Bessent: 'I am not worried about inflation' from Trump's tariffs

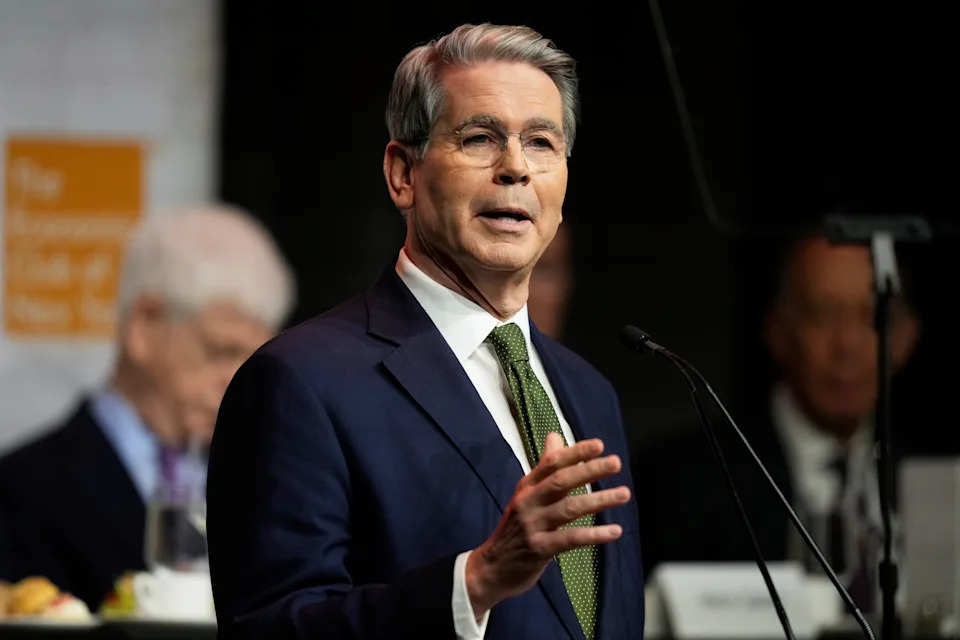

Treasury Secretary Scott Bessent said Thursday that "I am not worried about inflation" resulting from President Donald Trump's new tariffs , although he did acknowledge that "we could get a one-time price adjustment."

Bessent made his remarks after Trump this week levied additional tariffs on China, Mexico, and Canada while also carving out exemptions for the Big Three automakers and any goods and services from Mexico that fall under a trade agreement known as USMCA.

Some economists have argued that Trump's tariffs will be inflationary and push prices higher, creating a new dilemma for the Federal Reserve as policymakers try to bring inflation down to their 2% target.

“Can tariffs be a one-time price adjustment?” Bessent said while speaking before the Economic Club of New York. "Yes." But "across a continuum, I am not worried about inflation."

He also argued the one-time adjustment resulting from tariffs should not affect the thinking of the Fed, which held its rates steady last month following three consecutive reductions at the end of 2024. Its next meeting is March 18-19.

Bessent even invoked the word "transitory," which central bank policymakers used during the early stages of the COVID-19 pandemic to describe their view of inflation. Because Fed officials expected inflation to be transitory, they argued there was no reason to aggressively raise rates — an expectation that turned out to be misguided as inflation rose to a four-decade high in 2022.

Read more: How the Fed rate decision affects your bank accounts, loans, credit cards, and investments

"While I've agreed not to talk about prospective Fed policy going forward, I would hope that the failed team transitory could get back together and think that nothing is more transitory than tariffs," Bessent said Thursday.

He reiterated that the president is not focused on the Fed and is instead trying to bring down 10-year Treasury yields. On Thursday the 10-year rose for a third straight session to 4.28% but sat lower than the yield of more than 4.6% when Trump took office.

"Notice that he has stopped calling for the Fed to cut rates," Bessent said, referring to the president.

Bessent argued the administration will be able to get long-term borrowing costs down with sound fiscal policy, which he argued includes lower spending, making Trump's first-term tax cuts permanent and ensuring no taxes on tips, Social Security, and overtime pay.

He doubled down on the president's proposal to make full expensing for capital equipment retroactive to Jan. 20 and said the administration is looking at having full expensing of factories and equipment.

Read more: The latest news and updates on Trump's tariffs

Bessent also championed the goal of collecting revenue from tariffs to pay for the tax cuts. So-called reciprocal tariffs are scheduled to go into effect April 2, which could affect an array of nations. Bessent addressed those when talking about Canada and its leader, Justin Trudeau.

"If you want to be a numskull like Justin Trudeau and say, 'oh, we're going to do this,'" then "tariffs are gonna go up. But if you want to sit back, have a discussion with the Commerce Department, USTR, they all have my phone number too, I am happy to have a discussion with our foreign counterpart."

Bessent noted that changes to the regulation of big banks were also a part of his agenda, designed to get big lenders lending again.

But he clarified he did not want a consolidation of bank regulatory agencies, an idea that reportedly had been under consideration by Trump advisers. Instead, he wants better coordination among agencies using the Financial Stability Oversight Council, which he leads.

"We need our financial regulators singing in unison from the same song sheet," he said.