Shake Shack’s (NYSE:SHAK) Q4 Earnings Results: Revenue In Line With Expectations, Stock Soars

Fast-food chain Shake Shack (NYSE:SHAK) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.8% year on year to $328.7 million. Its non-GAAP profit of $0.26 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy Shake Shack? Find out in our full research report .

Shake Shack (SHAK) Q4 CY2024 Highlights:

Company Overview

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $1.25 billion in revenue over the past 12 months, Shake Shack is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s working from a smaller revenue base.

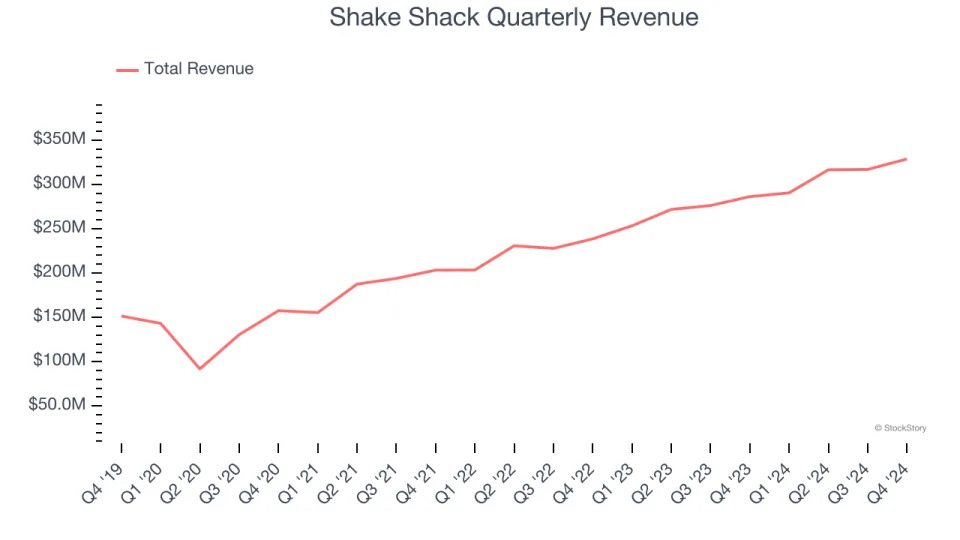

As you can see below, Shake Shack grew its sales at an excellent 16.1% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Shake Shack’s year-on-year revenue growth was 14.8%, and its $328.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 16.5% over the next 12 months, similar to its five-year rate. This projection is noteworthy and implies the market is factoring in success for its menu offerings.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Restaurant Performance

Number of Restaurants

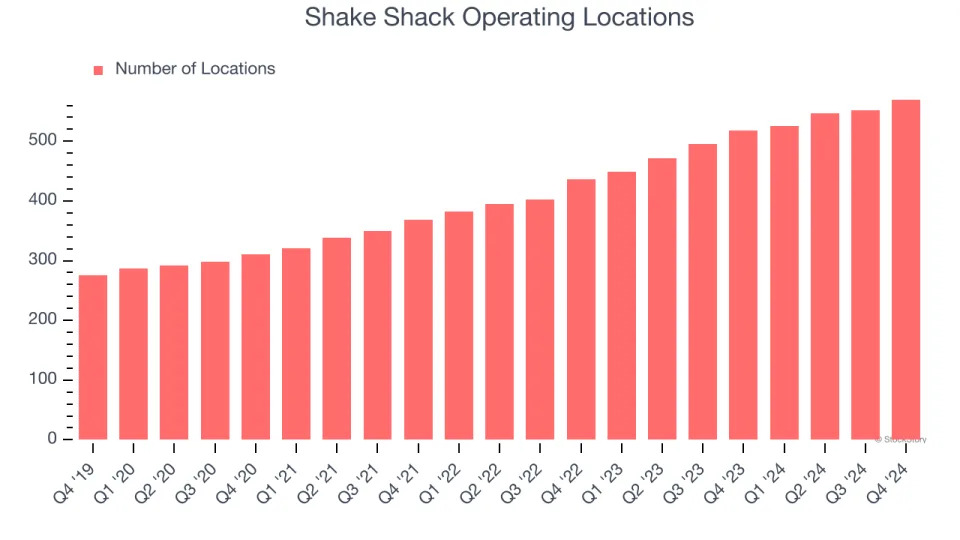

Shake Shack sported 570 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 16.7% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

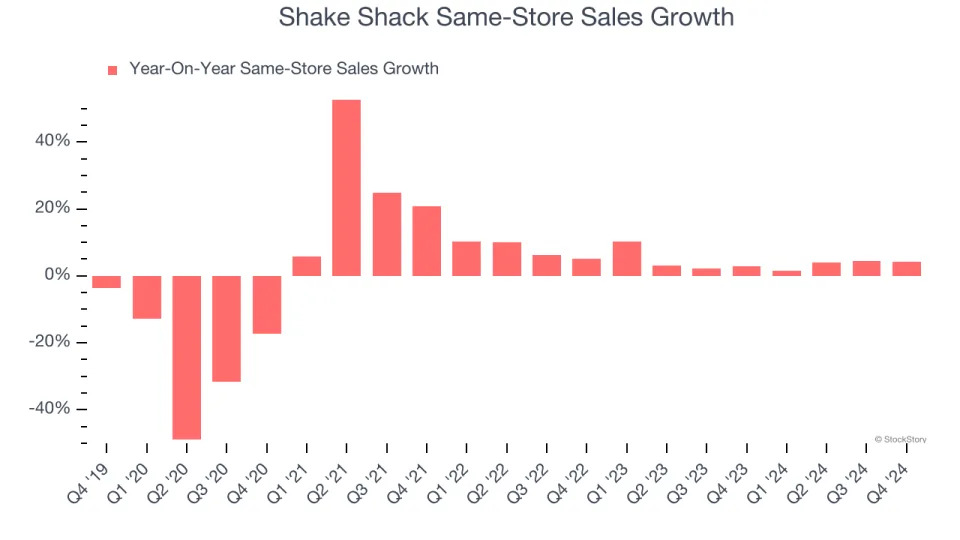

Shake Shack’s demand has been spectacular for a restaurant chain over the last two years. On average, the company has increased its same-store sales by an impressive 4.1% per year. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Shake Shack’s same-store sales rose 4.3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Shake Shack’s Q4 Results

It was encouraging to see Shake Shack beat analysts’ EBITDA expectations this quarter. The company also initiated 2025 guidance, with revenue coming in ahead. Lastly, the company initiated three-year guidance that was encouraging, calling for healthy low/mid-teens EBITDA growth over that period. Overall, this quarter had some key positives. The stock traded up 9.4% to $121.61 immediately after reporting.

Is Shake Shack an attractive investment opportunity at the current price? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .