Workday’s (NASDAQ:WDAY) Q4 Sales Top Estimates, Stock Soars

Finance and HR software company Workday (NASDAQ:WDAY) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 15% year on year to $2.21 billion. Its non-GAAP profit of $1.92 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Workday? Find out in our full research report .

Workday (WDAY) Q4 CY2024 Highlights:

"Our fourth quarter performance is a testament to Workday's value proposition as organizations seek to boost productivity, run more efficiently, and deliver incredible employee experiences," said Carl Eschenbach, CEO, Workday.

Company Overview

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

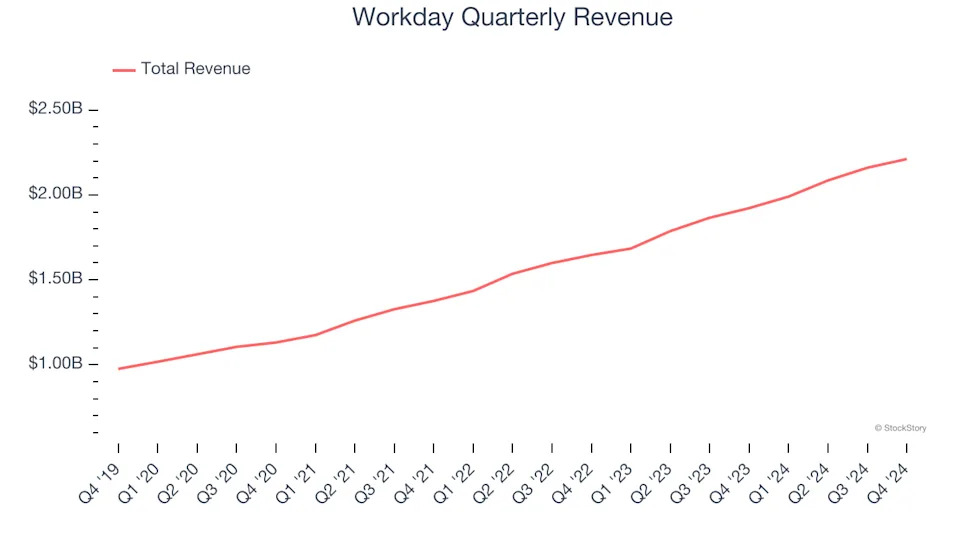

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Workday grew its sales at a 18% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Workday.

This quarter, Workday reported year-on-year revenue growth of 15%, and its $2.21 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

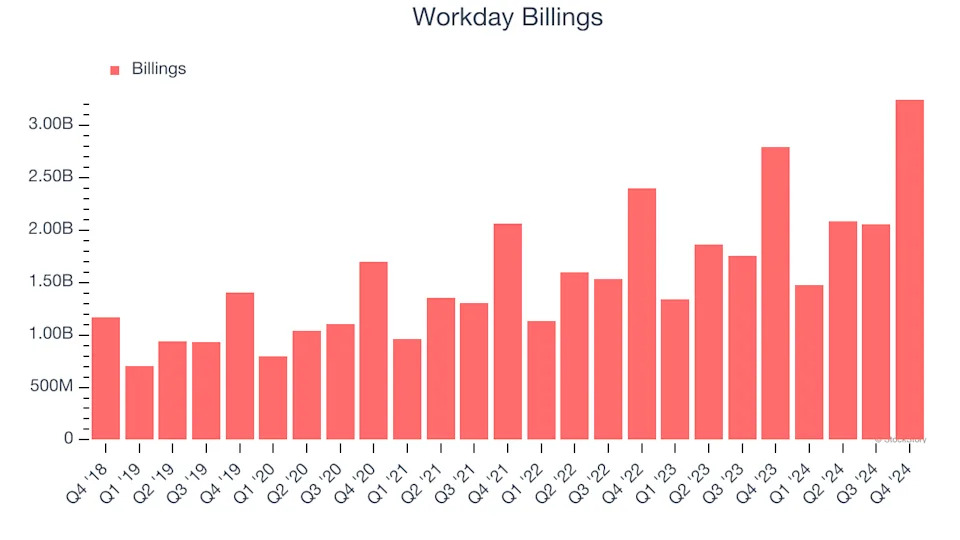

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Workday’s billings punched in at $3.25 billion in Q4, and over the last four quarters, its growth slightly outpaced the sector as it averaged 13.9% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

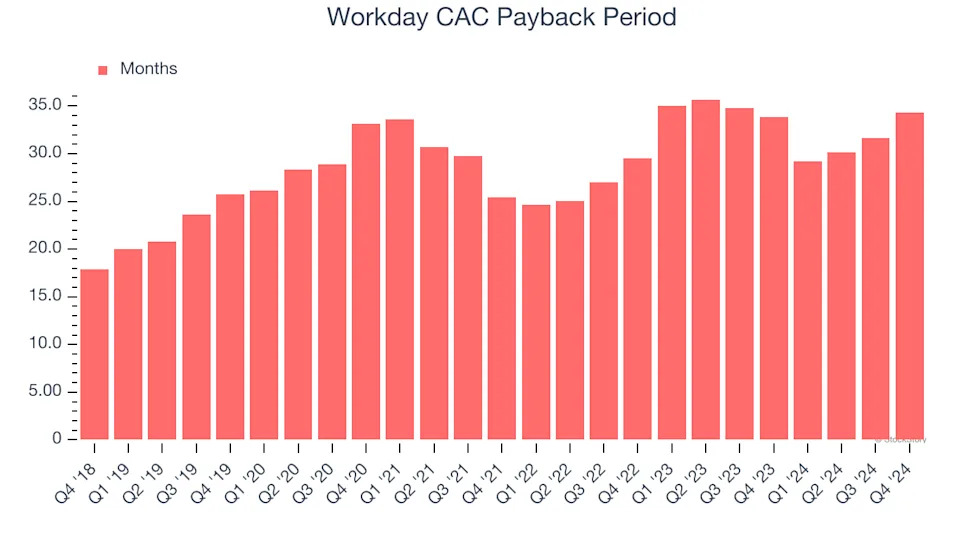

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Workday is quite efficient at acquiring new customers, and its CAC payback period checked in at 34.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Workday’s Q4 Results

We enjoyed seeing Workday beat analysts’ billings expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.4% to $271.37 immediately following the results.

Workday had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .