Procore (NYSE:PCOR) Beats Q4 Sales Targets, Stock Soars

Construction management software maker Procore (NYSE:PCOR) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 16.2% year on year to $302 million. The company expects next quarter’s revenue to be around $302 million, close to analysts’ estimates. Its non-GAAP profit of $0.01 per share was 91.2% below analysts’ consensus estimates.

Is now the time to buy Procore? Find out in our full research report .

Procore (PCOR) Q4 CY2024 Highlights:

Company Overview

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE:PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

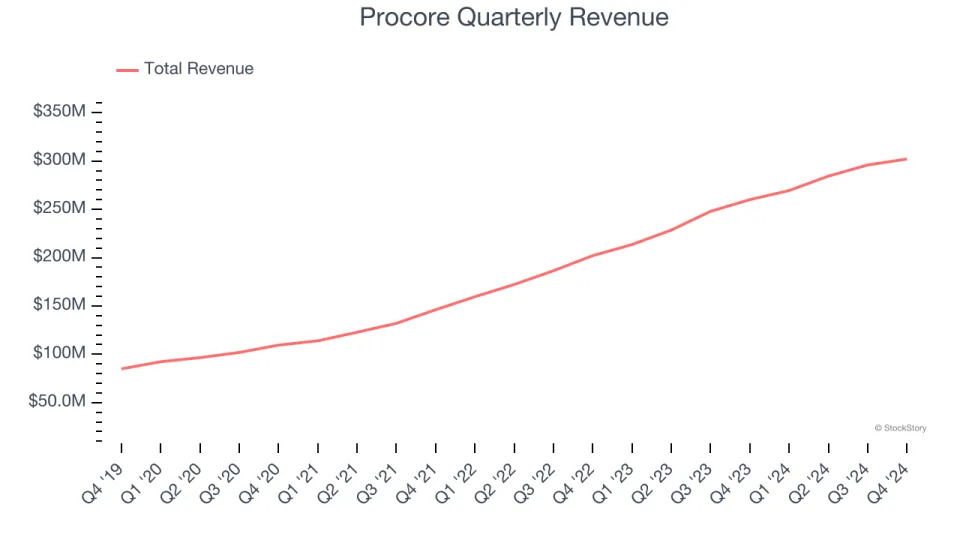

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Procore grew its sales at an impressive 30.8% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Procore reported year-on-year revenue growth of 16.2%, and its $302 million of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 12.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.8% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above the sector average and implies the market is factoring in some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

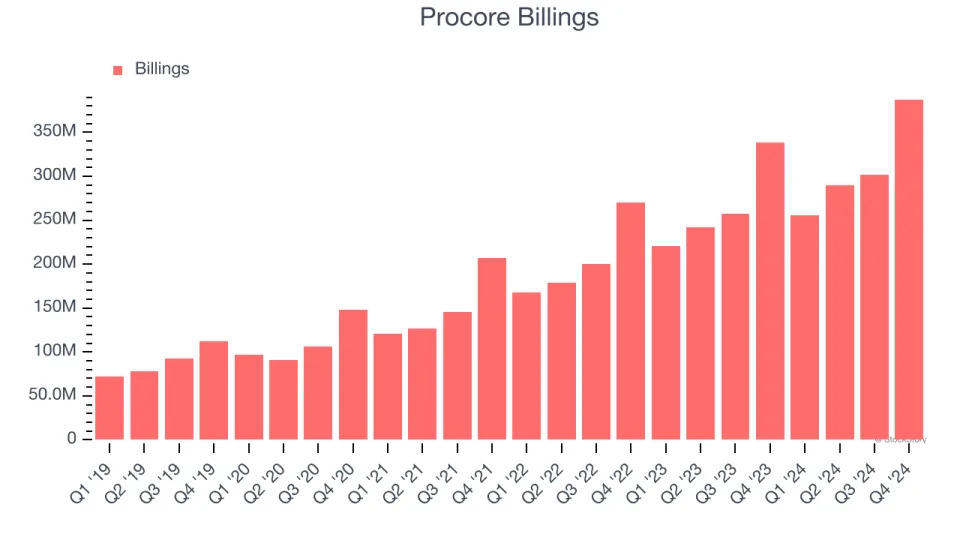

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Procore’s billings punched in at $387.4 million in Q4, and over the last four quarters, its growth was solid as it averaged 16.8% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

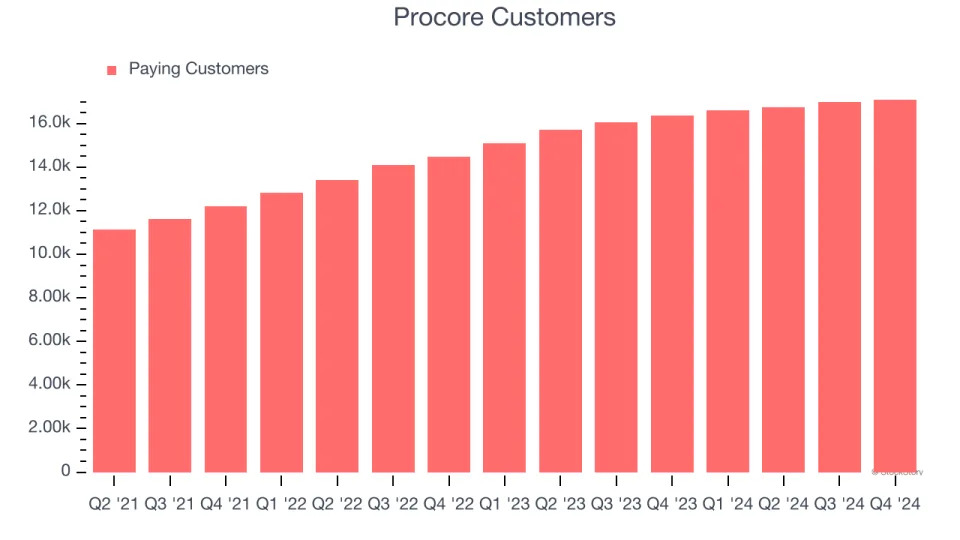

Customer Base

Procore reported 17,088 customers at the end of the quarter, a sequential increase of 113. That’s worse than what we’ve observed previously, but we wouldn’t put too much weight on one quarter given its billings growth over the last year.

Key Takeaways from Procore’s Q4 Results

We enjoyed seeing Procore exceed analysts’ revenue and billings expectations this quarter. We were also happy its full-year revenue guidance narrowly topped Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a mixed quarter, but the stock traded up 9.2% to $82 immediately after reporting due to the top-line momentum.

Is Procore an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .