A $576 Billion Stock-ETF Juggernaut Hit by Extreme Dislocations

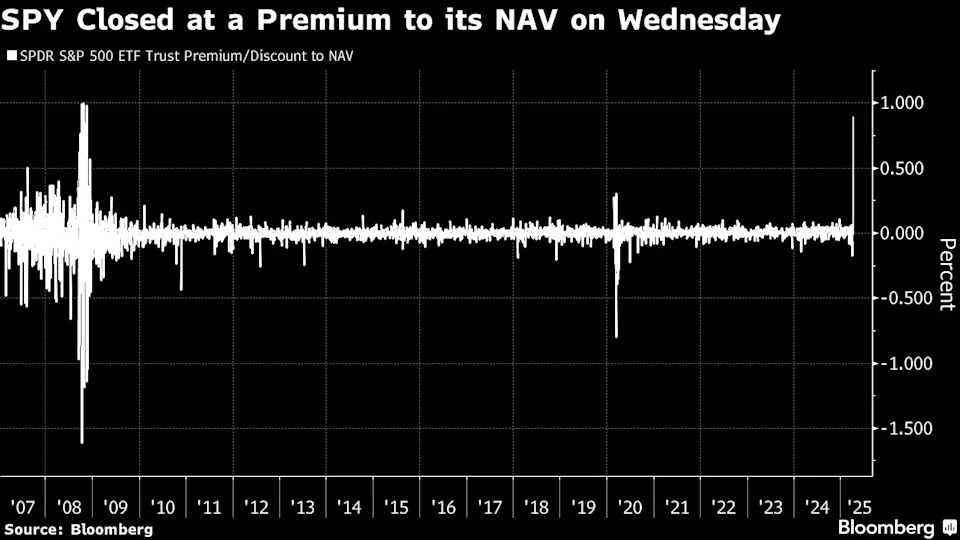

(Bloomberg) — One of the largest exchange-traded funds in the world was left at the widest premium to its underlying holdings since 2008 at the end of Wednesday’s historic session.

In another sign of the frantic trading on Wall Street, the $576 billion SPDR S&P 500 ETF Trust, or SPY, closed roughly 90 basis points above its net-asset value on a day when it surged 10.5% — the most in 16 years — data compiled by Bloomberg show. For comparison, SPY’s average dislocation to its NAV over the past decade is just a fraction of a basis point. The early Covid months of 2020 also saw it trade above or below its net-asset value, though none of those gaps were as wide as where Wednesday’s ended up.

Traders frantically covering bearish trades likely contributed to the flood of capital into SPY that afternoon. The fund, which on average has traded roughly 56 million shares a day over the past year, is known for its liquidity. But on Wednesday, closing-auction volumes were running roughly 300% higher than usual and likely a factor in driving up the premium, according to Matt Bartolini, head of SPDR Americas Research at State Street Global Advisors.

“That’s just a function of the ETF, of SPY — it’s a significant liquidity vehicle for a large swath of traders and investors to rotate into,” he said in an interview. “Given the sizable moves that we saw yesterday intraday, but also heading into the close, there was just a large balance of buy orders coming in to mark the close that then pushed the price up above.”

It’s important to remember the context in which the frenzied trading happened: market moves have been extreme in recent days, he added. “It’s a feature of SPY to have the ability to absorb that much liquidity in two-way trading volumes.”

The S&P 500 on Wednesday staged a historic rebound after President Donald Trump said he would pause tariffs on some trading partners. More than 241 million shares of SPY changed hands.

“Yesterday’s moves were so extreme that even the world’s most liquid ETF was not immune to an impact as the closing auction traded well above its fair value,” said Dave Mazza, chief executive officer at ETF issuer Roundhill Investments. “When SPY sees moves like this, you know it’s a wild day in the markets.”

His calculations show that some 8 million shares ended up paying about $5 above the closing-auction price.

Trump’s disruptive trade plans are challenging the most liquid investing tools in the world as fresh volatility hits Wall Street. Stocks resumed their plunge Thursday.

“I think there is a good likelihood you’ll see some elevated dislocations in SPY and other ETFs — it’s not uncommon in panicked markets,” said Bloomberg Intelligence’s Athanasios Psarofagis. “But that said, ETFs are handling this phenomenally.”

Still others had another theory to offer: short sellers contributed to the flood of capital into SPY on Wednesday afternoon, according to Ling Zhou, head of equity derivatives strategy at TD Securities.

Investors that were net short equities or options needed to chase the rally after Trump’s tariff pause announcement, he said. SPY ended up being used as an emergency hedging tool for traders who held short positions, because challenging market conditions made it hard for investors to hedge any other way.

Elevated volatility makes it far more expensive than usual to buy options. Thin liquidity on Thursday widened the bid-ask spreads on stocks and other financial instruments leaving investors with few choices.

“This speaks to how much people got hurt on their shorts on the rally yesterday,” Zhou said. “Liquidity worsened and investors needed to hedge shorts via SPY.”