Option Care Health (NASDAQ:OPCH) Delivers Impressive Q4, Guides for Strong Full-Year Sales

Alternate site health provider Option Care Health (NASDAQ:OPCH) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 19.7% year on year to $1.35 billion. The company’s full-year revenue guidance of $5.4 billion at the midpoint came in 2.5% above analysts’ estimates. Its non-GAAP profit of $0.44 per share was 21.4% above analysts’ consensus estimates.

Is now the time to buy Option Care Health? Find out in our full research report .

Option Care Health (OPCH) Q4 CY2024 Highlights:

John C. Rademacher, Chief Executive Officer, commented, “The Option Care Health team’s execution produced solid financial results in the fourth quarter and full year 2024, demonstrating resilience in a dynamic and challenging period, while continuing to place the patient at the center of everything that we do. I am excited about the road ahead and the opportunity to leverage our capabilities to provide more patients high quality, affordable care, in a setting in which they wish to receive it.”

Company Overview

Founded in 1979, Option Care Health (NASDAQ:OPCH) delivers home and alternate site infusion therapy services, specializing in the administration of medications and care for patients with chronic and acute conditions.

Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Sales Growth

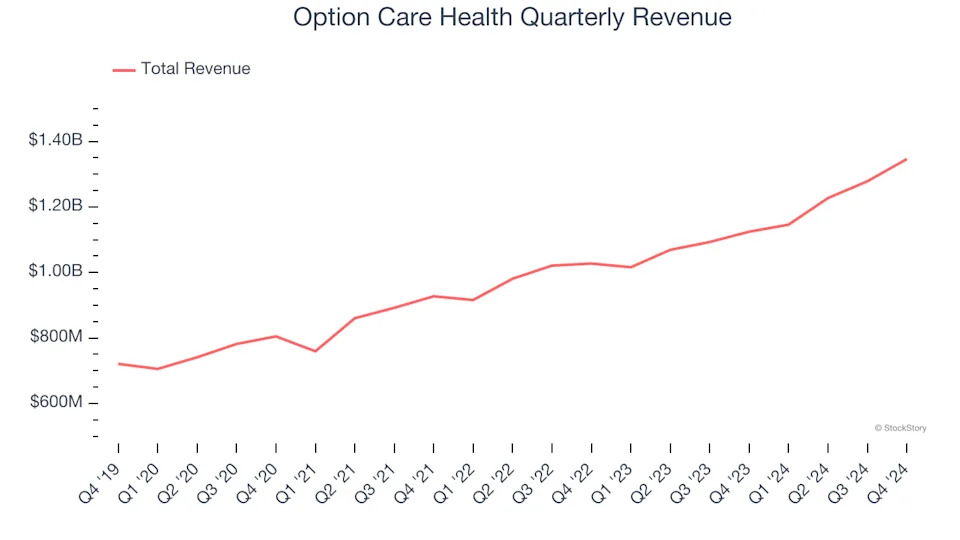

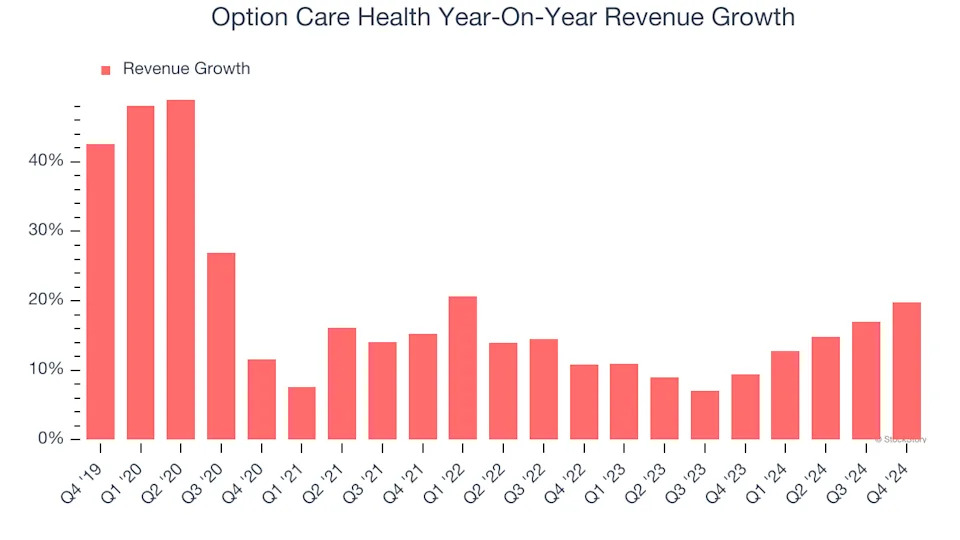

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Option Care Health’s 16.7% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Option Care Health’s annualized revenue growth of 12.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Option Care Health reported year-on-year revenue growth of 19.7%, and its $1.35 billion of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

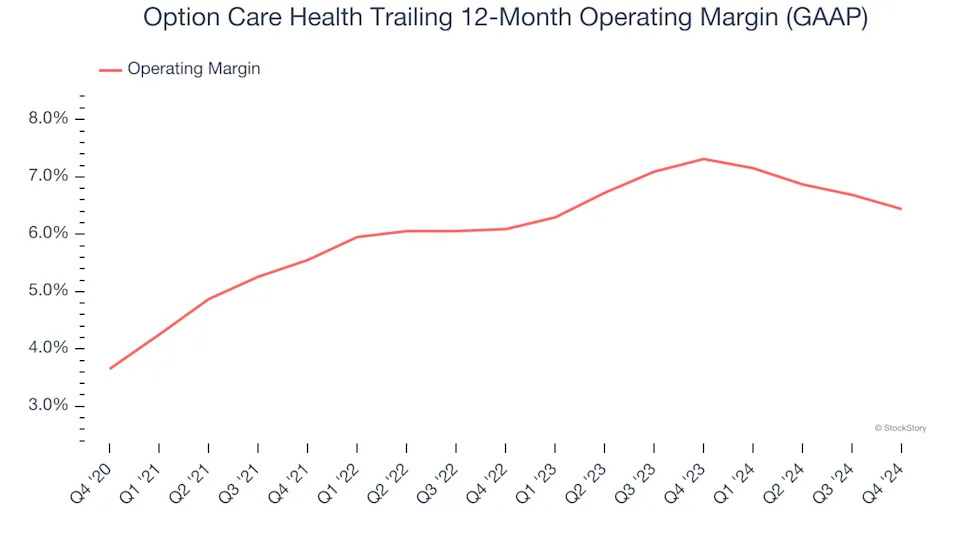

Option Care Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 6% was weak for a healthcare business.

On the plus side, Option Care Health’s operating margin rose by 2.8 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its past improvements as the company’s margin was relatively unchanged on two-year basis.

This quarter, Option Care Health generated an operating profit margin of 6.5%, down 1.1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

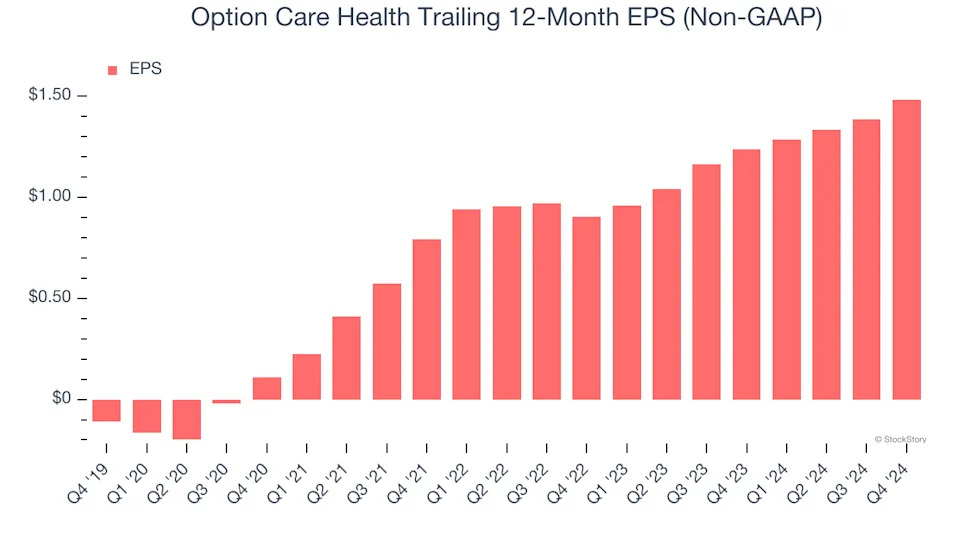

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Option Care Health’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Option Care Health reported EPS at $0.44, up from $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Option Care Health’s full-year EPS of $1.48 to shrink by 15.1%.

Key Takeaways from Option Care Health’s Q4 Results

We were impressed by how significantly Option Care Health blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 2% to $33.29 immediately after reporting.

Option Care Health put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .