Amplitude (NASDAQ:AMPL) Exceeds Q4 Expectations, Stock Soars

Data analytics software provider Amplitude (NASDAQ:AMPL) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 9.4% year on year to $78.13 million. Guidance for next quarter’s revenue was optimistic at $79.5 million at the midpoint, 2.3% above analysts’ estimates. Its non-GAAP profit of $0.02 per share was in line with analysts’ consensus estimates.

Is now the time to buy Amplitude? Find out in our full research report .

Amplitude (AMPL) Q4 CY2024 Highlights:

"Amplitude closed 2024 strong. Our platform strategy is resonating with customers, and we're making great progress with enterprises," said Spenser Skates, CEO and co-founder of Amplitude.

Company Overview

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

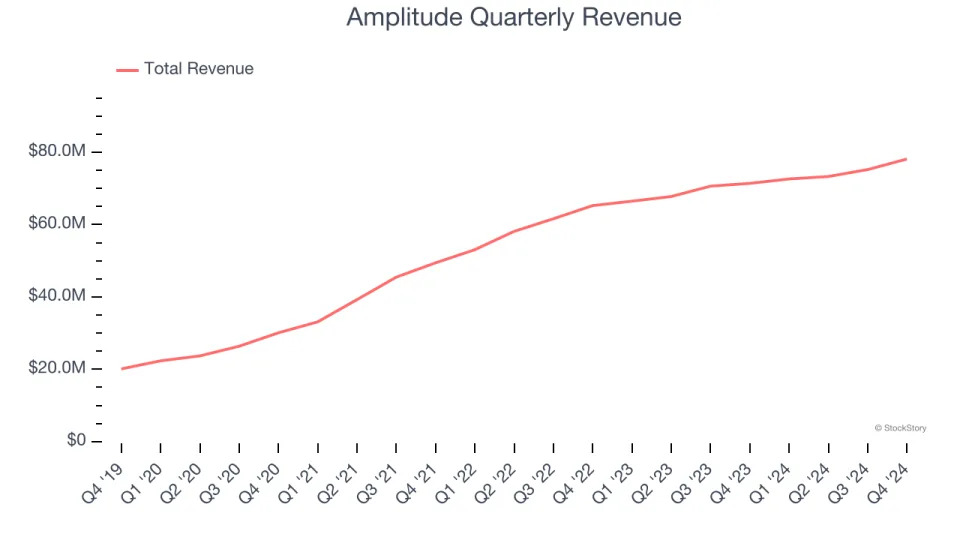

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Amplitude’s 21.4% annualized revenue growth over the last three years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Amplitude reported year-on-year revenue growth of 9.4%, and its $78.13 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

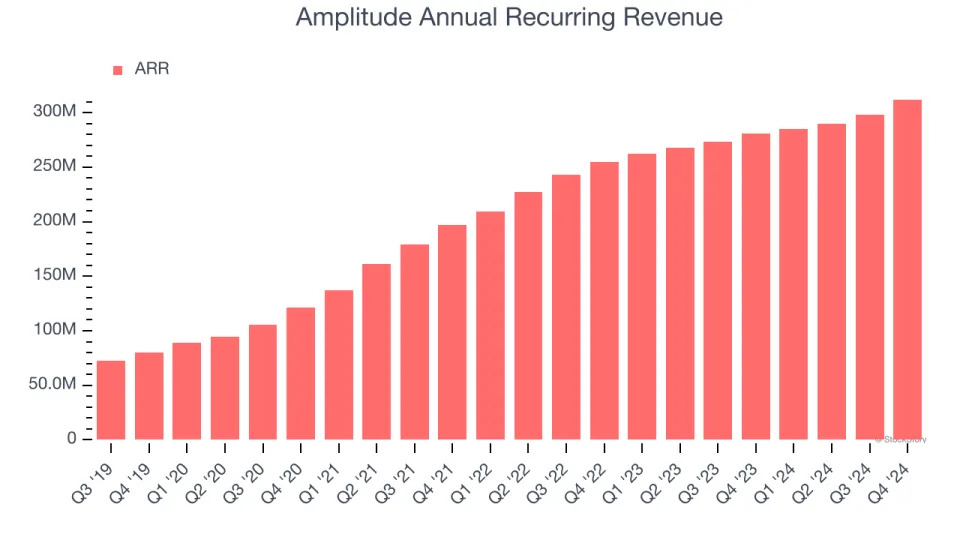

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Amplitude’s ARR came in at $312 million in Q4, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.3% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

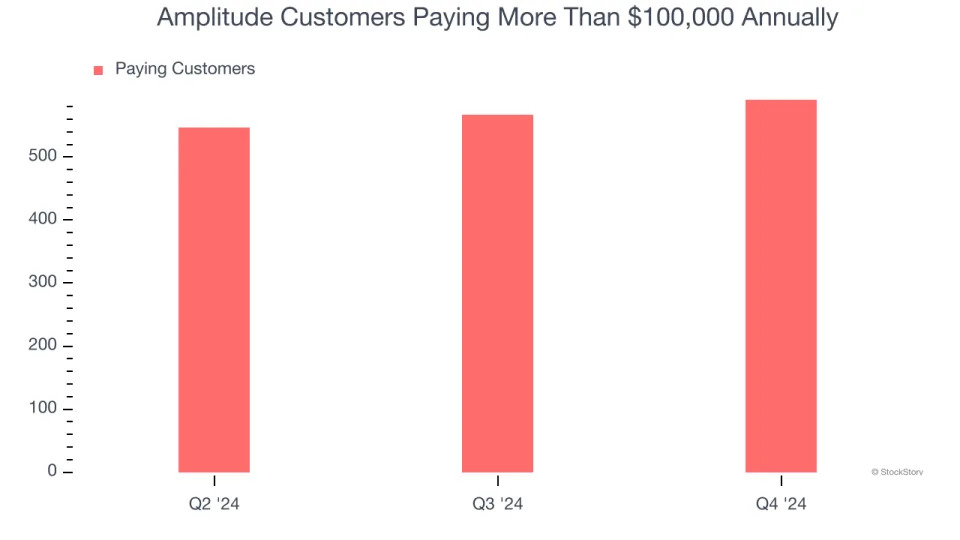

Enterprise Customer Base

This quarter, Amplitude reported 591 enterprise customers paying more than $100,000 annually, an increase of 24 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Amplitude has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

Key Takeaways from Amplitude’s Q4 Results

It was great to see Amplitude expecting revenue growth to accelerate next year. We were also happy its annual recurring revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.6% to $12.64 immediately after reporting.

Sure, Amplitude had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .