Wall Street sinks as Trump threatens 200pc tariffs on French wine

US stock markets fell today on Wall Street as Donald Trump threatened to impose 200pc tariffs on French wine and alcoholic drinks.

The S&P 500 lost 1.4pc while the tech heavy Nasdaq Composite closed down 2pc, after resuming their heavy losses suffered this week.

The Dow Jones Industrial Average closed down 1.3pc as the US tariff war raised concerns that the American economy faces a downturn.

“Sentiment’s terrible,” said Mike Dickson, head of research at Horizon Investments. “There’s new tariff headlines every day, and that’s weighing on things.

“And you’re seeing it most acutely in some of the more sensitive areas of the market like the fairly inflated Magnificent 7,” Mr Dickson added, referring to the group of big technology firms including Microsoft and Amazon. “It doesn’t feel great out there right now.”

The S&P 500 closed 10.1pc below its February 19 record closing high, confirming that America’s top index has been in an official market correction since then.

The stock market fall came as the US president threatened to impose a 200pc tariff on French wine and champagne, in retaliation to the bloc’s decision to introduce a “nasty” levy on US whiskey.

The US president said he would introduce the tariff on all wines, champagnes, and alcohol from France and the EU unless Brussels removed its levy “immediately”.

“The Entire World is RIPPING US OFF!!!” Mr Trump wrote on his Truth Social platform.

The EU and Canada announced retaliatory tariffs against US goods including bourbon whisky as “countermeasures” to Washington’s 25pc duties on steel and aluminium that came into effect on Wednesday.

In a post on Truth Social, Mr Trump, who is teetotal, said: “The European Union, one of the most hostile and abusive taxing and tariffing authorities in the world, which was formed for the sole purpose of taking advantage of the United States, has just put a nasty 50pc tariff on whiskey.

“If this tariff is not removed immediately, the US will shortly place a 200pc tariff on all wines, Champagnes and alcoholic products coming out of France and other EU represented countries. This will be great for the wine and Champagne businesses in the US.”

Mr Trump’s son, Eric, is one of those who potentially stands to benefit as owner of Trump Winery in Charlottesville, Virginia.

The EU and Canada announced retaliatory tariffs against US goods including bourbon whiskey as “countermeasures” to Washington’s 25pc duties on steel and aluminium that came into effect on Wednesday.

Announcing the tariffs which will come into effect on April 13, Ursula von der Leyen, president of the European Commission, said: “We deeply regret this measure… tariffs are bad for business and worse for consumers.

“The European Union must act to protect consumers and business. The countermeasures we take today are strong but proportionate.”

Speaking shortly after Trump’s post on Truth Social, US Commerce Secretary Howard Lutnick told Bloomberg that the US was going to “teach the rest of the world respect” when it comes to trade.

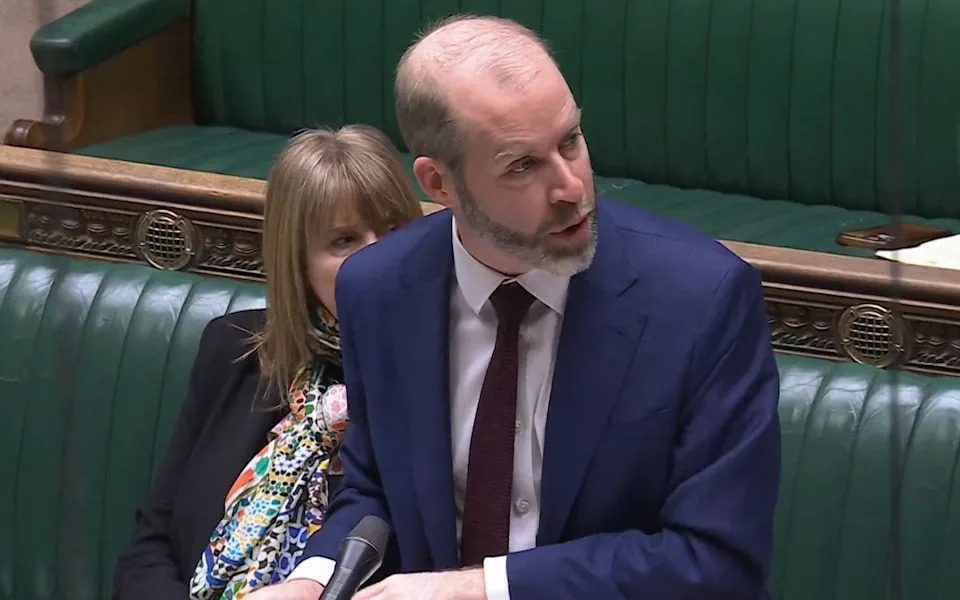

Jonathan Reynolds, the Business Secretary, has refused to rule out imposing tariffs on Elon Musk’s Tesla in response to Mr Trump’s global metal tariffs.

Read the latest updates below.

08:18 PM GMT

Wall Street tumbles 10pc below its record in official market correction

Wall Street’s sell-off hit a new low today after Donald Trump’s escalating trade war dragged the S&P 500 more than 10pc below its record, which was set just last month.

A 10pc drop is a big enough deal that professional investors have a name for it - a “correction” - and the S&P 500’s 1.4pc slide on Thursday sent the index to its first since 2023. The losses came after Trump upped the stakes in his trade war by threatening huge taxes on European wines and alcohol.

The Dow Jones Industrial Average dropped 1.3pc, and the Nasdaq fell 2pc.

The dizzying, battering swings for stocks have been coming not just day to day but also hour to hour.

The turbulence is a result of uncertainty about how much pain Trump will let the economy endure through tariffs and other policies in order to reshape the country and world as he wants. The president has said he wants manufacturing jobs back in the United States, along with a smaller U.S. government workforce and other fundamental changes.

That’s all for today on this blog. You can read all our latest news and commentary about business and the economy here .

07:45 PM GMT

Encouraging US inflation data doesn’t make Wall Street gain

Global shares and US Treasury yields both fell on Thursday on worries about global trade tensions after Donald Trump threatened duties of 200pc on European alcohol imports.

However, data out today from the US Labor Department showed US producer prices were unexpectedly unchanged in February and Wednesday’s data showed consumer prices rising more slowly than expected.

“If it wasn’t for the trade war going on, the market would be up strongly” as a result of the inflation data, said Tim Ghriskey, of Ingalls & Snyder in New York. “Traders are focused on the trade war.”

“It seems like the [US] administration is being very aggressive and promises, at least at this point, to be in it for the longer term.”

He added that “the personalities look unlikely to back down at least in the near term.”

Bill Adams, chief economist for Comerica Bank said that the inflation outlook depends more on government policies such as tariffs, deportations and Department of Government Efficiency (Doge) moves than “the backward-looking data releases right now.”

The MSCI World index, a gauge of global stocks, is down 1.2pc.

The S&P 500 is currently down 1.5pc. The Dow is down 1.3pc and the Nasdaq is down 2.1pc.

07:39 PM GMT

Oil prices fall amid fears of US downturn

Oil prices continued to fall today, with Brent Crude, the global benchmark, down 1.6pc at $69.88 a barrel. It has now fallen 6.4pc since the start of the year.

West Texas Intermediate, a US measure, fell to $66.56, down 1.6pc.

John Kilduff, a partner at Again Capital In New York, said: “A negative US economic outlook is problematic for this market. That’s really why we’re down near the lower end of the range here at $66. If we break that, we are going to go back down into the $50s.”

07:34 PM GMT

US Treasury secretary says EU ‘on the losing side of this argument’

US Treasury secretary Scott Bessent has said that the EU has more to lose than America in a trade war, as it relies more on exports to the United States.

“I would counsel these government leaders that they are on the losing side of this argument economically,” he said on CNBC.

Mr Trump’s barrage of threats has spooked investors, businesses and consumers. Producers of jets, coffee, clothing, cars and packaged foods are among the many businesses scrambling to assess their operations as Mr Trump’s actions threaten international supply chains.

Some economists say the uncertainty threatens the health of the US economy and raises the risk of recession. A Reuters/Ipsos poll released yesterday found that 70pc of Americans expect Trump’s tariffs to make regular purchases more expensive.

07:01 PM GMT

Trump policies a tragedy for US economy, says French central banker

The Trump administration’s policies are delivering a negative shock to the global economy but, above all, for the US economy, according to France’s European Central Bank policymaker.

Francois Villeroy de Galhau, who is governor of the Bank of France, has previously warned that “the current wave of US deregulation is dangerous”.

06:36 PM GMT

FTSE 100 closes flat amid trade war worries

British stocks ended mixed on Thursday, with the benchmark index flat amid US tariff concerns. Downbeat corporate results further dragged down the mid-cap index.

The benchmark FTSE 100 ended flat, paring gains from Wednesday’s rise sparked by positive Ukraine-Russia developments. Russian president Vladimir Putin said today that his country agrees with proposals for a ceasefire, but many details need to be sorted out.

The mid-cap FTSE 250 fell 1pc to its lowest closing level since last April.

06:33 PM GMT

Job losses loom in US after alcohol tariff threat

The drinks trade in the US selling French champagne and Italian wines have warned that Donald Trump’s threatened 200pc tariff on European imports will hit them hard.

Donald Trump said the tariffs would be “great for the wine and champagne businesses in the US”. However, wine importers and distributors, retailers and bar owners have said that they would pay the price.

Mary Taylor, owner of European wine importer Mary Taylor Wine, told Reuters that she has 16 shipping containers of wine currently being shipped. It is an amount that would wipe out her “entire net worth” if 200pc tariffs were applied, she said.

“If I have to pay... I’m done,” she said, adding she was looking to see if she could cancel some of the shipments and had written to contacts close to the president to argue against the tariffs.

Under US law, alcohol producers cannot sell directly to consumers, bars or restaurants. Instead, producers must sell to importers or distributors, who sell products on to bars and restaurants.

This means European wines are mostly imported by some 4,000 small American importers and distributors.

It is these US businesses that have to pay the levies, said Ben Aneff, of Tribeca Wine Merchants, a wine store in New York.

“A 200pc tariff on imported wine would ... destroy US businesses,” he said, adding many thousands would likely be forced to close. “It would do significantly more economic damage here in the US than it would in Europe.”

Gab Bowler, president of New York-based wine importer and distributor Bowler Wine, said European wines represent 70pc of his company’s sales.

He will first try to increase prices, he said, but this will impact sales. “What consumer wants to pay $45 for a bottle of wine that was $15 a week ago?”

“If this were to go on a long time, we would have to lay off about 50pc of our employees and borrow a bunch of money from the bank, putting us in a lot of debt,” he said.

05:49 PM GMT

US Treasury secretary plays down worries about financial markets

US Treasury secretary Scott Bessent has said he is not concerned about the market volatility caused by Donald Trump’s tariffs.

He said: “I’m less concerned about the short term. I think we’ve had a big unwind and the tariffs... we’ve got strategic industries we’ve got to have. We want to protect the American worker, that a lot of these trade deals haven’t been fair.

