PubMatic (NASDAQ:PUBM) Reports Sales Below Analyst Estimates In Q4 Earnings, Stock Drops

Programmatic advertising platform Pubmatic (NASDAQ: PUBM) missed Wall Street’s revenue expectations in Q4 CY2024 as sales only rose 1.1% year on year to $85.5 million. Next quarter’s revenue guidance of $62 million underwhelmed, coming in 5.9% below analysts’ estimates. Its non-GAAP profit of $0.41 per share was 9.6% above analysts’ consensus estimates.

Is now the time to buy PubMatic? Find out in our full research report .

PubMatic (PUBM) Q4 CY2024 Highlights:

“Revenue growth in the year more than doubled over 2023, driven by strength in CTV, emerging revenue streams, and marquee customers choosing PubMatic to build and scale their ad businesses. Our revenue mix is evolving; in the fourth quarter, CTV more than doubled to 20% of total revenue. These achievements mark an inflection point in our underlying business that highlights critical scale on our platform and a significant shift in ad buying toward channels with the highest consumer engagement such as CTV, mobile app and commerce media,” said Rajeev Goel, co-founder and CEO at PubMatic.

Company Overview

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

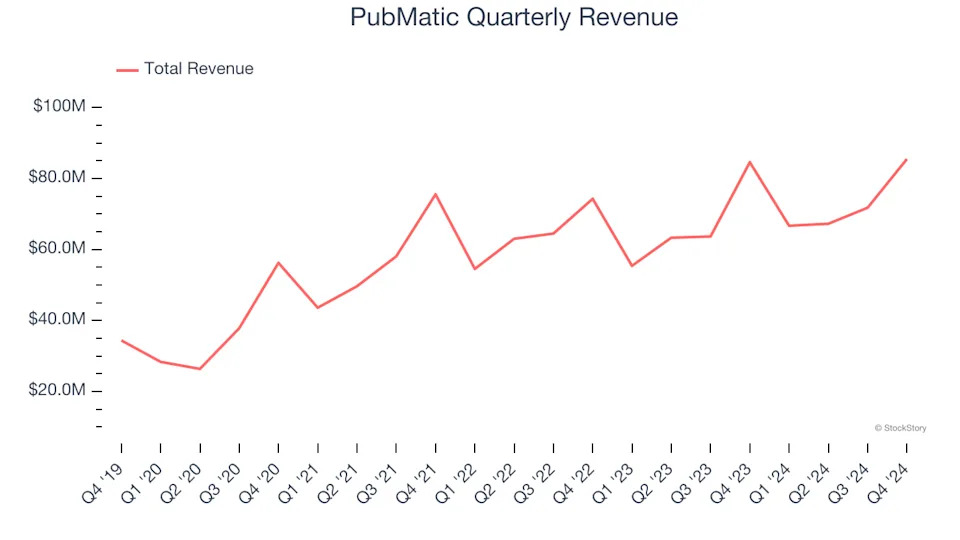

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, PubMatic’s 8.7% annualized revenue growth over the last three years was sluggish. This was below our standard for the software sector and is a tough starting point for our analysis.

This quarter, PubMatic’s revenue grew by 1.1% year on year to $85.5 million, falling short of Wall Street’s estimates. Company management is currently guiding for a 7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, similar to its three-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Customer Retention

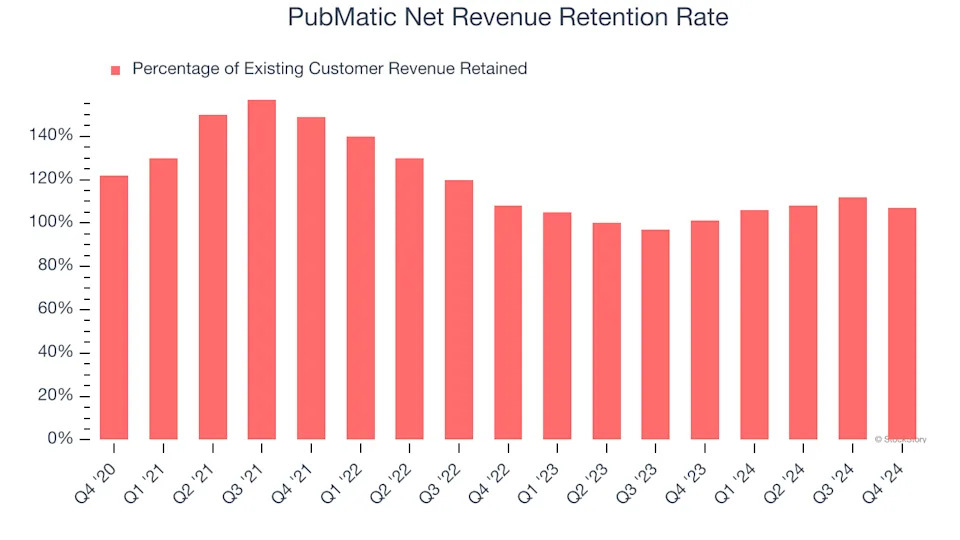

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

PubMatic’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 108% in Q4. This means PubMatic would’ve grown its revenue by 8.3% even if it didn’t win any new customers over the last 12 months.

Trending up over the last year, PubMatic has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from PubMatic’s Q4 Results

We enjoyed seeing PubMatic beat analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue and EBITDA guidance for next quarter fell short of Wall Street’s estimates. We note that ad tech companies had weaker quarters in general, as both The Trade Desk and DoubleVerify missed on revenue and guided below for next quarter. PubMatic wasn't spared, and the stock traded down 9.1% to $12.70 immediately following the results.

PubMatic’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .