Cruise Operator Viking's Stock Falls as One-Time Charges Drag Down Earnings

SOPA Images / Contributor / Getty Images

Key Takeaways

Shares of Viking ( VIK ) tumbled Thursday after the cruise operator posted weaker-than-expected results for the second quarter as one-time charges weighed on its profits.

The company reported second-quarter net income fell 18% from a year ago to $155.8 million, or diluted earnings per share of 37 cents, missing estimates compiled by Visible Alpha. Viking blamed the drop on a loss of $123 million from the revaluation of warrants issued by the company due to stock price appreciation, among other reasons.

Revenue was up 9.1% to $1.59 billion, though that was also short of forecasts. Viking said the gain came from higher passenger spending and an increase in the number of ships in its fleet. The larger fleet size also contributed to a 1.3% rise in vessel operating expenses.

Strong Advanced Bookings

CEO Torstein Hagan said that as of Aug. 11, the company already sold 95% of its capacity passenger cruise days and 55% of its core products for the 2024 and 2025 sailing seasons. He added that the strong advanced bookings “give us confidence that our core consumer demographic continues to show resiliency, prioritizing travel and actively seeking enriching, memorable experiences.”

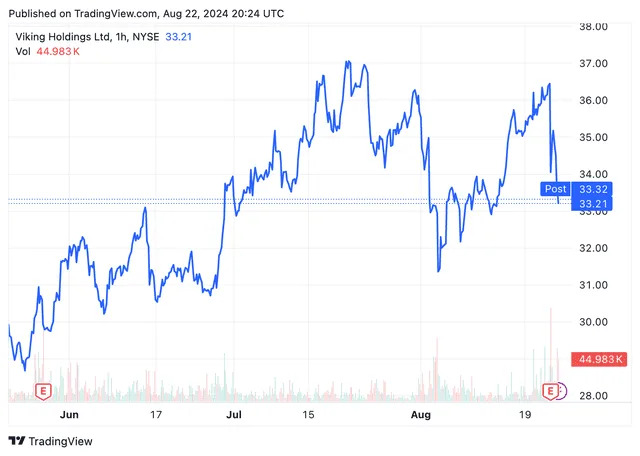

Viking shares finished nearly 9% lower at $33.22 Thursday, though despite Thursday’s losses, they’ve gained more than 38% from their

initial public offering price

of $24 in May.

TradingView

Read the original article on Investopedia .