05:27 PM GMT

Canadian supermarket group says sales of US products plunging

Canada’s second-largest supermarket group has said that a boycott of American goods is rapidly gaining pace.

Michael Medline, boss of Empire Company, which runs the Safeway and Sobeys chains, told Bloomberg: “American products we are selling as a percentage of our total sales are rapidly dropping.

“We have heard loud and clear from our customers that they want Canadian products.”

He said that while the company normally sourced 12pc of products from south of the border, this is falling and that it would be shifting supply from American to Canadian products.

05:17 PM GMT

European shares close down after Trump threatens new tariffs

European shares closed slightly lower after Donald Trump threatened to impose tariffs on alcoholic products from the European Union.

The pan-European Stoxx 600, which includes some of Britain’s largest companies, was 0.2pc lower, after closing higher on Wednesday.

Spirit-makers Pernod Ricard and Campari fell 4pc and 4.3pc respectively, with the food and beverages sector overall losing 0.2pc.

Hennessy cognac maker LVMH was down 1.1pc.

“It’s becoming really hectic now because the tariffs are going on and off and no one knows how far this could go,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

“One thing, whether they go live or whether they are negotiation tactics, is that they raise inflation expectations which is why markets are panicked right now.”

05:15 PM GMT

Trump hits out at EU’s ‘nasty’ protectionism

Donald Trump has hit out at the EU claiming again that “the European Union is very nasty” for preventing imports from the US.

He said that US producers “sell no cars to Europe ... We’re not allowed to sell cars there”.

The EU is America’s second-largest export market for vehicles, according to the European Automobile Manufacturers’ Association. It said that some 271,476 US vehicles were imported into the EU in 2022.

The US president, who said that tariffs are “very important”, also criticised the EU’s investigations in the US companies. “They’re suing Google, they’re suing Facebook, they’re suing all of these companies, and they’re taking billions of dollars out of American companies,” he said.

04:58 PM GMT

Trump says Americans don’t need Canadian products

Donald Trump has said that Americans do not need to buy any Canadian products but claimed that disruption from his trade war will not last.

He said: “We don’t need anything they have... We don’t need their lumber, we don’t need their energy”.

But he said America’s northern neighbour would great additional state for the US. Addressing the Canadian national anthem, he said: “I love it.”

He played down the length of his trade war. “There will be disruption but it won’t be long,” he said.

04:53 PM GMT

EU ‘open for negotiations’ after latest Trump tariff threat

The European Union is ready to negotiate with the US over escalating tariffs between the two economic superpowers, European Commission head Ursula von der Leyen has said.

“We don’t like tariffs because we think that tariffs are taxes, and they are bad for business and they’re bad for consumers,” Mr von der Leyen told reporters in South Africa.

“We’ve always said that we will, at the same time, defend our interests,” she said. But, “I also want to emphasise that we are open for negotiations.”

The bloc’s trade commissioner was in contact with his counterpart in the United States and they were expected to have a phone call on Friday, Ms von der Leyen said.

04:51 PM GMT

Trump says he won’t change his mind on April’s tariffs

Donald Trump has said that he will not change his mind on his plans for worldwide “reciprocal” tariffs next month, Reuters has reported.

Last month, Mr Trump announced that would impose the tariff increases on a country-by country basis, proportional to the trade protectionism of each country.

04:41 PM GMT

S&P 500 in correction territory as Trump tariffs fuel sell-off

Wall Street’s benchmark S&P 500 index is in market correction territory close to a 10pc plunge from its record high.

Steve Sosnick, chief strategist at Interactive Brokers, said: “Another day of tariff uncertainty is weighing upon markets once again.

“That said, over this week’s sessions, we have found support [i.e. investors buying stocks] right around the level that would represent a 10pc correction for the S&P 500.”

The S&P 500 hit a record high on Feb 19, closing at 6,144.15. A ten percent fall would mean reaching 5,529.74. So far, stocks have hit a low of 5,530.06 in trading after declining more than 1.2pc.

04:27 PM GMT

Canada files complaint about Trump’s tariffs

Canada has asked the WTO to start dispute consultations with the US over its imposition of new tariffs on steel and aluminium products from Canada, the trade body said on Thursday.

The request was circulated to World Trade Organisation members on Thursday, it said.

Canada claims that the measures, which took effect on Wednesday, are inconsistent with US obligations under the General Agreement on Tariffs and Trade, the WTO said in a statement.

The dispute resolution system at the WTO, were Canada to escalate its complaint, lacks powers to protect Canada from the damage of tariffs while the dispute is resolved or to award compensation for the time it takes the US to implement any ruling.

04:14 PM GMT

Trump’s trade war will hit already-hurting American whiskey producers

Holly Seidewand, owner of First Fill Spirits, a shop in Saratoga Springs, New York, said that before Trump threatened the tariffs on European alcohol, the spirits industry had already been reeling.

It had been hit by redundancies after sales of American whiskeys fell by by 1.8pc to $5.2bn (£4bn) last year, as consumers cut spending.

She said: “This ongoing tariff war doesn’t just harm importers - it weakens domestic brands, disrupts distributors, and squeezes retailers who rely on global selections. In the end, consumers will bear the brunt of it all.”

Ronnie Sanders, the boss of Vine Street Imports in Mount Laurel Township, New Jersey, said a 200pc tariff would essentially shut down the European wine business in the US.

He said: “I don’t think customers are prepared to pay two to three times more for their favourite wine or Champagne.”

Under Donald Trump’s plan, a previously untariffed $15 bottle of Italian Prosecco could possibly increase in price to $45. Similarly, the EU’s response to Trump’s steel and aluminium tariffs means that the cost of a €30 bottle of bourbon in Paris could increase to €45.

04:05 PM GMT

Entire world ‘ripping us off’, claims Trump

Donald Trump has claimed that the entire world is “ripping us off”. In comments on his Truth Social network, he said that the US had “stupid trade” rather than free trade.

04:01 PM GMT

Gold prices surges amid stock market pessimism

The price of gold surged this afternoon as stock markets fall in response to Donald Trump’s latest tariff threats.

The price of gold is currently up around 1.4pc at $2,978 (£2,301) an ounce.

Axel Rudolph, senior technical analyst at online trading platform IG, said: “Fears of an escalating US-led trade war provoked a safe haven precious metal buying spree and slight appreciation in the US dollar.

“The gold price hit a new record high, exceeding the $2,970 per troy ounce level, whilst gunning for the $3,000 mark.

“Other precious metal and Dutch gas prices also surged higher, the latter by over 3.5pc, while the oil price dropped by a percentage point amid demand worries linked to US recession fears.”

03:57 PM GMT

Dollar rises despite worries over US economy

The US dollar rose against major currencies including the pound and the euro today. But it still remained under pressure from concerns arising from slowing economic growth and global trade quarrels.

US president Donald Trump threatened to impose a 200pc tariff on wine, cognac and other alcohol imports from the EU, opening a new front in a global trade war that has roiled financial markets and raised recession fears.

Vassili Serebriakov, foreign exchange strategist at UBS in New York, said: “We’ve had a very large dollar weakening move in the previous days and weeks and it feels like we’re entering a bit of a consolidation period.”

Consolidation periods refer to when a price oscillates within narrow boundaries, usually during periods of indecision in the market.

He added: “We do see the possibility that the dollar recovers because we’re still being hit with tariffs news and we have this early April reciprocal tariff deadline coming up.”

The dollar is up more than 0.1pc against sterling and 0.2pc against the euro.

03:50 PM GMT

Putin says ‘welcome’ to Western companies wishing to return to Russia

Russian president Vladimir Putin has said that Western companies are welcome to return to Russia and that Moscow was in closed-door talks about facilitating the return of some of them.

“To those who want to return, we say: welcome, welcome at any moment,” Putin said at a press conference following talks with Belarusian president Alexander Lukashenko.

You can read The Telegraph’s live blog on Mr Putin’s press conference here .

03:46 PM GMT

US drug companies are ‘deeply embedded’ in Ireland, says Irish PM

US drug companies that are paying corporation tax in Ireland are “deeply embedded” in the country, the Irish premier Micheál Martin has said.

Yesterday, Donald Trump hit out at the practice of US drug companies domiciling in Ireland for tax purposes. He said that had the moves started when he was in power, he would have imposed a 200pc tariff on all Irish imports.

Mr Martin said that the situation is “somewhat uncertain”.

Speaking to reporters in Washington, DC, he said: “A lot remains to be seen in terms of how this manifests itself, in terms of specific US legislation or mechanism or tax or whatever. It’s all somewhat uncertain and unclear in relation to that.

“But suffice to say that the investment in Ireland is very solid, deeply embedded, and plays a huge role in the overall architecture of these pharmaceutical companies in terms of their broader business offering, and particularly their access to the European market and their access to the Asian markets, for which the Irish base has been particularly important.”

03:41 PM GMT

Irish premier calls for ‘dialogue’ over trade war

The Irish Taoiseach Micheál Martin has called for for “dialogue” over threatened tariffs on European alcohol, a correspondent at Ireland’s Virgin Media News has reported.

“I think the only effective way to deal with it is through dialogue between the European Union and the United States government,” Mr Martin told journalists in Washington.

“It needs to get to the dialogue stage because business tariffs increase inflation and are not good for the consumer and are not good for business,” he said. “But I do believe there will be some distance to go ... there will be discussions and consultations within the European Union in respect of European actions. And obviously again, in that scenario we’ve been endeavouring to protect Irish interests in terms of specific Irish products of Irish sectors.”

03:37 PM GMT

US spirits lobby urges ‘toasts not tariffs’

A trade association representing US producers and marketers of spirits has urged Donald Trump to avoid a prolonged trade with with Europe involving

Chris Swonger, head of the Distilled Spirits Council, said: “The US-EU spirits sector is the model for fair and reciprocal trade, having zero-for-zero tariffs since 1997.

“We urge President Trump to secure a spirits agreement with the EU to get us back to zero-for-zero tariffs, which will create US jobs and increase manufacturing and exports for the American hospitality sector. We want toasts not tariffs.”

An ocean apart, the French Wine and Spirits Exports Federation had called on the EU to remove wines and spirits from the lists of products hit by tariffs in response to the US duties on steel and aluminium. The federation said it was “dismayed” by the EU’s plan, which came “when the French wine and spirits sector is extremely vulnerable, for both economic and geopolitical reasons”.

03:31 PM GMT

Stop using drinks industry as ‘bargaining chip’, EU and US urged

The European spirits trade group called on the EU and United States to stop using the sector as a “bargaining chip” in their tit-for-tat tariffs war.

Spirits Europe said it was “deeply alarmed” by the deepening trade dispute as Donald Trump threatened to impose 200pc tariffs on French wines unless the EU lifts its planned levies on US whiskey.

The trade body said: “We urge both sides to stop using our sector as a bargaining chip in conflicts that have nothing to do with us.

“Spirits trade exemplifies how open markets create mutual benefits. Reimposing tariffs would be a step backward—hurting businesses, workers, and consumers on both sides.

“The EU and US must de-escalate this dispute now and ensure spirits are never again caught in the crossfire.”

You might forgive me for wanting to disappear off for a drink after the turmoil in markets this week.

Thanks for following the coverage so far. Alex Singleton will keep you informed for the rest of the day.

03:12 PM GMT

Pound edges down after Trump’s wine tariff threat

The pound has fallen slightly against the dollar after Donald Trump’s latest tariff threats.

Sterling was 0.1pc lower at $1.294 but remained close to four-month highs after US Commerce Secretary Howard Lutnick praised Britain for not hitting back at US metal tariffs.

The pound has gained more than 6pc against the dollar since Mr Trump took office in January.

The euro was down 0.2pc versus the US currency to $1.086.

Francesco Pesole of ING said: “It’s mostly a dollar story at the moment driving markets.”

Michael Pfister of Commerzbank added: “The important thing for GBP is that the UK has a trade deficit with the US and exports a lot more services than other countries, so is not as vulnerable to US tariffs as the European Union.”

02:51 PM GMT

Remove ‘unnecessary American IPAs’ over tariff threat, says Verhofstadt

Guy Verhofstadt, the MEP who chaired the European Parliament’s Brexit steering group, described Donald Trump as a “madman” after the US president threatened to impose 200pc tariffs on French wine.

The former Belgian prime minister called for Belgian beer on all EU shelves and “no more unnecessary American IPAs” in response to the tariff threat.

02:32 PM GMT

Drinks maker shares plunge as Trump threatens 200pc tariffs

Shares in European drinks makers plunged in afternoon trading as Donald Trump threatened to impose 200pc tariffs.

Pernod Ricard plunged 3.7pc to the bottom of the Cac 40 in Paris, while bottler Coca-Cola HBC sank 3.3pc to the bottom of the FTSE 100.

Remy Cointreau was down 3.2pc while LVMH, which owns Champagne houses Moët & Chandon and Veuve Clicquot, dropped 1pc.

Guinness-maker Diageo fell as much as 1.8pc but was last trading flat as the US president said he would penalise French wine makers unless the EU lifted its proposed tariffs on US whiskey.

02:14 PM GMT

US stocks hit by recession fears

All three of the major US stock indexes have fallen heavily this week amid concerns Donald Trump’s trade war risks a recession in the world’s largest economy.

The Dow Jones Industrial Average and S&P 500 are each down more than 3pc since the start of trading on Monday, while the Nasdaq Composite gas dropped over 4pc.

It puts the Dow on course for its worst week since September 2022, with the S&P 500 and Nasdaq Composite putting in their weakest performance in six months.

Daniel Murray at EFG said: “Market weakness may last for longer should the uncertainty about US economic policy stay high or increase further, pushing the US economy in recession.”

01:55 PM GMT

Wall Street slumps as Trump threatens French wine tariffs

US stock markets declined in early trading on Wall Street as Donald Trump threatened to impose 200pc tariffs on French wine and alcoholic drinks.

The S&P 500 fell 0.5pc to 5,571.94 while the tech heavy Nasdaq Composite dropped 0.9pc to 17,488.32.

The Dow Jones Industrial Average was down 0.4pc to 41,182.53 as the US tariff war raised concerns that the American economy faces a downturn.

01:45 PM GMT

Trump official praises Britain for holding back in trade war

Britain and Mexico were praised by one of Donald Trump’s top officials for refraining from retaliation as the US imposed metal tariffs this week.

Commerce Secretary Howard Lutnick said trading partners that had hit back with countermeasures had left themselves open to further escalation.

“If you make him unhappy, he responds unhappy,” Mr Lutnick told Bloomberg TV.

The European Union announced “countermeasures” to America’s 25pc tariffs on steel and aluminium that came into force on Wednesday, while Canada also announced retaliatory measures.

Mr Lutnick said: “The British didn’t respond, the Mexicans didn’t respond — you have some countries that actually thoughtfully examine how they do business with us.”

He told nations that had resorted to “old-school” tit-for-tat measures: “The president’s going to deal with them with strength and with power.”

01:19 PM GMT

Trump tariff threats grow: What countries face so far

Donald Trump’s latest threat of tariffs against EU wine and drinks joins a long list of threats by his administration against a host of industries.

This week, the US brought into force 25pc tariffs against all steel and aluminium imports to the American economy.

The White House has also imposed an additional 20pc tariffs on all Chinese goods, on top of the levies that were in place before Mr Trump took office.

The US president has announced 25pc tariffs against Canada and Mexico but has rowed back on these measures in various ways.

He delayed the introduction of the duties for car manufacturers so long as they complied with the United States-Mexico-Canada Agreement (USMCA) on trade.

He then widened these exemptions to all Canadian and Mexican goods that comply with the agreement, until April 2. Around 50pc of the goods the US imports from Mexico and 38pc of the goods from Canada comply with USMCA terms, according to CNN.

Canada this week faced a threat that Mr Trump would be double his metal tariffs against the country to 50pc.

However, Mr Trump rowed back on the plan after the premier of Ontario agreed to suspend tariffs on US electricity exports.

The US president said all tariffs against the country could be avoided if it agreed to become the 51st state of America.

Today, he threatened the EU with 200pc tariffs on wine from France “and other EU represented countries” unless the bloc cancels its counter tariffs on US whiskey.

01:01 PM GMT

Wholesale inflation falls ahead of tariff impact

US wholesale inflation decelerated by more than expected last month in the first figures covering a full month of Donald Trump’s second presidency.

The Labor Department reported that its producer price index — which tracks inflation before it reaches consumers — fell from an upwardly revised 3.7pc in January to 3.2pc in February.

Excluding volatile food and energy prices, so-called core wholesale prices fell from 3.8pc to 3.4pc.

However, the progress comes as the US ramps up its trade war, imposing 25pc tariffs on steel and aluminium, with 20pc levies on China.

In coming weeks, Mr Trump is set to impose 25pc tariffs on Canada and Mexico and to introduce “reciprocal tariffs’’ that match higher taxes that other countries slap on US products.

The US president has just threatened to impose 200pc tariffs on French wine, which would send wholesale inflation in the food and drink sector soaring.

12:30 PM GMT

Trump threatens 200pc tariffs on French wine and Champagne

Donald Trump said he would put a 200pc tariff on all wines and other alcoholic products coming out of the EU if the bloc refused to remove its tariff on whiskey.

The US president posted on Truth Social: “The European Union, one of the most hostile and abusive taxing and tariffing authorities in the world, which was formed for the sole purpose of taking advantage of the United States, has just put a nasty 50pc tariff on whisky.

“If this tariff is not removed immediately, the US will shortly place a 200pc tariff on all wines, Champagnes and alcoholic products coming out of France and other EU represented countries,

“This will be great for the wine and Champagne businesses in the US.”

12:02 PM GMT

Tesla shares fall as Reynolds refuses to rule out tariffs

Tesla shares have edged lower in premarket trading after the Business Secretary refused to rule out imposing tariffs that would hit the electric vehicle maker.

Elon Musk’s car company was down 1pc ahead of the opening bell on Wall Street, having plunged 50pc since hitting a record high in December.

11:41 AM GMT

Wall Street on track to fall amid trade war

US stock indexes are poised to decline at the opening bell amid fears of an economic slowdown as a result of Donald Trump’s tariff war.

All three of Wall Street’s main share indexes were lower as investors were also worried by the deepening risk of a federal government shutdown.

The Republican-controlled House passed a stop-gap funding bill earlier in the week but Democrats in the Senate have called for a one-month extension of existing spending, buying time to complete more comprehensive appropriations bills for the year.

ING analysts said: “The proposed alternative is an interim funding plan until April 11: that would simply postpone a key risk for markets, hence the negative reaction in stock futures.”

All three main indexes have seen their post-election gains being wiped out. The benchmark S&P 500 nearly confirmed a 10pc correction drop on Tuesday from its record high.

In premarket trading, the Dow Jones Industrial Average was down 0.1pc, the S&P 500 fell 0.2pc and the Nasdaq 100 was 0.4pc lower.

11:19 AM GMT

Tesla tariffs could target energy business

Tesla cars sold in the UK are largely manufactured in the company’s Shanghai and Berlin factories so it is unclear to what extent putting tariffs on Tesla vehicles would affect prices or imports.

The company’s Model S and Model X cars are made in the US but are exclusively left-hand drive, meaning very few are imported into the UK.

Tariffs on UK imports may have a bigger impact on the company’s energy business which sells batteries to households.

Elon Musk’s businesses have been singled out by some politicians in response to Mr Trump’s tariffs. Canadian provinces have cancelled deals for his Starlink satellite internet service and some have suggested tariffs on Teslas.

Mr Musk has floated the idea of a UK gigafactory in the past but more recently suggested he would not invest in Britain amid a clash with Labour.

11:09 AM GMT

Britain can pursue US policy that other nations cannot, says Reynolds

The Business Secretary said Britain has opportunities that are not available to other countries as he defended the Government’s decision not to impose retaliatory tariffs against the US.

Jonathan Reynolds said the US had objections to “significant deficits in manufacturing goods” with China and the EU, but this did not apply to the UK.

During business questions in the Commons, Chris Law, the SNP MP, asked: “The president in the US has said ‘the EU was created to screw over the US’.

“But while the EU stood up for their economy and imposed a counter tariff, it is the UK being screwed by the US and made it clear there will not be an exception to its levies, despite the Prime Minister’s pleading.

“So tell me, minister, is the Government content to remain a bridge between the EU and the US, if it’s a bridge that the US continues to walk all over, risking the UK economy with every single step?”

Mr Reynolds said: “The simple position is that we will represent the UK’s national interest in this matter, and when it comes to the objections that the US has about the significant deficits in manufacturing goods they have with China and the EU, that is not the relationship between the US and the UK.

“And there is the chance for the UK, therefore, to pursue a different policy - one that actually produces greater benefits for every part of the UK than perhaps is available to other countries.

“Of course we are cognisant of the overall impact. No-one wants to see this kind of turmoil in the global economy but our job is to deliver for the UK and that is exactly what we’re focused on doing.”

10:42 AM GMT

Britain refuses to rule out tariffs on Teslas in escalating trade war

The Business Secretary has refused to rule out imposing tariffs on Elon Musk’s Tesla in response to Donald Trump’s global metal tariffs.

Jonathan Reynolds said he would “reserve all rights to take any action” in response to the 25pc levies on steel and aluminium that came into effect on Wednesday.

The European Union and Canada announced retaliatory tariffs against US goods in response to the latest step in Mr Trump’s trade war.

However, Sir Keir Starmer said during Prime Minister’s Questions on Wednesday that “all options are on the table”.

Clive Jones, the Liberal Democrat MP, asked in the Commons today: “If the Government have to push forward with retaliatory measures against the United States for their steel tariffs, they must strike at the political allies of the President, to meaningfully move on the conversation.

“Can the Secretary of State confirm if Elon Musk’s Tesla are being considered as a potential target for retaliatory measures?”

Mr Reynolds replied: “We reserve the right to take any action in response to any changes in our trading relationships but I do think we can look to the opportunity the UK has, which is greater than any other country, to get to an agreement which improves our terms of trade with the US.

“I reserve all rights to take any action but I think we can look forward in a positive way to improving that trade relationship, and that right now is my message and focus.”

10:27 AM GMT

Trump administration’s trade policies are challenging, admits Reynolds

The new trade policy of the US “is challenging”, the Business Secretary has admitted after Donald Trump imposed 25pc tariffs on metal imports to America this week.

Jonathan Reynolds told the Commons: “We have engaged closely with the US administration, including Commerce Secretary Howard Lutnick and the new US trade representative Jamieson Greer.

“The new trade policy of the US is challenging but we believe our decision to engage and seek potential agreement on a new economic deal between the UK and the US offers us an opportunity to ensure the UK is the best connected market in the world.”

10:11 AM GMT

Pound flat amid uncertainty over US trade plans

The pound and the euro were both little changed against the dollar as doubts lingered about the impact of Donald Trump’s trade policies.

Sterling was trading at about $1.296 while the euro fetched $1.088 on a calmer morning for markets after the turmoil at the start of the week.

The yen was among the top gainers against a weaker dollar, rising 0.3pc to 147.75, following comments by the Bank of Japan Governor Kazuo Ueda reaffirming the bank’s resolve to shrink its “too big” balance sheet.

Data on Wednesday showed US inflation rose slightly less than expected in February, but the relief it offers could be temporary as the figures did not fully capture the cascade of Trump’s tariffs.

James Reilly of Capital Economics said: “What is more uncertain is the outlook for future inflation and the state of US economic activity, thanks largely to the unpredictability of US trade policy.

“It is these issues driving markets, and (the) report gave little fresh insight into either of those.”

09:50 AM GMT

How to protect your investments as the Trump sell-off takes off

The US stock market is not happy . An estimated $4 trillion (£3.1 trillion) has been wiped off the value of companies thanks, for the most part, to President Trump’s imposition of tariffs , writes Fran Ivens .

However, Stephen Yiu, chief investment officer and founder of Blue Whale Growth Fund, thinks the market is wrong.

He says: “People were panicking that America was heading into a severe recession , that is why everyone is selling and de-risking.

“We think that is wrong and the understanding is incorrect.”

09:17 AM GMT

Global oil demand downgraded as Trump tariffs upend trade

Global demand for oil has been forecast to grow at a slower pace as Donald Trump’s tariff war hits the world economy.

The International Energy Agency (IEA) downgraded its growth estimates for the fourth quarter of last year and first three months of 2025 to about 1.2 million barrels per day, saying recent data had “underwhelmed”.

The Paris-based organisation warned that its oil demand projections “deteriorated over the past month as trade tensions escalated between the United States and several other countries”.

It said: “New US tariffs, combined with escalating retaliatory measures, tilted macro risks to the downside.”

While it downgraded its recent estimates, it said global oil demand is still expected to average more than a million barrels per day this year, up from 830,000 in 2024.

It said this was “boosted in part by lower oil prices” which have slumped 13pc since a peak in mid-January shortly before Mr Trump’s return to the White House.

The IEA warned: “Risks to the market outlook remain rife and uncertainties abound.”

09:04 AM GMT

Gold rises amid Trump tariff fears

Gold has climbed for a third straight session to as high as $2,947, closing in on the record high from February 24 at $2,956.15.

The safe-haven metal gained as stocks resumed their sell-off, with the Dax down 0.8pc, the Cac 40 falling 0.4 and Asian markets mostly lower. The FTSE 100 reversed course and was last 0.2pc higher.

Mohit Kumar, chief European economist at Jefferies, said: “Markets are still being driven by Trump tariffs and US growth concerns.

“Beyond the growth and inflation impact of tariffs, they create uncertainty which is negative for investment and outlook for any company involved in cross-border trades.

“Our view has been that tariffs are not an inflation story but a growth story.”

08:51 AM GMT

Hong Kong surges as Trump wages trade war

Hong Kong’s stock market has surged since Donald Trump took office after his trade policies hit confidence in the US economy.

The city’s Hang Seng index has become the world’s top performing stock market during the US president’s second term in office.

It has risen by 18pc since Mr Trump’s inauguration, compared to a more than 7pc slump in the S&P 500 on Wall Street.

Thomas Ip, executive director at Gaoyu Securities, told Bloomberg: “We have been waiting for this moment for many years.

“Trump’s policies have created so much uncertainty for the US stock market.

“As angst grows, the smart money will come to Hong Kong where valuations are cheaper and the policy environment is better.”

The Hang Seng was down 0.6pc today.

08:31 AM GMT

European stocks fall over trade fears

European stock markets slumped at the open after Donald Trump threatened further action against the European Union in his tariff war.

The Stoxx 600, which features companies from across the Continent, was down 0.1pc in early trading, while the Cac 40 in Paris fell 0.5pc to 7,952.71 and the Dax in Frankfurt dropped 0.7pc to 22,514.82.

Mr Trump threatened on Wednesday to ratchet up a global trade war with further tariffs on European Union goods, just hours after the EU announced retaliatory levies in response to US trade barriers.

Car and parts makers, which are vulnerable to trade barriers, took the biggest hit and fell over 1pc, while European banks also lost 0.7pc.

08:15 AM GMT

China urges ‘dialogue’ with US over Trump tariffs

China has called for “dialogue” with Donald Trump’s administration to resolve spiralling trade tensions that have seen the world’s two largest economies plunged into a trade war.

Beijing’s commerce ministry spokesman He Yongqian said: “China has always advocated that China and the United States should adopt a positive and cooperative attitude towards differences and controversies in economic and trade fields.

“But it must be stressed that any form of communication and consultation must be based on mutual respect, equality and mutual benefit.

“Threats and intimidation can only be counterproductive. It is hoped that the United States and China will work together... to return to the correct track of resolving issues through dialogue and consultation.”

Her comments come after the US this month raised its 10pc blanket tariff on Chinese goods to 20pc.

Beijing responded with levies of up to 1pc on a range of US agricultural goods including soybeans, pork and chicken.

08:05 AM GMT

UK markets slump over Trump trade war fears

The FTSE 100 fell at the open as fears linger about the impact of Donald Trump’s trade war.

The UK’s benchmark stock index fell 0.1pc to 8,529.89 while the midcap FTSE 250 dropped 0.3pc to 19,819.57.

It comes after a brief rally on Wednesday which saw the FTSE 100 rise 0.5pc and the FTSE 250 gain 0.6pc after data showed US inflation was lower than expected in February.

08:00 AM GMT

Worst of Trump stock market correction is over, says JP Morgan

The worst of the correction on US stock markets may be over, according to a Wall Street banking giant after a week of turmoil.

JP Morgan said credit markets “are once again more dismissive of US recession risks than equity or rate markets”.

Donald Trump triggered a sharp sell-off on stock markets after he warned of a “period of transition” for the US economy as he wages his tariff trade war.

The benchmark S&P 500 has dropped nearly 9pc from a record high in February, with Goldman Sachs and Citi downgrading their outlook for Wall Street’s performance this year.

However, JPMorgan analysts Nikolaos Panigirtzoglou and Mika Inkinen said that while small cap US stocks are pricing in a 50pc probability of a US recession, debt is implying a probability of 9pc to 12pc.

07:45 AM GMT

Deliveroo makes first profit but warns of ‘uncertain’ times for consumers

Deliveroo has posted its first full-year profit amid growing orders despite an “uncertain” consumer environment - as Donald Trump’s trade war threatens global growth.

The delivery app made a £2.8m profit last year, up from a £31.8m loss in 2023.

Revenue and orders were both up 2pc while chief executive Will Shu pointed to the app’s attempts to continue branching out from takeaway food to groceries, as well as increasing customer satisfaction scores.

Mr Shu said: “Over the past year, we have been relentlessly focused on making the Deliveroo experience even better.”

He added: “Whilst the consumer environment remains uncertain, I am confident that we can continue to deliver growth by focusing on the levers in our control: supporting our restaurant partners to meet untapped consumer demand around new occasions, expanding our grocery and retail offering.”

07:44 AM GMT

Gold ‘to hit record high’ after Trump market chaos

Gold is predicted to soar to record highs later this year amid the turmoil caused by Donald Trump’s tariff war .

Bullion could jump to an unprecedented $3,500 an ounce during the third quarter, according to analysts at Macquarie Group, as investors take flight to safe-haven assets.

The precious metal was trading at about $2,940 an ounce today but Macquarie said it could average $3,150 an ounce between July and September.

Gold climbed to within $10 of its record high in overnight trading and has risen by 12pc this year as President Trump wages a global trade war which has triggered retaliatory measures by China, the EU and Canada.

There are also fears that the US is on course for a federal shutdown after Democrats in the Senate failed to agree to a stop-gap funding bill on Wednesday.

Macquarie analysts said: “We view gold’s price strength to date, and our expectation for it to continue, as primarily being driven by investors’ and official institutions’ greater willingness to pay for its lack of credit or counterparty risk.”

07:37 AM GMT

Good morning

Thanks for joining me. Gold is on track to hit a record high of $3,500 later this year, analysts have said as Donald Trump steps up his global trade war.

Bullion will climb from about $2,940 an ounce today to hit the new peak in the third quarter, according to Macquarie Group, as investors seek out safe-haven assets amid the recent stock market turmoil.

5 things to start your day

-

More retired baby boomers pay income tax than Gen Z | Triple lock and youth worklessness contribute to dramatic reversal of pre-lockdown trend

-

Sir Jim Ratcliffe’s Ineos recalls cars after doors open while driving | Ineos Automotive plans to replace parts on 7,000 Land Rover-inspired Grenadiers

-

British steelmakers demand protection from Trump’s trade war | Industry leaders urge ministers to secure tariff exemptions as US introduces 25pc levy

-

Tesco to give shoppers food for free after net zero row | Supermarket introduces £0 ‘yellow stickers’ in effort to slash waste

-

America’s deep political divisions are splitting offices along ideological lines | US workplaces are increasingly polarised amid heightened societal tensions

What happened overnight

Stocks sank in Asia over worries about the economic impact of President Donald Trump’s trade policies.

Gold climbed to within $10 of its record peak and the safe-haven yen rallied, while US Treasury yields turned lower. Crude oil prices also declined.

Hong Kong’s Hang Seng slumped 1.4pc, and mainland Chinese blue chips slid 0.7pc.

Japan’s Nikkei gave up gains of as much as 1.4pc to last trade flat, while Taiwanese equities dropped 1.1pc and South Korea’s KOSPI lost 0.4pc.

Australia’s stocks benchmark closed down 0.5pc and is now 10pc off its record peak struck on February 14, confirming a technical correction.

On Wall Street, the S&P 500 rose 0.5pc, to close at 5,599.30, the Dow Jones fell 0.2pc to 41,350.93, and the Nasdaq added 1.2pc, closing at 17,648.30.

In the bond market, the yield on benchmark 10-year US Treasury notes rose to 4.316pc, from 4.288pc late on Tuesday.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.