3 Reasons to Sell QRVO and 1 Stock to Buy Instead

Qorvo has gotten torched over the last six months - since October 2024, its stock price has dropped 41.7% to $59.21 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Qorvo, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with QRVO and a stock we'd rather own.

Why Do We Think Qorvo Will Underperform?

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

1. Long-Term Revenue Growth Disappoints

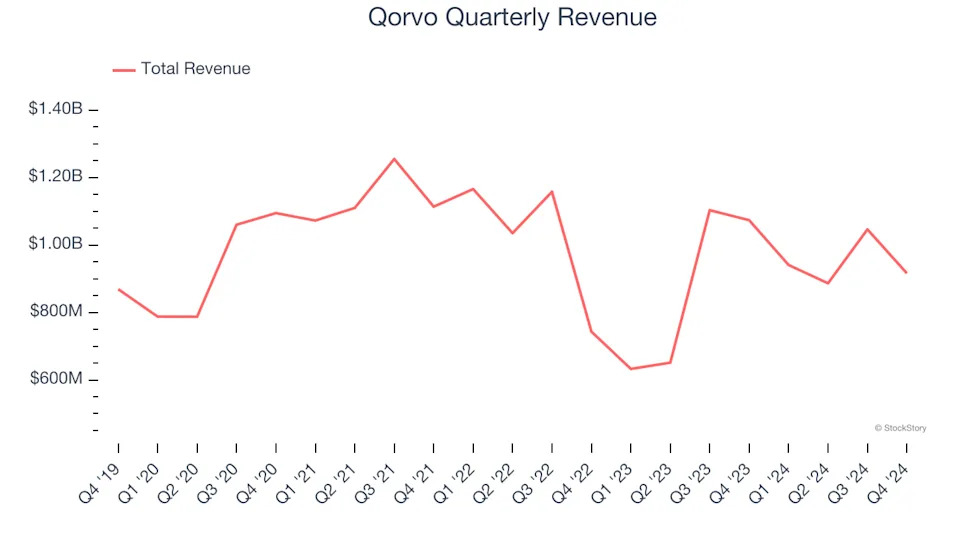

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Qorvo’s 3.9% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Shrinking Operating Margin

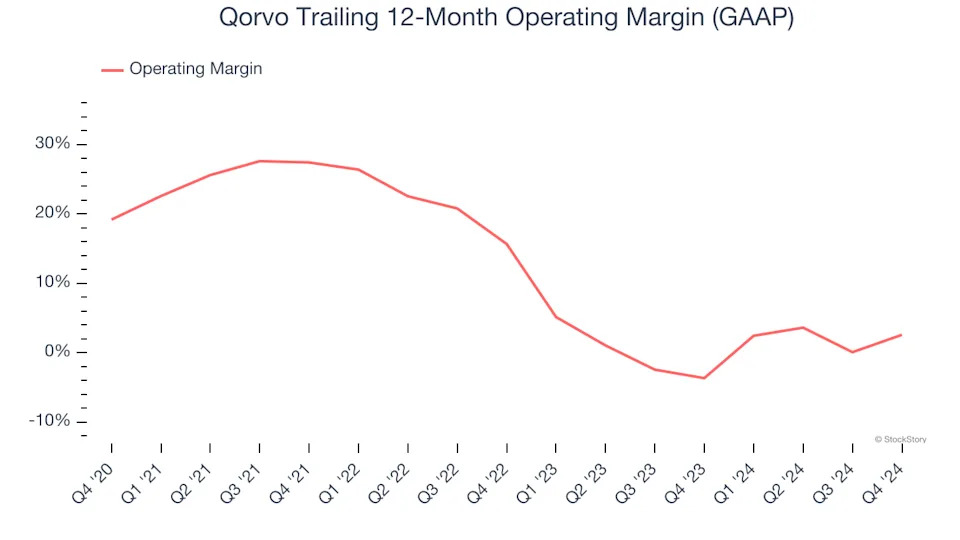

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Qorvo’s operating margin decreased by 16.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Qorvo’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 2.6%.

3. Free Cash Flow Margin Dropping

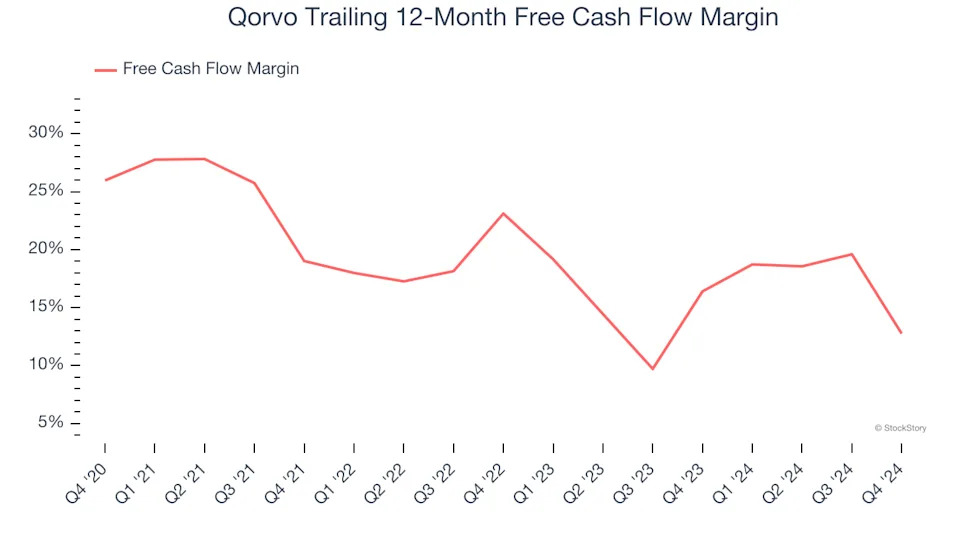

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Qorvo’s margin dropped by 13.2 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle. Qorvo’s free cash flow margin for the trailing 12 months was 12.8%.

Final Judgment

Qorvo falls short of our quality standards. After the recent drawdown, the stock trades at 11.5× forward price-to-earnings (or $59.21 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle .

Stocks We Would Buy Instead of Qorvo

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .