Short sellers mint $159 billion profit in 6 days as stocks sink

(Bloomberg) — Short sellers, or traders who wager on share price declines, are up $159 billion in paper profits over just six trading days after an escalating trade war sent the US stock market plummeting down more than 10%.

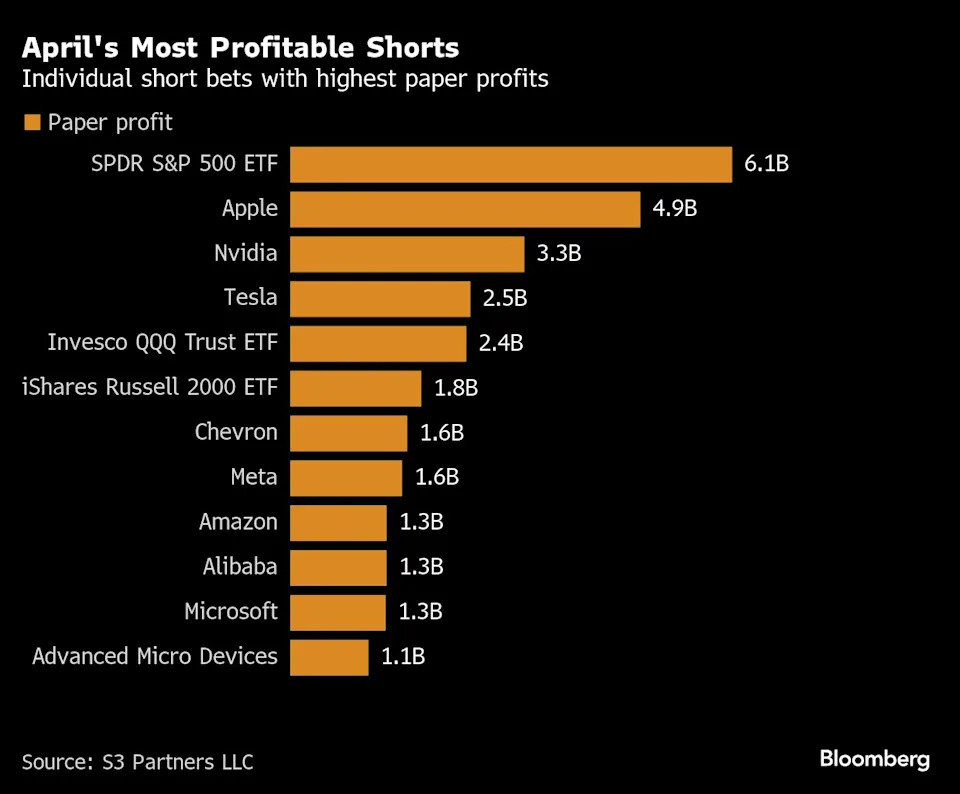

The biggest market drawdown since 2022 on President Donald Trump’s pronouncement of sweeping worldwide tariffs made bets against an exchange traded fund tracking the S&P 500 Index, known as SPY, the most profitable short bet in that timeframe, according to data from S3 Partners LLC. Traders wagering that the ETF would fall have so far accumulated paper profits of more than $6.1 billion this month, per an S3 report Tuesday.

Shorts stand to benefit from the wild intraday swings that erased trillions of dollars of market value, though it will ultimately depend on when they cash out on their wagers. With another $46 billion of new short bets made in April, according to S3, there’s a risk those contrarian wagers further amplify the next big shift in the market, especially if current weakness reverses and sends the major indexes higher.

“Overall, the short side was an extraordinarily profitable trade up and down the market during this correction,” Ihor Dusaniwsky, managing director of predictive analytics at S3, wrote. “81% of every short trade was profitable and 97% of every dollar shorted was a profitable trade.”

Other contrarian bets that netted shorts the most gains include Apple Inc. ( AAPL ), Nvidia Corp ( NVDA ) and Tesla Inc. ( TSLA ). The Invesco QQQ Trust Series, which tracks the Nasdaq 100 ( ^NDX ) Index, rounds out the top five most-profitable short trades so far in April. Each of the top five has so far netted paper profits of more than $2 billion for short sellers.

Most of the so-called Magnificent Seven megacap technology stocks are included in the list of most profitable shorts so far in April. Meta Platforms Inc ( META ), Amazon.com ( AMZN ) and Microsoft Corp. ( MSFT ) are also in the top fifteen. Outside of Nvidia, shorts have made solid bets that share prices of Advanced Micro Devices Inc., Broadcom Inc. and Micron Technology Inc. would decline.

Total short interest, or the dollar amount of total shares sold short, decreased by $114 billion — in part due to falling equity prices. In the event of a market rebound, short sellers will likely exit their negative positions by buying back shares, which could boost upside momentum for the overall market.

“When the market hits a floor and starts trending upwards again, we should expect a slew of buy-to-covers as the mark-to-market increase of shares shorted creates a short side over-exposure in hedged portfolios and short sellers look to realize their mark-to-market gains,” said Dusaniwsky. “Short sellers will be shoulder to shoulder with momentum and FOMO traders buying into a future rally, exacerbating market volatility on the way up as they did on the way down.”

More stories like this are available on bloomberg.com