Autodesk (NASDAQ:ADSK) Posts Q4 Sales In Line With Estimates, Growth To Accelerate Next Year

Design software company Autodesk (NASDAQ:ADSK) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 11.6% year on year to $1.64 billion. The company expects next quarter’s revenue to be around $1.61 billion, coming in 1% above analysts’ estimates. Its non-GAAP profit of $2.29 per share was 7% above analysts’ consensus estimates.

Is now the time to buy Autodesk? Find out in our full research report .

Autodesk (ADSK) Q4 CY2024 Highlights:

"Autodesk is focused on the convergence of design and make in the cloud, enabled by platform, industry clouds, and AI. We are reallocating internal resources toward these critical areas and beginning the optimization of our go-to-market functions to better meet the evolving needs of our customers and channel partners," said Andrew Anagnost, Autodesk president and CEO.

Company Overview

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

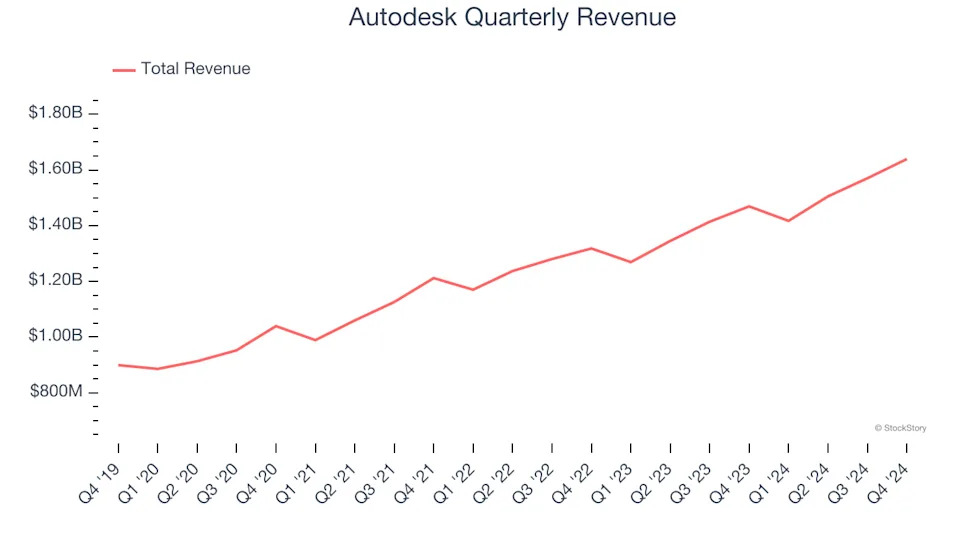

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Autodesk grew its sales at a 11.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Autodesk.

This quarter, Autodesk’s year-on-year revenue growth was 11.6%, and its $1.64 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 13.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.3% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and implies its newer products and services will help support its historical top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

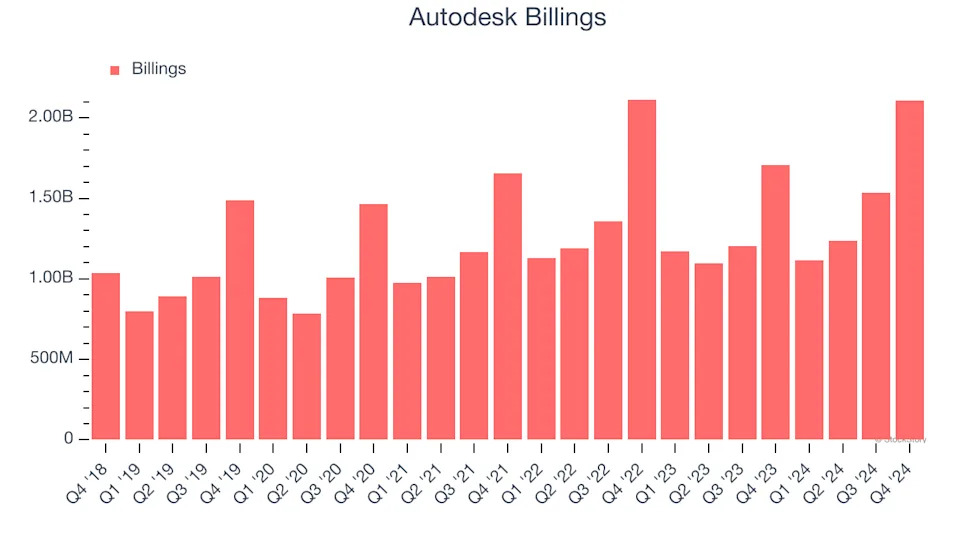

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Autodesk’s billings punched in at $2.11 billion in Q4, and over the last four quarters, its growth was solid as it averaged 14.7% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Autodesk is extremely efficient at acquiring new customers, and its CAC payback period checked in at 9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Autodesk more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Autodesk’s Q4 Results

It was great to see Autodesk expecting revenue growth to accelerate next year as its full-year revenue and EPS guidance exceeded Wall Street’s estimates. We were also glad this quarter's EPS and adjusted operating income beat. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.8% to $296 immediately following the results.

Autodesk may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .