Crypto ETFs Plunge as Growth Scare Hits Market

Bitcoin and ethereum exchange-traded funds swooned on Monday as trade wars and recession fears added fresh uncertainty to markets, pushing investors away from high-risk trades and toward safer investments like bond and dividend funds .

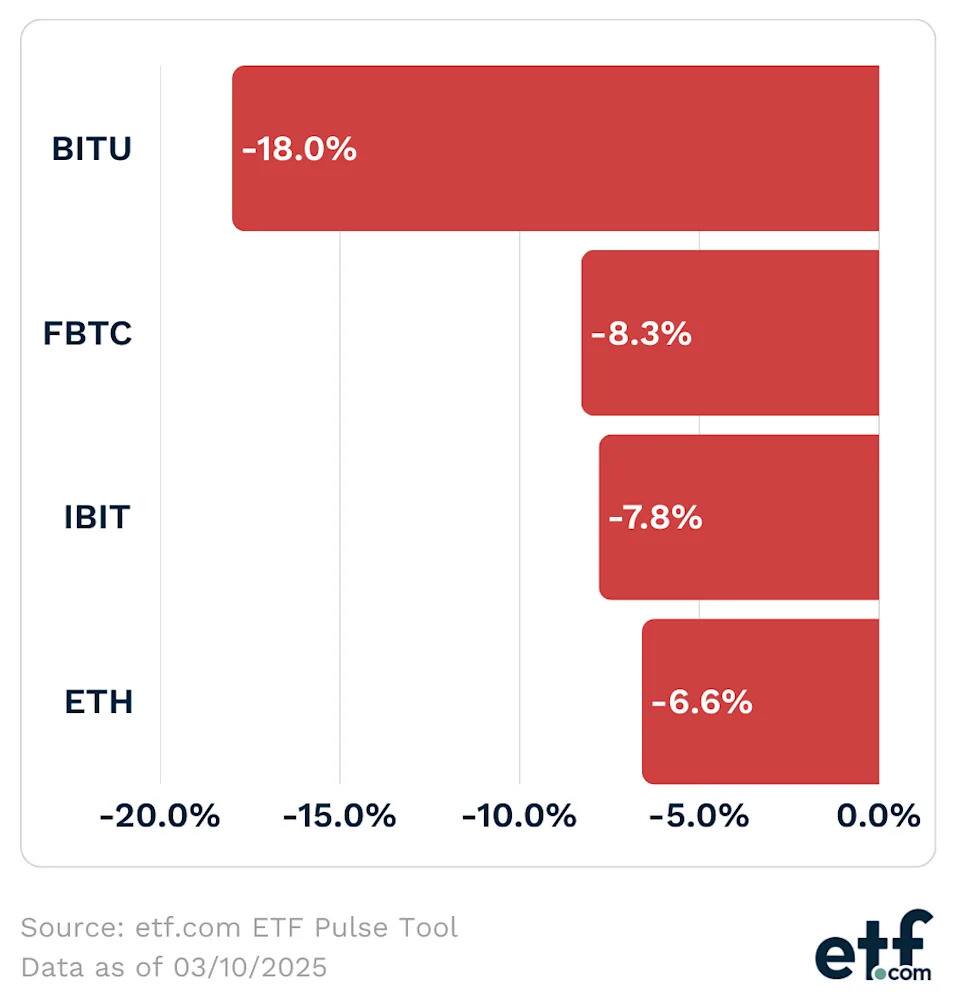

The world’s biggest crypto ETF, the $50.9 billion iShares Bitcoin Trust (IBIT) , fell 7.8%, continuing a slide that began the day after President Donald Trump was sworn in on Jan. 20. While inflows are positive for the year, investors have pulled a net $1.4 billion from the fund since Feb. 21.

Crypto ETFs Tank as Bond, Dividend ETFs Rise

Other spot crypto funds dropped as the price of bitcoin briefly fell beneath $79,500, according to CoinMarketCap data. Crypto and equities have dipped in response to President Trump’s efforts to reshape the global economy with nationalist policies like tariffs, and his declining this weekend to rule out a recession in the near future further rattled stock markets.

Meanwhile, bond funds like the iShares 20+ Year Treasury Bond ETF (TLT) jumped along with dividend ETFs like the Schwab U.S. Dividend Equity ETF (SCHD) .

“Cryptocurrencies are highly volatile, and investors may choose to scale back exposure when recession fears arise,” Morningstar’s director of passive strategies research Bryan Armour said in an email. “Bitcoin tends to rise along risk appetite and fall when markets go risk-off.”

Other spot crypto ETFs slid: The $17.8 billion Fidelity Wise Origin Bitcoin Fund (FBTC) lost 8.3%, and the leveraged ProShares Ultra Bitcoin ETF (BITU) , with $957.3 million in assets, plummeted 18%. Funds trading in spot ethereum also continued their decline, with the $1.1 billion Grayscale Ethereum Mini Trust (ETH) losing 6.6%. That fund has lost 42% over the past three months.

Those declines come as issuers file dozens of applications for exchange-traded funds that hold smaller cryptocurrencies, from XRP to Hedera to Solana. Those applications flooded the Securities and Exchange Commission after Trump signaled a more open approach to crypto and Gary Gensler, who advocated a cautionary approach to crypto ETFs, stepped down.

Spot bitcoin ETF investors haven’t responded enthusiastically to the president’s stance on crypto. Since Jan. 21, the day after Trump was sworn in, IBIT has dropped 24% amid Trump’s promises to be the “crypto president.”

Permalink | © Copyright 2025 etf.com. All rights reserved