ANI Pharmaceuticals (NASDAQ:ANIP) Delivers Impressive Q4, Stock Soars

Specialty pharmaceutical company ANI Pharmaceuticals (NASDAQ:ANIP) announced better-than-expected revenue in Q4 CY2024, with sales up 44.8% year on year to $190.6 million. The company’s full-year revenue guidance of $766 million at the midpoint came in 5.7% above analysts’ estimates. Its non-GAAP profit of $1.63 per share was 13.6% above analysts’ consensus estimates.

Is now the time to buy ANI Pharmaceuticals? Find out in our full research report .

ANI Pharmaceuticals (ANIP) Q4 CY2024 Highlights:

Nikhil Lalwani, President and CEO of ANI stated, “We’re thrilled to report another year of strong execution for ANI, capped by our record fourth quarter results, with total net revenues, adjusted non-GAAP EBITDA, and adjusted non-GAAP diluted EPS all finishing above our previously announced guidance for the full year. Cortrophin Gel generated nearly $200 million in sales during 2024, in just the third year since launch, and our Generics business delivered its third straight year of double-digit growth. In addition, we expanded our Rare Disease business with the addition of the durable ophthalmology franchise of ILUVIEN and YUTIQ, through the acquisition of Alimera Sciences in September.”

Company Overview

Founded in 2001, ANI Pharmaceuticals (NASDAQ:ANIP) develops, manufactures, and markets branded and generic pharmaceutical products, with a focus on complex formulations and niche markets.

Generic Pharmaceuticals

The generic pharmaceutical industry operates on a volume-driven, low-cost business model, producing bioequivalent versions of branded drugs once their patents expire. These companies benefit from consistent demand for affordable medications, as they are critical to reducing healthcare costs. Generics typically face lower R&D expenses and shorter regulatory approval timelines compared to branded drug makers, enabling cost efficiencies. However, the industry is highly competitive, with intense pricing pressures, thin margins, and frequent legal challenges from branded pharmaceutical companies over patent disputes. Looking ahead, the industry is supported by tailwinds such as the role of AI in streamlining drug development (reverse engineering complex formulations) and manufacturing efficiency (optimize processes and remove inefficiencies). Governments and insurers' focus on reducing drug costs can also boost generics' adoption. However, headwinds include escalating pricing pressure from large buyers like pharmacy chains and healthcare distributors as well as evolving regulatory hurdles.

Sales Growth

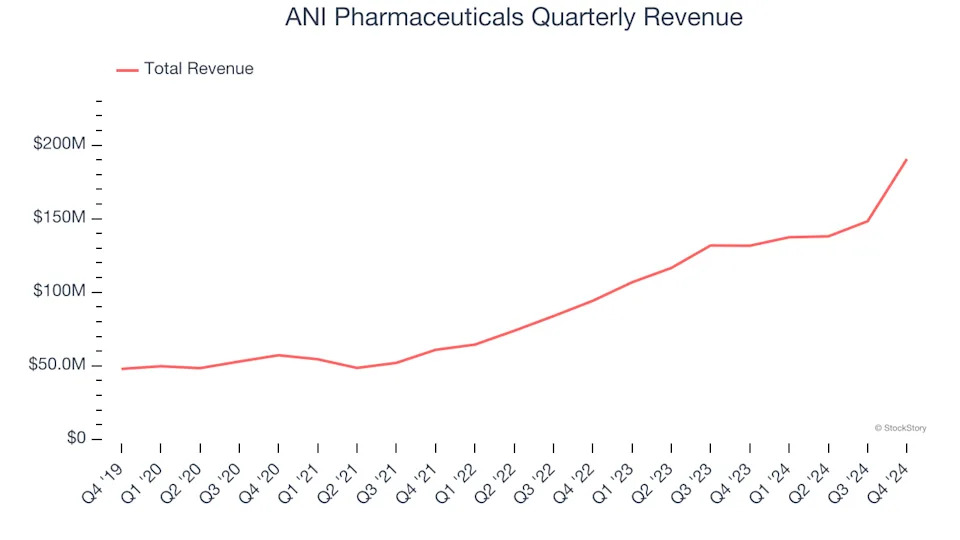

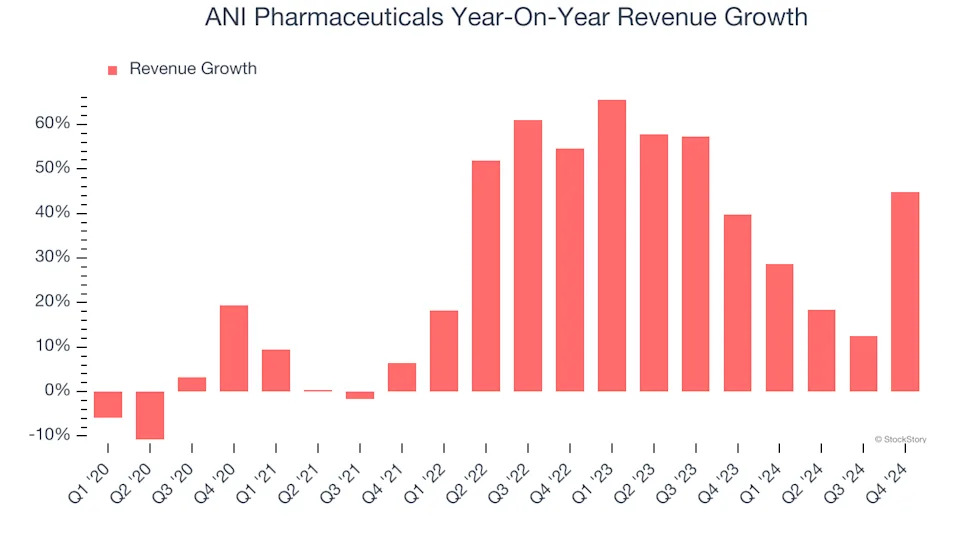

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, ANI Pharmaceuticals’s sales grew at an excellent 24.4% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. ANI Pharmaceuticals’s annualized revenue growth of 39.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, ANI Pharmaceuticals reported magnificent year-on-year revenue growth of 44.8%, and its $190.6 million of revenue beat Wall Street’s estimates by 8.5%.

Looking ahead, sell-side analysts expect revenue to grow 17.4% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is noteworthy and suggests the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

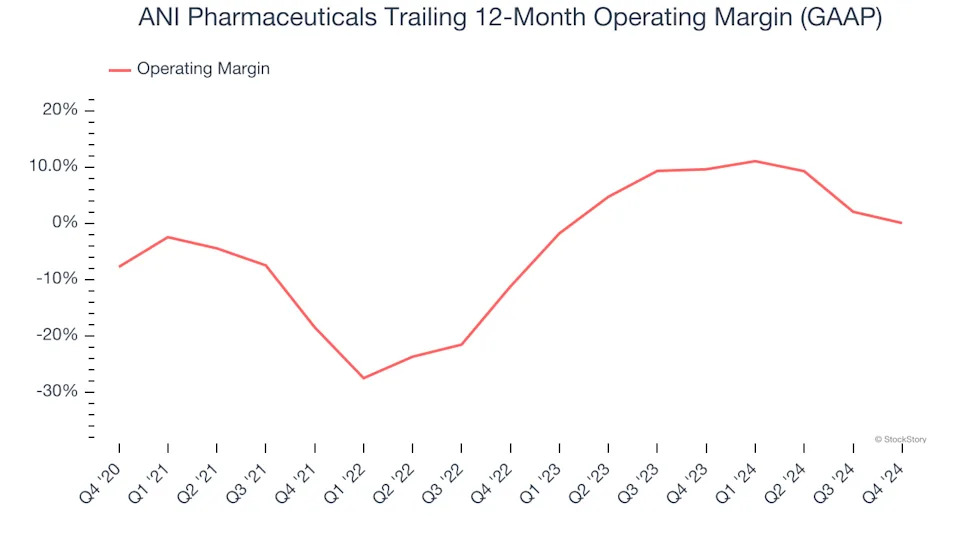

ANI Pharmaceuticals’s high expenses have contributed to an average operating margin of negative 2.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, ANI Pharmaceuticals’s operating margin rose by 7.8 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 11.2 percentage points on a two-year basis.

In Q4, ANI Pharmaceuticals generated a negative 2.3% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

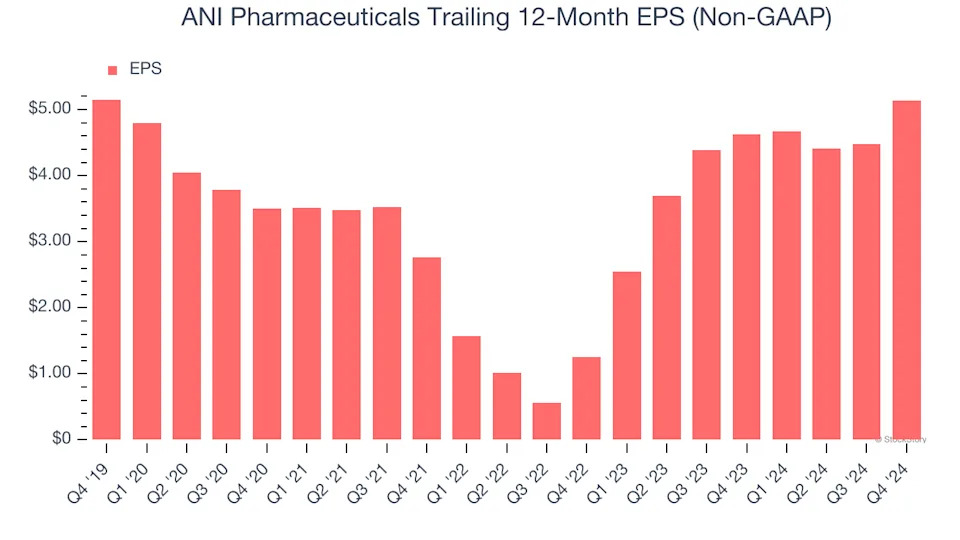

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

ANI Pharmaceuticals’s flat EPS over the last five years was below its 24.4% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

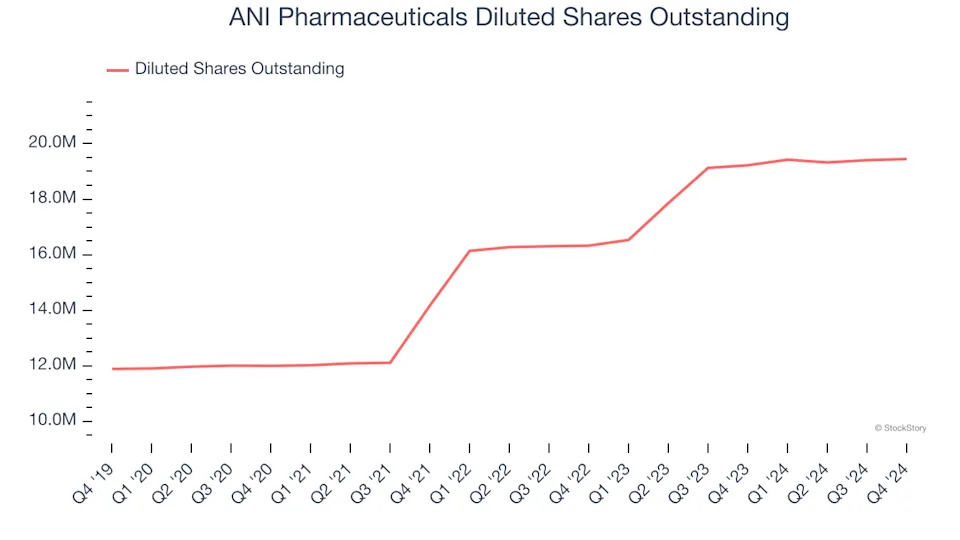

Diving into the nuances of ANI Pharmaceuticals’s earnings can give us a better understanding of its performance. A five-year view shows ANI Pharmaceuticals has diluted its shareholders, growing its share count by 63.6%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, ANI Pharmaceuticals reported EPS at $1.63, up from $0.98 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ANI Pharmaceuticals’s full-year EPS of $5.13 to grow 4.5%.

Key Takeaways from ANI Pharmaceuticals’s Q4 Results

We were impressed by how significantly ANI Pharmaceuticals blew past analysts’ revenue expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 8.3% to $59.10 immediately following the results.

Sure, ANI Pharmaceuticals had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .