Neogen (NASDAQ:NEOG) Misses Q1 Revenue Estimates, Stock Drops

Life sciences company Neogen (NASDAQ:NEOG) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 3.4% year on year to $221 million. The company’s full-year revenue guidance of $895 million at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.10 per share was 13% below analysts’ consensus estimates.

Is now the time to buy Neogen? Find out in our full research report .

Neogen (NEOG) Q1 CY2025 Highlights:

Company Overview

Founded in 1981 and operating at the intersection of food safety and animal health, Neogen (NASDAQ:NEOG) develops and manufactures diagnostic tests and related products to detect dangerous substances in food and pharmaceuticals for animal health.

Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

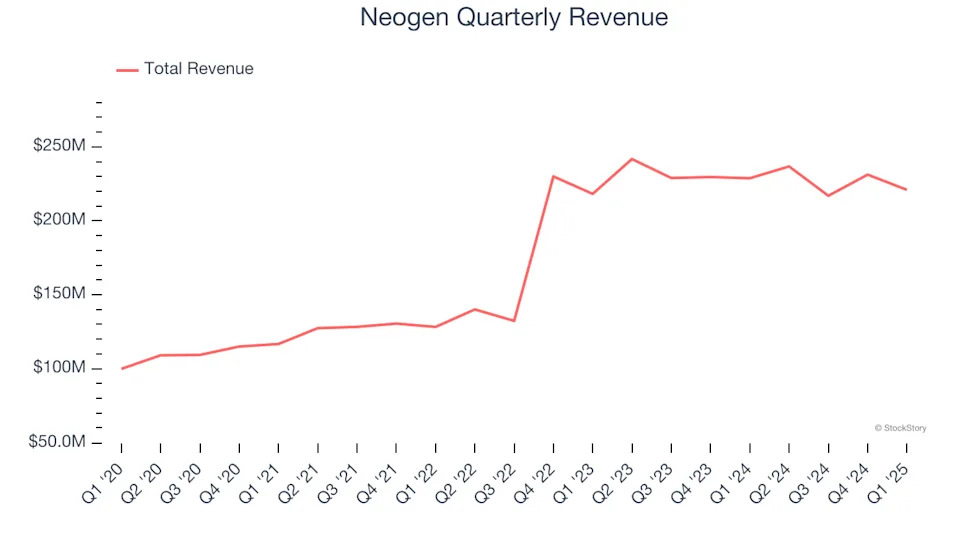

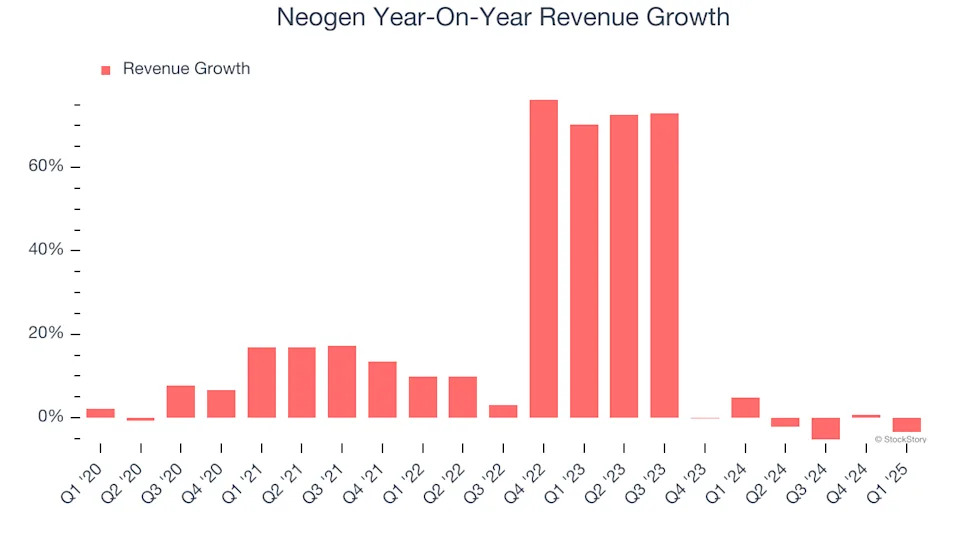

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Neogen’s sales grew at an impressive 16.7% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Neogen’s annualized revenue growth of 12.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Neogen missed Wall Street’s estimates and reported a rather uninspiring 3.4% year-on-year revenue decline, generating $221 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

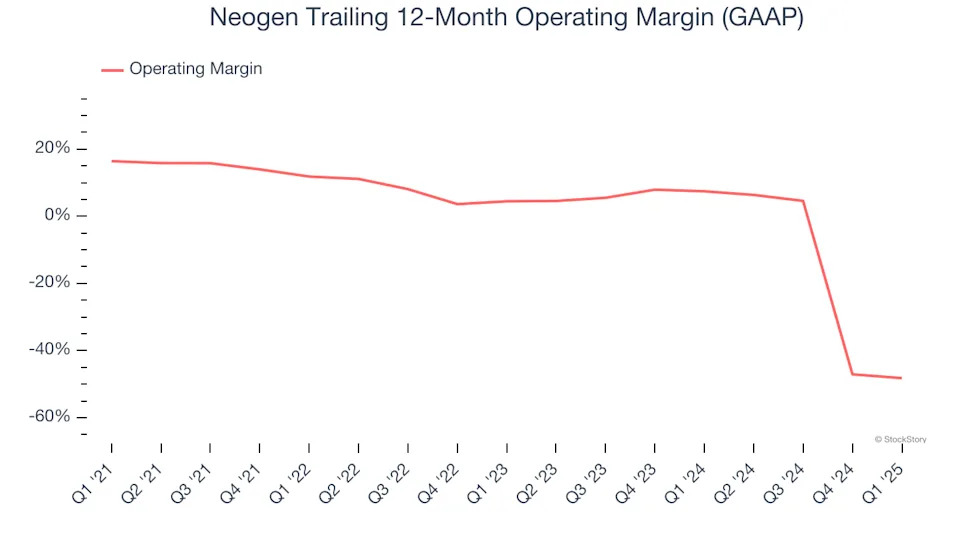

Operating Margin

Although Neogen was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Neogen’s operating margin decreased by 64.6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 52.7 percentage points. This was due to a large impairment charge in the last 12 months.

In Q1, Neogen generated an operating profit margin of 2.5%, down 2.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

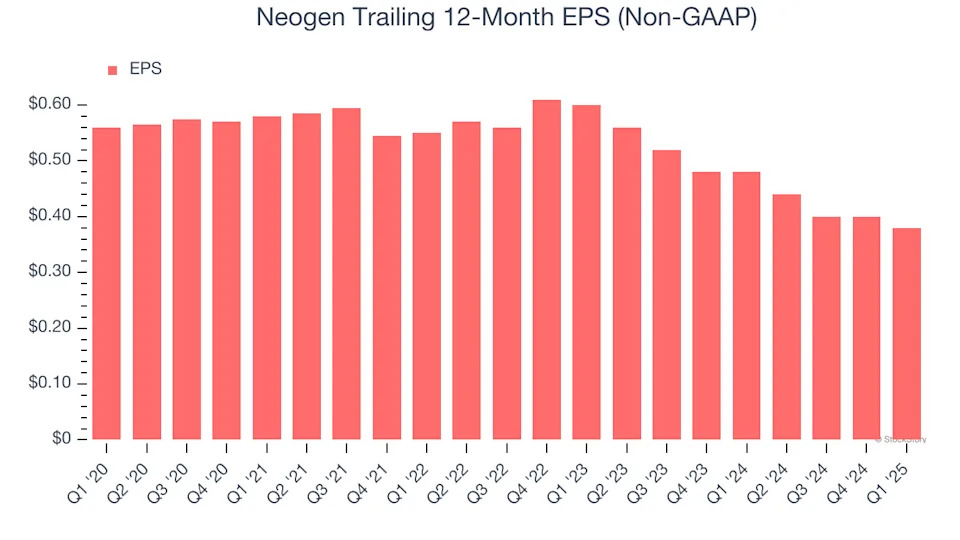

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

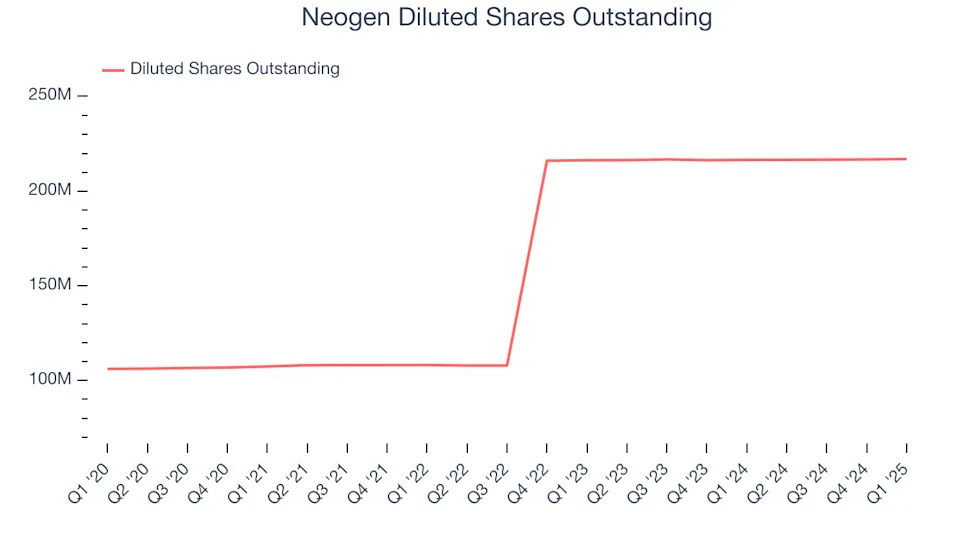

Sadly for Neogen, its EPS declined by 7.5% annually over the last five years while its revenue grew by 16.7%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Neogen’s earnings can give us a better understanding of its performance. As we mentioned earlier, Neogen’s operating margin declined by 64.6 percentage points over the last five years. Its share count also grew by 105%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Neogen reported EPS at $0.10, down from $0.12 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Neogen’s full-year EPS of $0.38 to grow 34.2%.

Key Takeaways from Neogen’s Q1 Results

We struggled to find many positives in these results. Both its revenue and EPS missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.3% to $6.58 immediately following the results.

Neogen may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .