Nvidia stock slips ahead of earnings release as Wall Street reiterates bullish outlook

Nvidia ( NVDA ) stock fell more than 3% on Thursday as Wall Street analysts reiterated their bullish views of the chip giant ahead of its highly anticipated earnings report next week.

Nvidia shares have gained more than 25% since early August.

KeyBanc's John Vinh was among the latest Wall Street analysts to outline why the company should be poised to beat lofty forecasts in its report on Aug. 28.

"We believe modest expectations for Blackwell shipments in FQ3 have been backfilled with higher Hopper bookings," Vinh wrote in a recent note.

"We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs."

The analyst reiterated a Buy rating on the stock with a price target of $180.

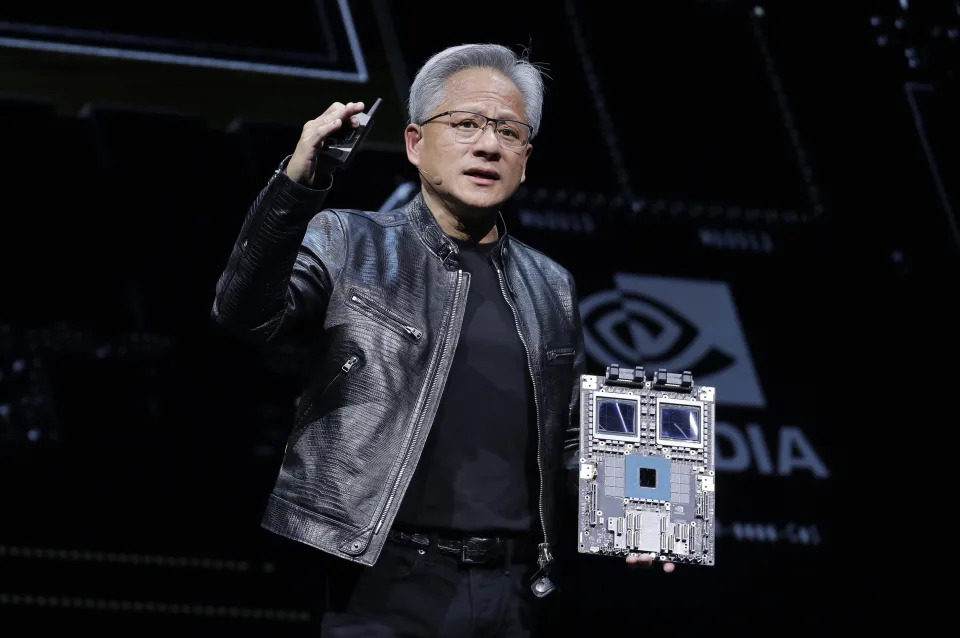

Nvidia's next-generation Blackwell chips were reported to be facing delays of up to three months, potentially pushing out future orders and weighing on plans from key customers like Microsoft, ( MSFT ) Meta ( META ), Google ( GOOG , GOOGL ), and Amazon ( AMZN ), which collectively account for about 40% of the company's revenue .

Citi analysts also reiterated their Buy rating on the stock this week, writing that they expect "Blackwell comments [from Nvidia] to reassure investors on a strong 2025 outlook, and [the] stock to make fresh 52 week high." The firm's analysts have a $150 price target on the stock.

Goldman Sachs analysts also restated their Buy rating on Nvidia, which also sits on the firm's "Conviction List."

Wall Street remains positive on Big Tech's AI infrastructure spending, with Goldman Sachs recently saying it believes "customer demand across the large Cloud Service Providers and enterprises is strong and Nvidia's robust competitive position in AI/accelerated computing remains intact."

Analyst forecasts have Nvidia's revenue set to grow 112% in its latest quarter, though this would mark a slowdown from the over 250% growth seen by the company in the same quarter last year.

Nvidia shares have been a major driver of the August market rebound, as the stock roared back roughly from its August low, when it fell below $100.

Shares last touched an intraday high north of $140 in June, closing at an all-time high of $135.58 on June 18. The majority of analysts are bullish on the AI chip heavyweight, with 66 Buy recommendations, eight Hold ratings, and zero Sell recommendations.

@ines_ferre .