this could be a game-changer for the mining sector. We're talking about a potential $20 billion market for mining chips and hardware over the next five years.

Currently, most mining hardware comes from China. But Trump's push could flip that script.

For U.S. Bitcoin miners, this could be like hitting the jackpot. Better efficiency, cheaper chips, and even the chance to dabble in AI and high-performance computing.

For crypto investors, this is huge. We're potentially looking at a major shift in the global Bitcoin mining landscape. Could "Made in America" become the new standard for mining rigs?

How impactful would this be for Bitcoin or alts? Read the full story !

Solana Keeps Surging

Solana's SOL token made a 16% surge to $193.92, a move that was quickly followed by an 8% correction, landing the price at $179.

Despite the pullback, SOL still posted an impressive 23.5% gain for July.

The driving force? ETF speculation. With Ether ETFs now trading in the U.S., all eyes are on SOL as the potential next in line. The SEC's decision, expected by March 2025, is keeping investors on their toes.

The memecoin craze is also playing a significant role.

Platforms like Pump.fun are generating massive volumes, with fees surpassing even Bitcoin's protocol fees. It's a double-edged sword - driving activity but raising concerns about sustainability.

Is Solana relying too heavily on memecoins and the ETF dream? What do analysts think? Read the full story !

BlackRock's: Bitcoin and Ethereum Lead the Pack

Talking about ETFs, according to BlackRock's Samara Cohen, the CIO, only Bitcoin and Ethereum will be traded via ETFs in the near future. They're the only ones meeting BlackRock's strict criteria.

For other cryptocurrencies, including Solana, the demand just isn't there yet.

Despite the buzz around Solana, it's not on BlackRock's ETF radar.

But the crypto ETF world is far from stagnant. The recent Ethereum ETF launch saw trading volumes hit $14.8 billion in a week. That's significant traction in a short time.

So is this the end of the Solana ETF dream? Far from it!

But Solana ETF still has major institutions backing it. Read the full story !

Hamster Kombat to Airdrop Tokens to 300 Million Players

Hamster Kombat just hit a stunning milestone - 300 million players in less than five months.

Now, they're gearing up for what they're calling the "largest airdrop in the history of crypto." 60% of the HMSTR tokens are going straight to the players. That's a serious commitment to their community.

Here's an interesting twist: no venture capital or early investments behind HMSTR. The token's value will be purely driven by market demand.

But wouldn’t releasing that amount of tokens through an airdrop cause a major sell-off, hence a major price dip? Is the team preparing to prevent that situation? Read the full story !

Where Are We Headed? An Analysis

The crypto market recently took a dip after the U.S. government moved $2 billion worth of Bitcoin from seized Silk Road funds. We covered it all and how the situation may play out in the future in yesterday’s analysis .

So don't panic - we're still around prices we saw just yesterday.

Let's break down what's really going on behind the scenes.

HODLers Stand Strong

Glassnode data reveals compelling insights into investor behavior.

The Supply Last Active 1y+ metric shows that 65.8% of Bitcoin hasn't moved in over a year, indicating a strong holding mentality among long-term investors.

This suggests a significant portion of the market remains confident in Bitcoin's future prospects.

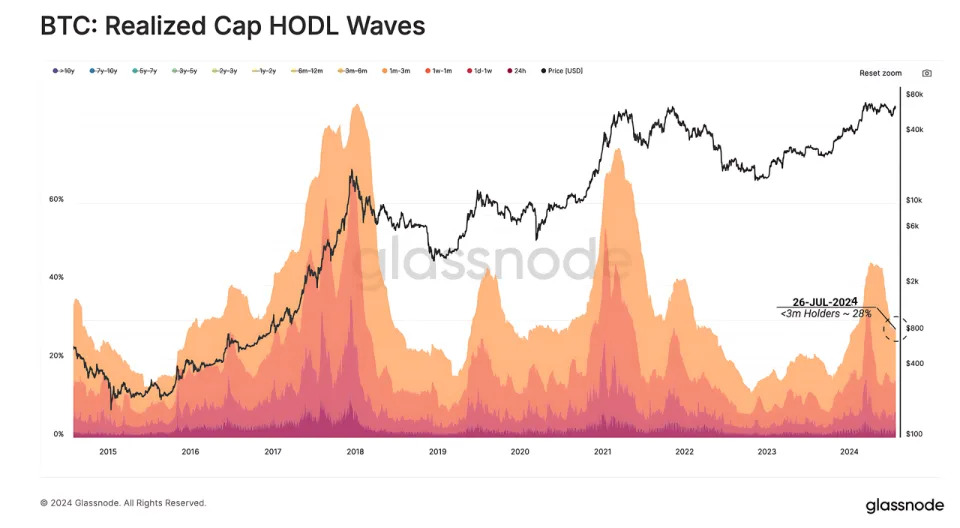

The Realized Cap HODL Wave metric gives us a unique view of how Bitcoin wealth is spread out. Right now, it's showing that newer investors (those who've held Bitcoin for less than three months) own less of the total Bitcoin wealth than before.

This usually happens when we're not at the peak of excitement in the market, hinting that we might not be at the top of this cycle yet.

At the same time, people who bought Bitcoin 3-6 months ago are seeing their share of the network's wealth grow. This suggests that these recent buyers are sticking around and becoming more committed to holding their Bitcoin.

Looking at the Long-Term Holder Supply, we see that 45% of all Bitcoin wealth is held by patient, long-term investors. That's a pretty high number.

The Long-Term Holder Binary Spending Indicator backs this up, showing that these experienced investors aren't selling much, and they're actually selling less than before. This behavior from long-term holders could help keep the market steady, even when prices get shaky.

Summary?

Bitcoin data shows that 65.8% haven't moved in over a year, indicating strong investor confidence. Long-term holders own 45% of Bitcoin wealth and aren't selling much, potentially stabilizing the market.

Beyond Bitcoin: Solana's Expansion

While Bitcoin's grabbing headlines, Solana's been making some interesting moves:

It's becoming a bigger player in stablecoins and real-world assets (RWAs).

Projects like Ondo's USDY and a partnership with Maple Finance are putting Solana on the map alongside big names like Ethereum and Tron.

This diversity could make the whole crypto world stronger. It's not just about one coin anymore.

The Big Picture

Sure, prices go up and down daily. But that's not the whole story. What really matters is how crypto is slowly becoming a part of mainstream finance. More stablecoins, more real-world assets in crypto - these are signs of a growing, maturing market.

So What Should Be Your Next Move?

The recent market dip might be unsettling, but our data analysis paints a more nuanced picture.

Long-term Bitcoin holders are standing firm, while newer investors are transitioning into more stable positions. This suggests underlying confidence despite short-term volatility.

Instead of reacting to every price swing, consider focusing on understanding these broader market dynamics.

For a clearer view of Bitcoin's market health, explore CMC's Bitcoin analytics tool . It offers insights into whale holdings, address changes, and holding patterns over time. This data can help you contextualize market movements and make more informed decisions about your crypto strategy.

Before you head out, take a sec to sign up for our newsletter below, and we'll deliver the hottest crypto stories straight to your inbox!

Subscribe to Our Newsletter!