Is Visa Stock a Buy?

One of the best ways to make solid investment decisions is to pay attention to Warren Buffett's portfolio . Many of his largest holdings have outperformed the market for years or even decades at a time.

One of his long-term positions, Visa (NYSE: V) , caught my eye after a recent correction. Buffett has held onto this stock since 2011. There are two exciting reasons why you should consider Visa for your portfolio right now.

This is the type of stock that every investor wants to own

In one of his more famous quotes, Buffett tried to explain a lesson he's learned over and over: Trust great businesses, not management teams. "When a management with a reputation for brilliance tackles a business with a reputation for bad economics," Buffett once advised, "it is the reputation of the business that remains intact."

The lesson here is simple: Buy high-quality businesses that even a half-competent management team could run. In this regard, Visa is the perfect example. A few months ago, I speculated that Visa could become the next trillion-dollar stock. It wasn't the savvy management team that I loved, but the business fundamentals that even a poor management team would find difficult to screw up. Visa's main advantage, I argued, was the long-term tailwind of network effects.

What are network effects? This business school term essentially describes a product or service that gets more valuable the more that people use it. Social media is a prime example. Even the best social media platform won't get anywhere without hitting a critical mass of users. In this way, a social media network's greatest advantage is its user base, not its technology. People want to join networks that others are a part of, which means that the larger platforms generally tend to grow even bigger over time.

Payment networks like Visa operate in much the same way. No one wants to use a credit or debit card that merchants won't accept. And merchants don't want to accept forms of payment that consumers don't use. The natural result is industry consolidation. According to data compiled by Statista, Visa has a massive 61% market share for general-purpose payment cards in the U.S. Mastercard comes in second with a market share of 25%, while just two companies round off the rest of the industry. This isn't a new dynamic, either. Mastercard and Visa have enjoyed industry-duopoly positions for more than a decade, with Visa commanding a heavy lead the entire time.

Great stocks rarely get this cheap

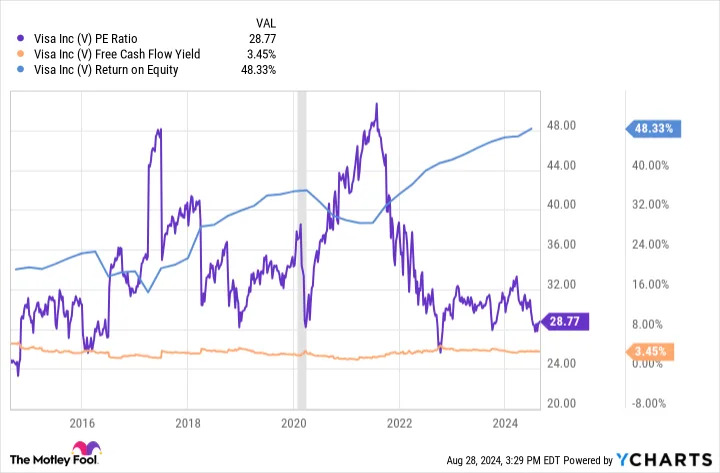

Massive-industry consolidation combined with an asset-light business model has resulted in huge and steady profits for Visa. Its returns on equity are incredibly impressive considering the company employs a conservative amount of leverage. Free-cash-flow generation has nearly always been positive. And after a small correction, shares now trade at nearly their cheapest levels in years on a price-to-earnings basis.

V PE Ratio data by YCharts .

Right now, the S&P 500 as a whole trades at a price-to-earnings ratio of 29.2. That means Visa stock trades at a discount to the market average despite operating an incredibly reliable and profitable business model that benefits from network effects that should endure for decades to come. According to recent filings, it doesn't appear as if Warren Buffett has been selling any of his Visa position. It's hard to imagine him doing so at these prices.

Is Visa stock a buy right now? The answer appears to be a strong "yes." At these levels, the company is a great match for value and growth investors alike.

Before you buy stock in Visa, consider this: