First Mover Americas: Bitcoin Advances Following Reports of RFK Jr. Withdrawal

This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day .

Latest Prices

CoinDesk 20 Index: 1,968 +2.8%

Bitcoin (BTC): $61,253 +3.0%

Ether (ETH): $2,638 +2.0%

S&P 500: 5,620.85 +0.4%

Gold: $2,541 +1.3%

Nikkei 225: 38,211.01 +0.68%

Top Stories

Bitcoin rallied during the late European morning having zigzagged between $59,000 and $61,000 , and climbed to around $61,250, a 24-hour increase of nearly 3%. Some news outlets reported late Wednesday that Robert Kennedy Jr. was planning to drop out of the U.S. presidential race by the end of this week and would endorse Donald Trump, who has positioned himself as a pro-crypto president if elected. Polymarket bettors give the withdrawal an almost 94% chance of it happening, a major shift from earlier in the week. The broader digital asset market is nearly 2.75% higher than 24 hours ago, as measured by the CoinDesk 20 Index.

Nearly half of all corporate political contributions in the 2024 election cycle came from cryptocurrency companies , according to a Wednesday report from corporate influence watchdog Public Citizen. The report found that, so far, 48% of corporate election spending has come from crypto companies like Ripple and Coinbase. That’s $119 million out of a total of $248 million. The vast majority of those donations have been funneled into pro-crypto super political action committees (PACs) like Fairshake as well as squashing the bids of crypto skeptics. Just under $108 million of the $203 million raised by Fairshake has come directly from crypto companies, according to the report. The rest came from large donations made by deep-pocketed and prominent individuals, like the Winklevoss twins and Brian Armstrong.

One year ago, HashKey Capital forecast that ether liquid-staking derivatives would double from their August 2023 total value locked to $44 billion by August 2025. Halfway through, it looks like things are on track . The TVL of Ether LSDs hit $36.25 billion, with Lido claiming a 70% market share, according to data from DeFiLlama. Despite relatively stagnant ETH prices recently, demand for staking continues to rise, with the validator entry queue surging to an all-time high of around 7,400, HashKey Capital analysts wrote in a note to CoinDesk. "However, annualized staking yields have remained at around 3.5% for the past four months. This creates a situation where more validators want to join but rewards are not increasing substantially."

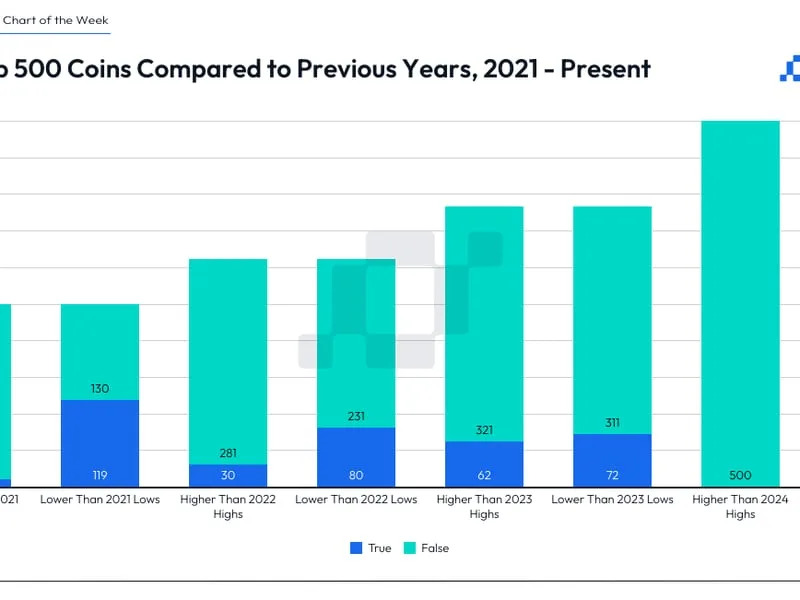

Chart of the Day

- Omkar Godbole