GoodRx (NASDAQ:GDRX) Misses Q4 Revenue Estimates

Healthcare tech company GoodRx (NASDAQ:GDRX) missed Wall Street’s revenue expectations in Q4 CY2024, with sales flat year on year at $198.6 million. On the other hand, the company expects next quarter’s revenue to be around $203 million, close to analysts’ estimates. Its non-GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy GoodRx? Find out in our full research report .

GoodRx (GDRX) Q4 CY2024 Highlights:

“I am excited to join GoodRx at such a pivotal time for both the company and healthcare system as a whole. I have spent the last thirty years in the pharmacy and medical benefit industry, and I intimately understand where there is friction and opportunity,” said Wendy Barnes, Chief Executive Officer and President of GoodRx.

Company Overview

Founded in 2011, GoodRx (NASDAQ:GDRX) provides a platform allowing consumers to compare prescription drug prices, access discounts, and save on medications through its digital tools.

Healthcare Technology for Patients

The consumer-focused healthcare technology industry aims to improve accessibility, affordability, and convenience for patients seeking healthcare services. These companies typically leverage digital platforms to offer services such as prescription discounts, telemedicine consultations, and wellness products. Their business models often benefit from recurring revenues via subscription plans or marketplace commissions. The primary advantages of this sector include the scalability of digital platforms and growing consumer demand for on-demand healthcare. However, challenges arise from heavy reliance on marketing to acquire and retain customers, evolving regulatory backdrops, and continuing to convince newer cohorts (especially older individuals who tend to have more healthcare needs) that healthcare can be accessed online. Looking ahead, the industry stands to gain from tailwinds such as increasing consumer comfort with telehealth, rising healthcare costs driving demand for cost-saving tools, and broader adoption of personalized, digital-first healthcare. Technological advancements, including AI-powered health assessments and seamless user experiences, are likely to further enhance growth prospects. Conversely, headwinds include heightened competition from large tech companies entering the healthcare space or large healthcare companies investing in digital technologies.

Sales Growth

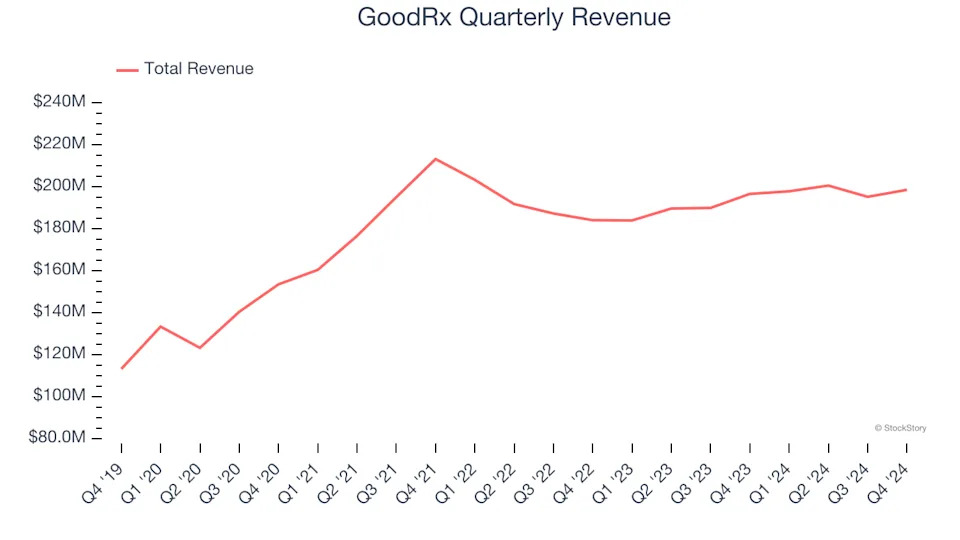

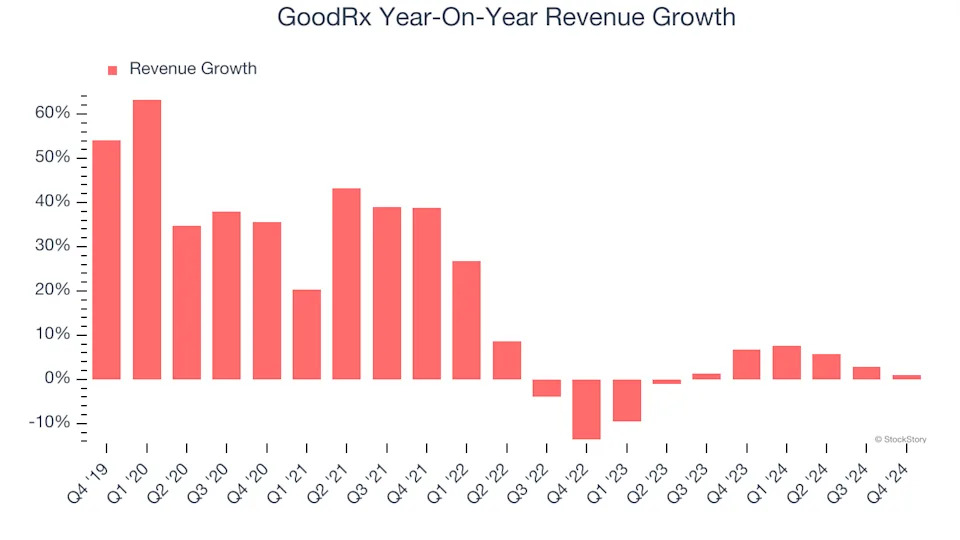

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, GoodRx’s sales grew at a solid 15.3% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. GoodRx’s recent history shows its demand slowed as its annualized revenue growth of 1.7% over the last two years is below its five-year trend.

GoodRx also reports its number of customers, which reached 6.6 million in the latest quarter. Over the last two years, GoodRx’s customer base averaged 5.2% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, GoodRx’s $198.6 million of revenue was flat year on year, falling short of Wall Street’s estimates. Company management is currently guiding for a 2.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although GoodRx was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, GoodRx’s operating margin rose by 58.4 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 8.1 percentage points on a two-year basis.

This quarter, GoodRx generated an operating profit margin of 9.2%, up 18.5 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

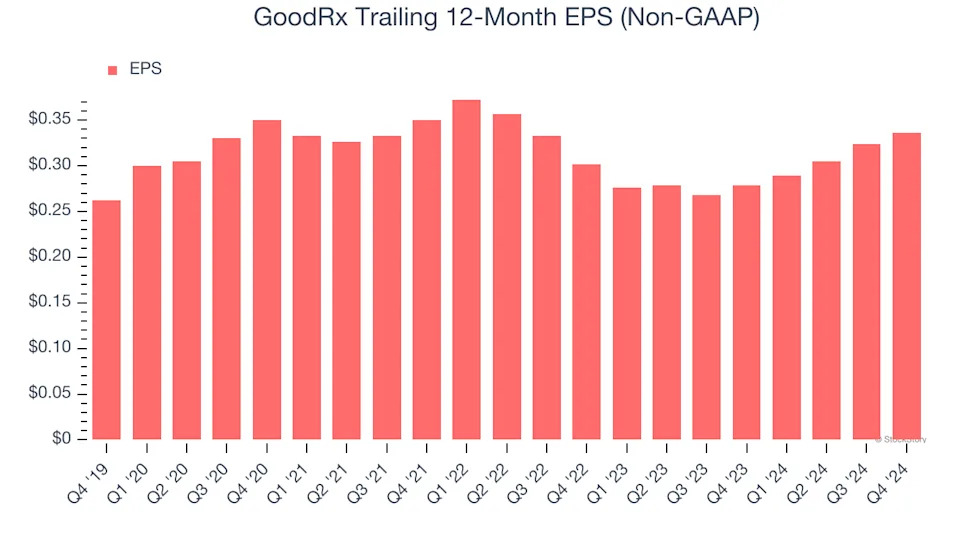

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GoodRx’s EPS grew at a decent 5.1% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 15.3% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

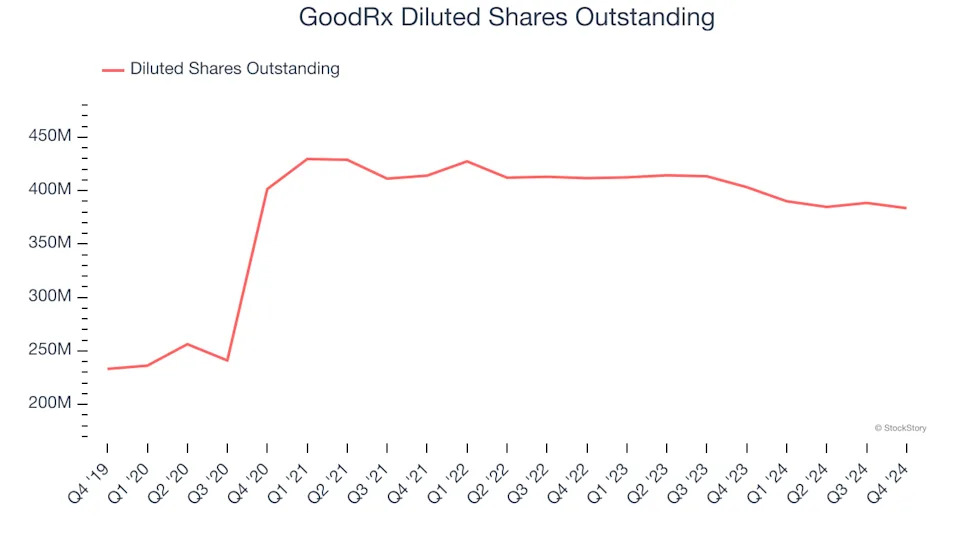

Diving into GoodRx’s quality of earnings can give us a better understanding of its performance. GoodRx recently raised equity capital, and in the process, grew its share count by 64.5% over the last five years. This has resulted in muted earnings per share growth but doesn’t tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.

In Q4, GoodRx reported EPS at $0.09, up from $0.08 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects GoodRx to perform poorly. Analysts forecast its full-year EPS of $0.34 will hit $0.41.

Key Takeaways from GoodRx’s Q4 Results

We struggled to find many positives in these results. Its revenue and EPS both fell short of Wall Street’s estimates. 2025 guidance for revenue and EBITDA were just in line, not exciting enough to overcome the misses in the quarter. The stock traded down 3.6% to $4.70 immediately following the results.

GoodRx underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .