American Outdoor Brands (NASDAQ:AOUT) Reports Upbeat Q4

Recreational products manufacturer American Outdoor Brands (NASDAQ:AOUT) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 9.5% year on year to $58.51 million. The company expects the full year’s revenue to be around $208.5 million, close to analysts’ estimates. Its GAAP profit of $0.01 per share was significantly above analysts’ consensus estimates.

Is now the time to buy American Outdoor Brands? Find out in our full research report .

American Outdoor Brands (AOUT) Q4 CY2024 Highlights:

Brian Murphy, President and Chief Executive Officer, said, "Our third quarter results came in ahead of our expectations. We believe our strong performance demonstrates the effectiveness of our long-term strategy to leverage our innovation advantage to broaden our distribution opportunities, expand awareness of our brands, and strengthen our margins. We delivered growth in both our Outdoor Lifestyle and our Shooting Sports categories, supported by year-over-year increases in nearly all sales channels in the third quarter, including our traditional, e-commerce, and domestic sales channels. In addition, we delivered a significant increase in Non-GAAP Adjusted EBITDAS, which nearly doubled year-over-year."

Company Overview

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers firearms and firearm accessories.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

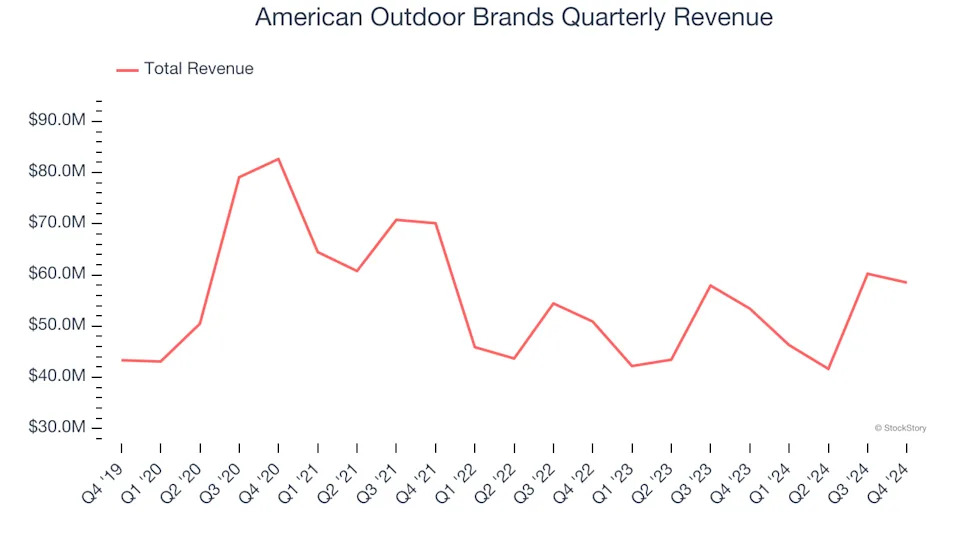

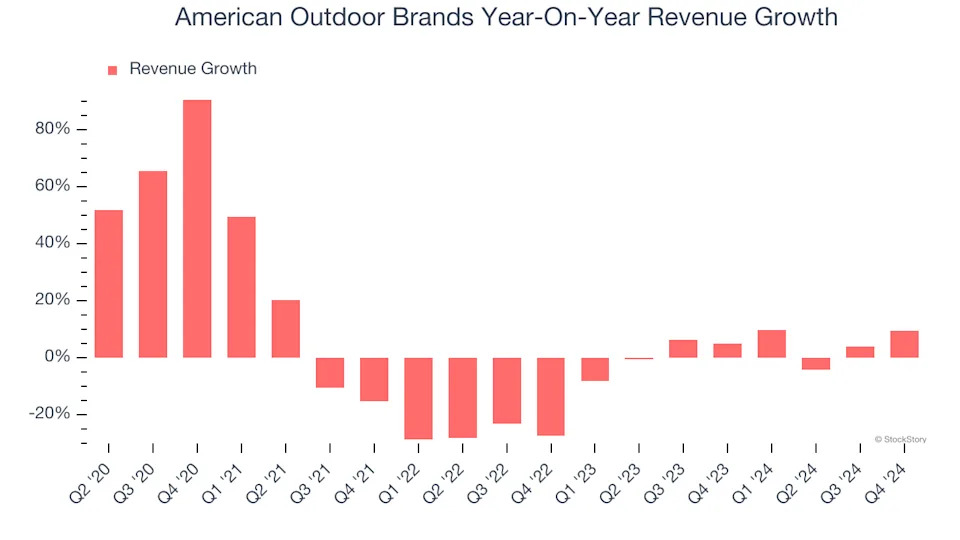

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, American Outdoor Brands grew its sales at a sluggish 5.2% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. American Outdoor Brands’s recent history shows its demand has slowed as its annualized revenue growth of 3% over the last two years was below its five-year trend.

This quarter, American Outdoor Brands reported year-on-year revenue growth of 9.5%, and its $58.51 million of revenue exceeded Wall Street’s estimates by 4%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

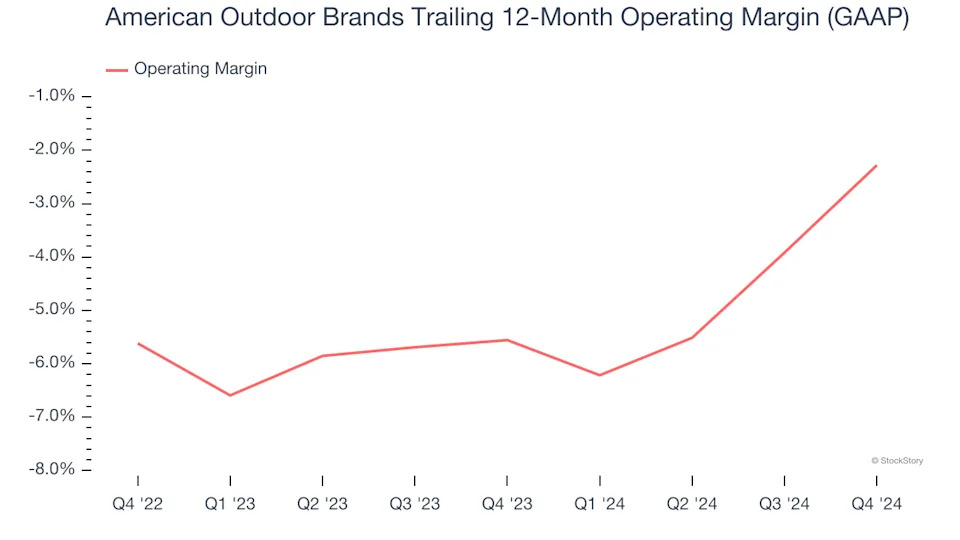

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

American Outdoor Brands’s operating margin has risen over the last 12 months, but it still averaged negative 3.9% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q4, American Outdoor Brands’s breakeven margin was up 5.9 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

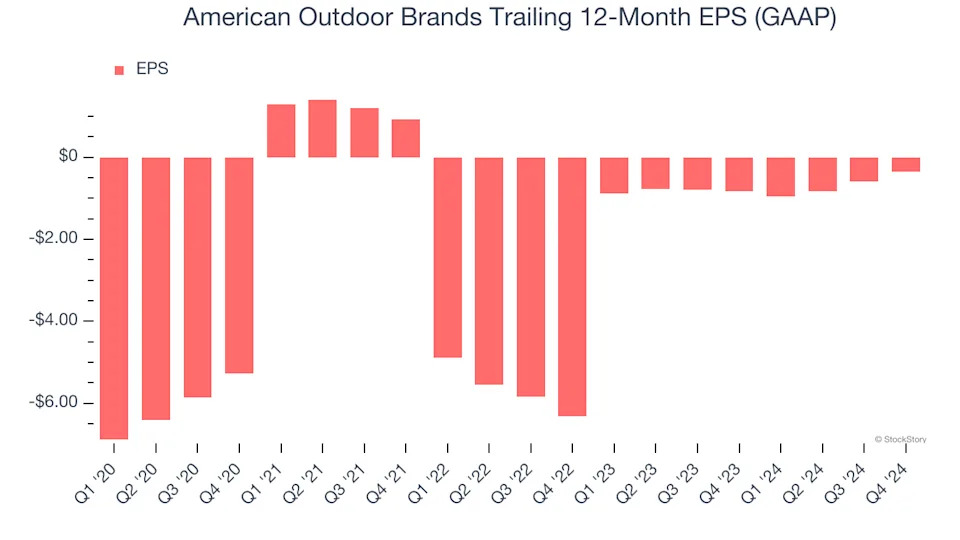

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although American Outdoor Brands’s full-year earnings are still negative, it reduced its losses and improved its EPS by 16.8% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, American Outdoor Brands reported EPS at $0.01, up from negative $0.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast American Outdoor Brands’s full-year EPS of negative $0.35 will reach break even.

Key Takeaways from American Outdoor Brands’s Q4 Results

We were impressed by how significantly American Outdoor Brands blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year guidance for all three metrics beat Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $15.09 immediately after reporting.

American Outdoor Brands may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .