Domo (NASDAQ:DOMO) Posts Better-Than-Expected Sales In Q4

Data visualization and business intelligence company Domo (NASDAQ:DOMO) reported Q4 CY2024 results topping the market’s revenue expectations , but sales fell by 1.8% year on year to $78.77 million. The company expects next quarter’s revenue to be around $78 million, close to analysts’ estimates. Its non-GAAP loss of $0.05 per share was 68.8% above analysts’ consensus estimates.

Is now the time to buy Domo? Find out in our full research report .

Domo (DOMO) Q4 CY2024 Highlights:

Company Overview

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

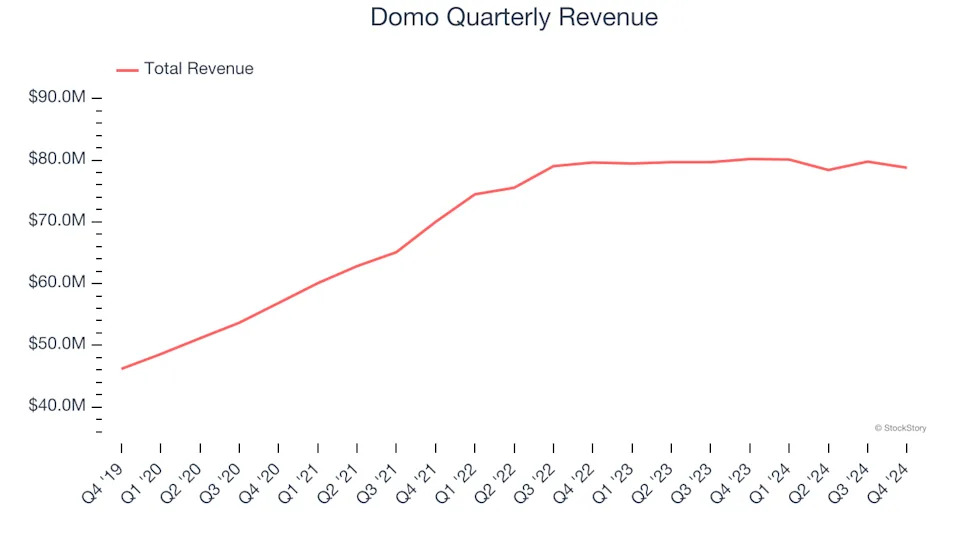

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Domo’s sales grew at a weak 7.1% compounded annual growth rate over the last three years. This fell short of our benchmark for the software sector and is a rough starting point for our analysis.

This quarter, Domo’s revenue fell by 1.8% year on year to $78.77 million but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 2.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

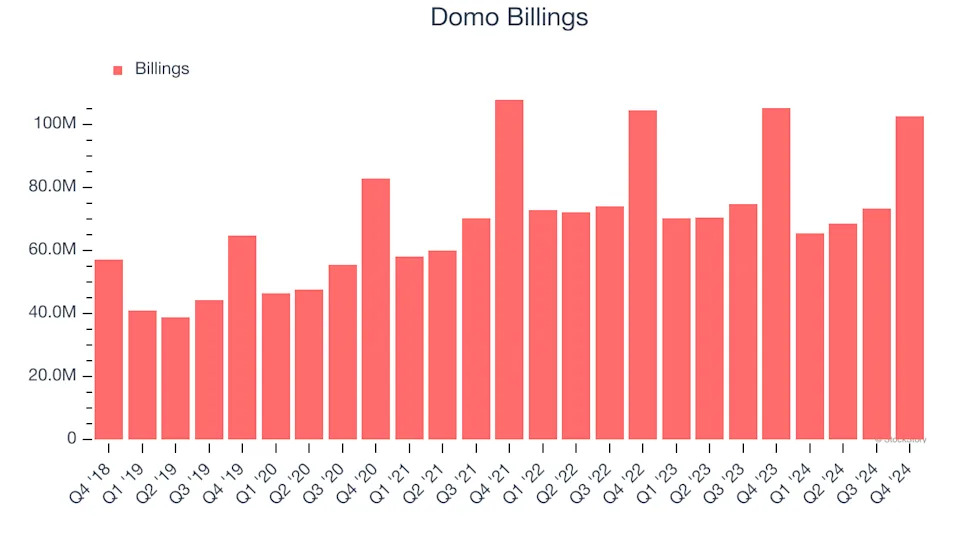

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Domo’s billings came in at $102.6 million in Q4, and it averaged 3.5% year-on-year declines over the last four quarters. This alternate topline metric underperformed its total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Domo’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Domo’s products and its peers.

Key Takeaways from Domo’s Q4 Results

We were impressed by how significantly Domo blew past analysts’ billings expectations this quarter. We were also glad its EPS guidance for next quarter trumped Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.8% to $7.40 immediately after reporting.

Domo may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .