Red Robin (NASDAQ:RRGB) Reports Q4 In Line With Expectations, Stock Jumps 11.4%

Burger restaurant chain Red Robin (NASDAQ:RRGB) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 7.7% year on year to $285.2 million. On the other hand, the company’s full-year revenue guidance of $1.24 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP loss of $0.94 per share was 63.8% below analysts’ consensus estimates.

Is now the time to buy Red Robin? Find out in our full research report .

Red Robin (RRGB) Q4 CY2024 Highlights:

G.J. Hart, Red Robin's President and Chief Executive Officer said, "The last two years have been transformational years for Red Robin, and I'm proud to say we began to see the benefit of our work as we progressed through 2024, culminating in a 600-basis point improvement in traffic trends from the first quarter of the year to the fourth. We also gained traction in our cost-saving initiatives to translate our top-line momentum during the fourth quarter into a 19.0% increase in adjusted EBITDA. While financial results for 2024 fell well below our original expectations, we've made substantial improvements to the guest experience and believe we still have a significant opportunity ahead of us to reach the full potential of our iconic brand."

Company Overview

Known for its bottomless steak fries, Red Robin (NASDAQ:RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.25 billion in revenue over the past 12 months, Red Robin is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

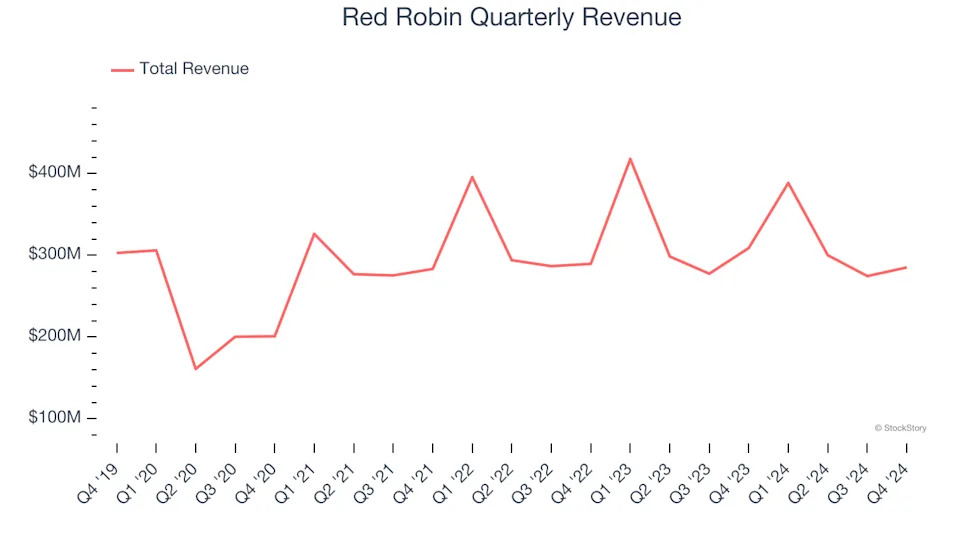

As you can see below, Red Robin’s demand was weak over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 1% annually as it closed restaurants.

This quarter, Red Robin reported a rather uninspiring 7.7% year-on-year revenue decline to $285.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer menu offerings will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Restaurant Performance

Number of Restaurants

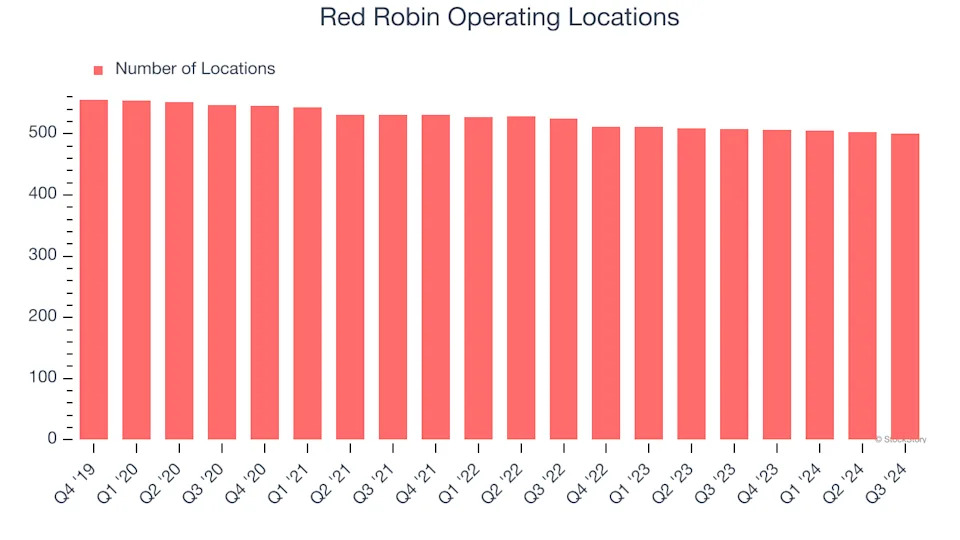

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Over the last two years, Red Robin has generally closed its restaurants, averaging 2.1% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

Note that Red Robin reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

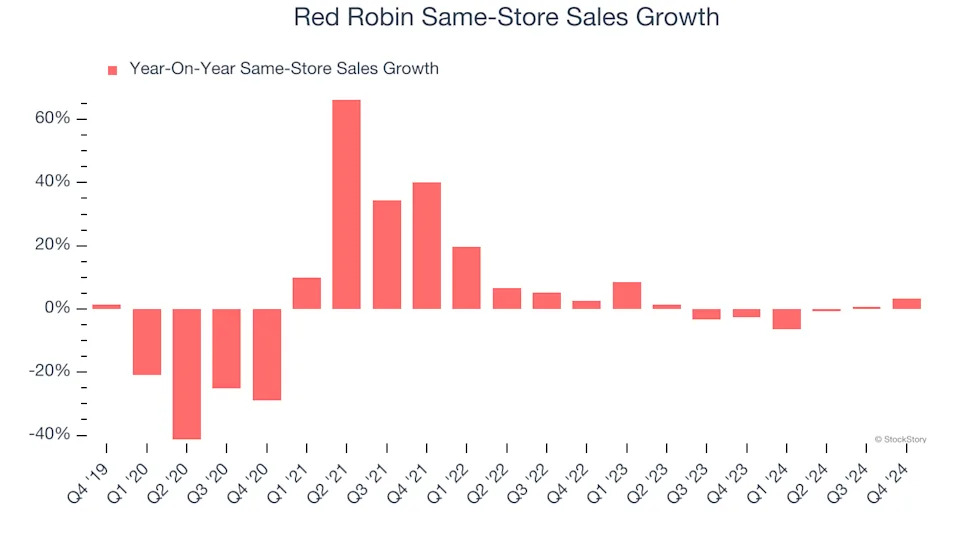

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Red Robin’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Red Robin is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Red Robin’s same-store sales rose 3.4% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Red Robin’s Q4 Results

Same-store sales beat expectations after a few tepid quarters. We were impressed by Red Robin’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. Overall, this quarter had a few things to like. The stock traded up 11.4% to $5.05 immediately after reporting.

Is Red Robin an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .