Funko’s (NASDAQ:FNKO) Q4 Sales Beat Estimates But Full-Year Sales Guidance Misses Expectations

Pop culture collectibles manufacturer Funko (NASDAQ:FNKO) beat Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $293.7 million. On the other hand, next quarter’s revenue guidance of $193 million was less impressive, coming in 21.5% below analysts’ estimates. Its non-GAAP profit of $0.03 per share was 2 cents below analysts’ consensus estimates.

Is now the time to buy Funko? Find out in our full research report .

Funko (FNKO) Q4 CY2024 Highlights:

Company Overview

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

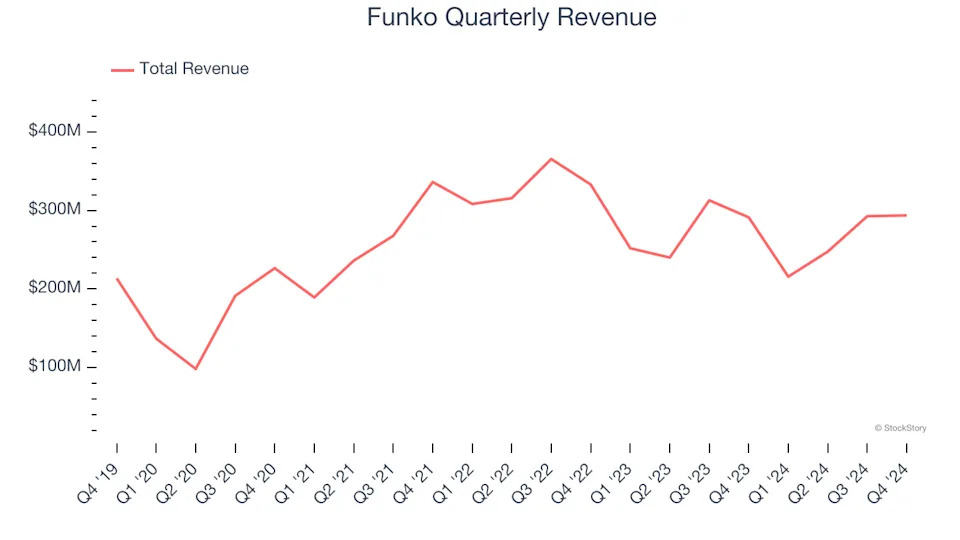

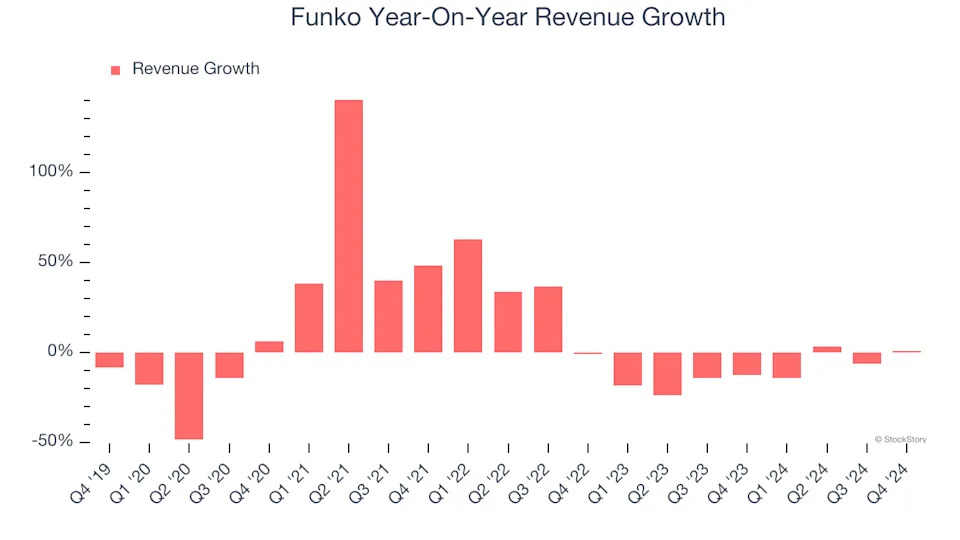

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Funko grew its sales at a sluggish 5.7% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Funko’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.9% annually.

This quarter, Funko’s $293.7 million of revenue was flat year on year but beat Wall Street’s estimates by 2.7%. Company management is currently guiding for a 10.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

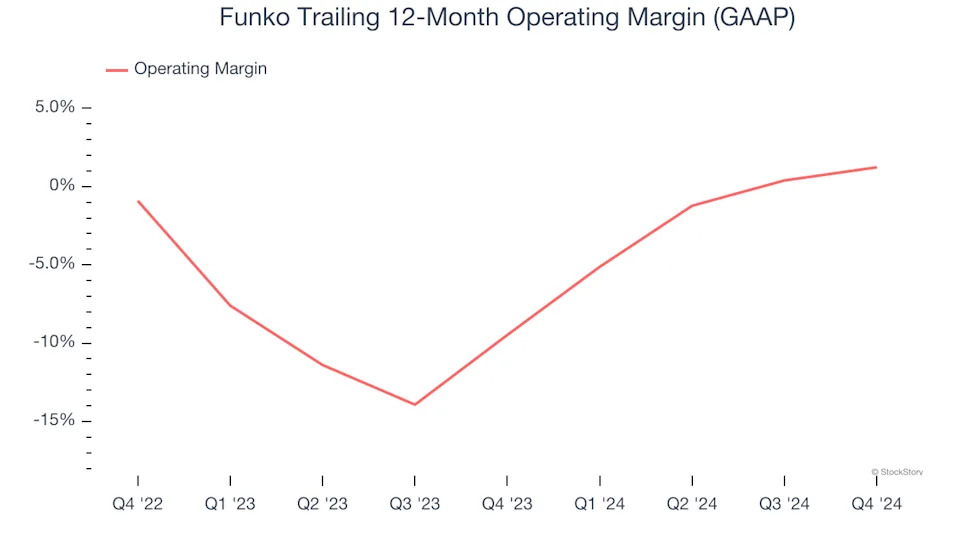

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Funko’s operating margin has risen over the last 12 months, but it still averaged negative 4.2% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q4, Funko generated an operating profit margin of 1.8%, up 3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

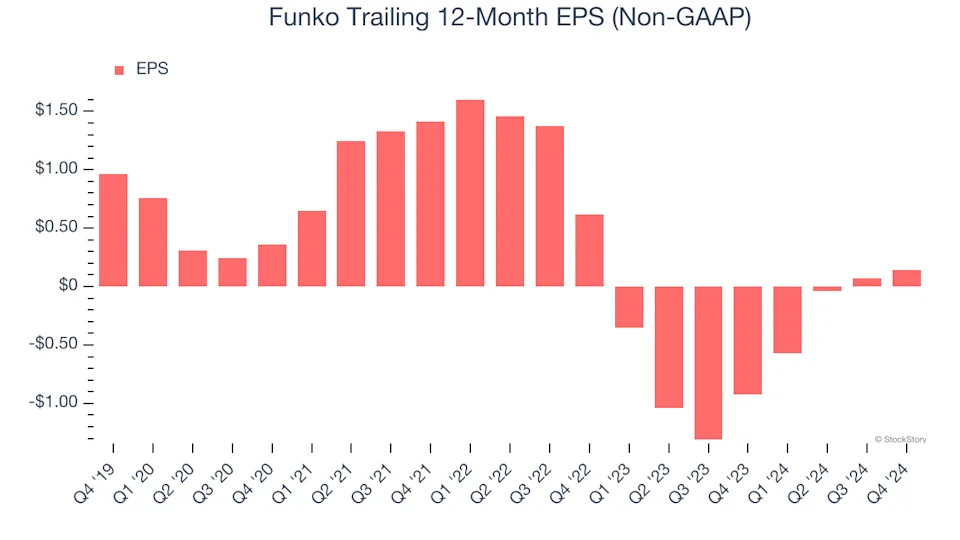

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Funko, its EPS declined by 31.6% annually over the last five years while its revenue grew by 5.7%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q4, Funko reported EPS at $0.08, up from $0.01 in the same quarter last year. Over the next 12 months, Wall Street expects Funko to perform poorly. Analysts forecast its full-year EPS of $0.14 will hit $0.41.

Key Takeaways from Funko’s Q4 Results

We enjoyed seeing Funko beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EBITDA guidance missed. Overall, this was a weaker quarter. The stock traded down 4.3% to $9.90 immediately after reporting.

Funko didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .