Acushnet (NYSE:GOLF) Misses Q4 Sales Targets, But Stock Soars 7.4%

Golf equipment and apparel company Acushnet (NYSE:GOLF) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 7.8% year on year to $445.2 million. The company’s full-year revenue guidance of $2.51 billion at the midpoint came in 1.3% below analysts’ estimates. Its GAAP loss of $0.02 per share was 93.9% above analysts’ consensus estimates.

Is now the time to buy Acushnet? Find out in our full research report .

Acushnet (GOLF) Q4 CY2024 Highlights:

Company Overview

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

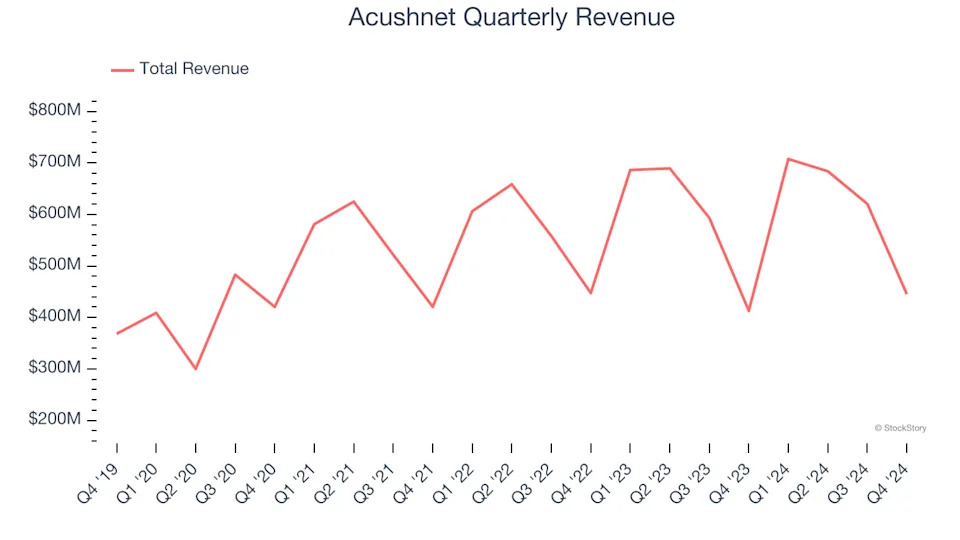

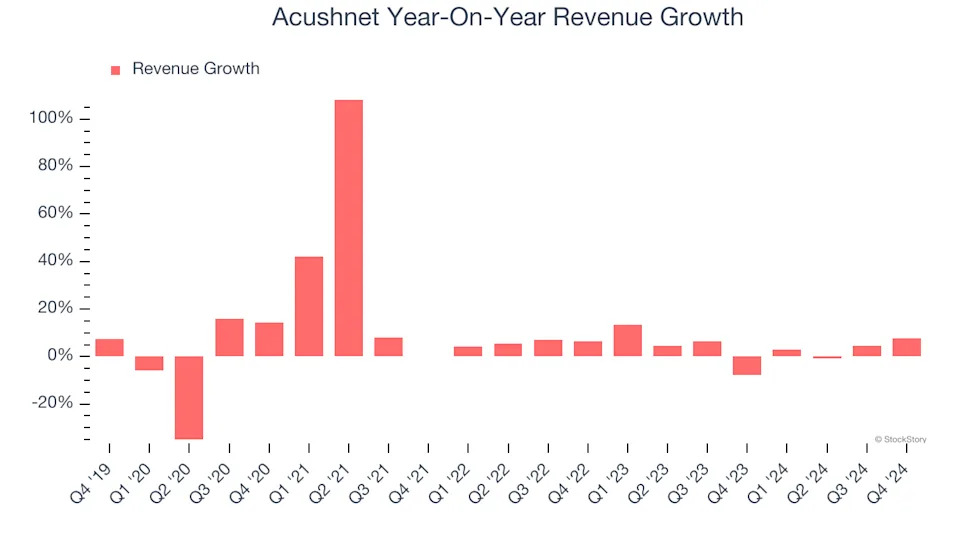

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Acushnet’s sales grew at a sluggish 7.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Acushnet’s recent history shows its demand slowed as its annualized revenue growth of 4% over the last two years is below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Titleist Balls, Titleist Clubs, and FootJoy, which are 31.6%, 28.3%, and 21.9% of revenue. Over the last two years, Acushnet’s Titleist Balls (golf balls) and Titleist Clubs (golf clubs) revenues averaged year-on-year growth of 7.4% and 8.6% while its FootJoy revenue (apparel) averaged 3.1% declines.

This quarter, Acushnet’s revenue grew by 7.8% year on year to $445.2 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Cash Is King

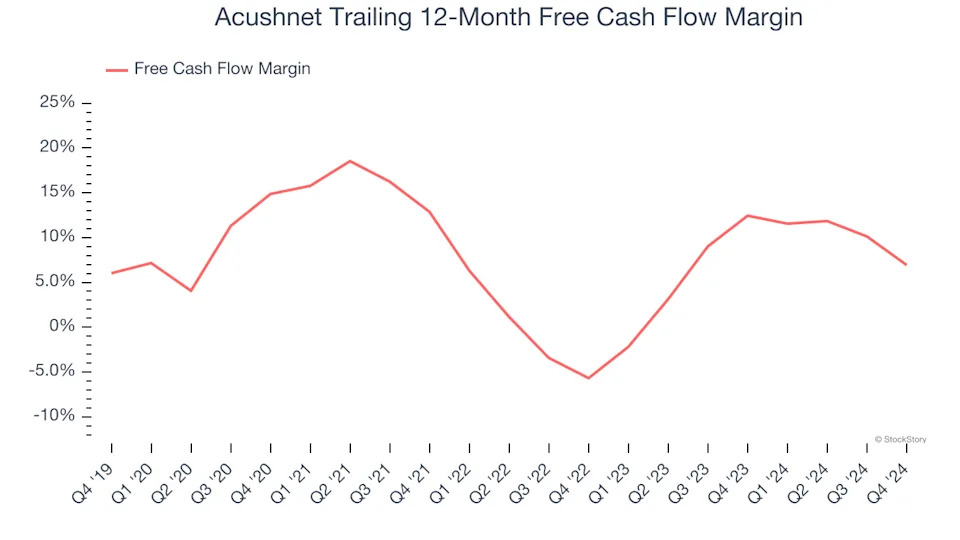

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Acushnet has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.6%, subpar for a consumer discretionary business.

Acushnet burned through $33.22 million of cash in Q4, equivalent to a negative 7.5% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Acushnet’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 6.9% for the last 12 months will increase to 8.5%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Acushnet’s Q4 Results

We were impressed by how significantly Acushnet blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its Titleist Balls revenue missed, leading total revenue to fall short of Wall Street’s estimates. Looking ahead, EBITDA guidance for the full year was in line with expectations. Zooming out, we think this was a mixed quarter featuring some areas of strength but also some blemishes. The stock traded up 7.4% to $70.99 immediately following the results.

So do we think Acushnet is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .