Rapid7’s (NASDAQ:RPD) Q4: Beats On Revenue But Full-Year Sales Guidance Misses Expectations Significantly

Cybersecurity software maker Rapid7 (NASDAQ:RPD) reported Q4 CY2024 results topping the market’s revenue expectations , with sales up 5.4% year on year to $216.3 million. On the other hand, next quarter’s revenue guidance of $208 million was less impressive, coming in 2.8% below analysts’ estimates. Its non-GAAP profit of $0.48 per share was 3.4% below analysts’ consensus estimates.

Is now the time to buy Rapid7? Find out in our full research report .

Rapid7 (RPD) Q4 CY2024 Highlights:

“As we reflect on 2024, I’m proud of the progress we made to position Rapid7 for long-term growth and success. We achieved $840 million in ARR and delivered over $150 million in free cash flow, while advancing our strategic priorities to innovate, scale, and empower our customers to consolidate and secure their operations more effectively. Continued momentum in Managed Detection and Response and the launch of our Exposure Command platform have further strengthened our ability to deliver measurable value for customers,” said Corey Thomas, Chairman and CEO of Rapid7.

Company Overview

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

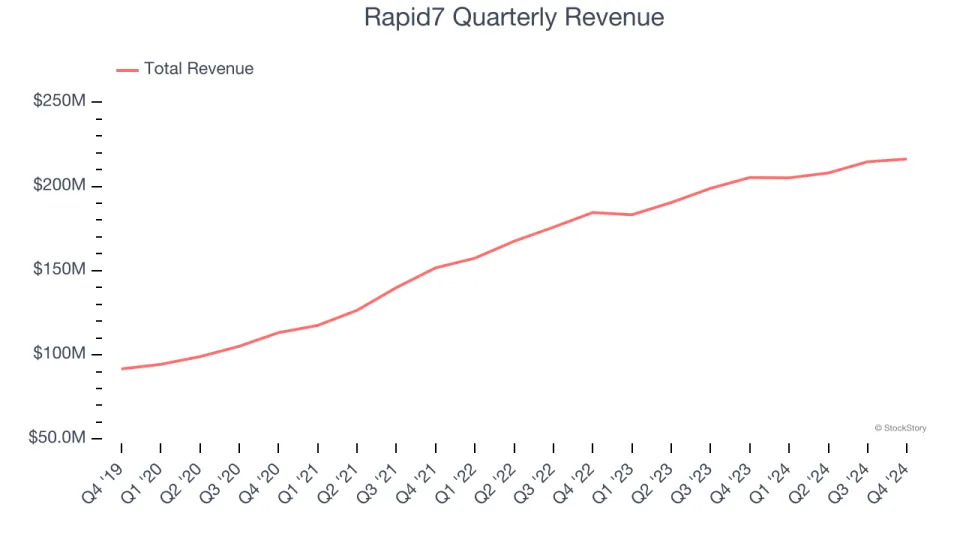

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Rapid7 grew its sales at a 16.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Rapid7 reported year-on-year revenue growth of 5.4%, and its $216.3 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 1.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

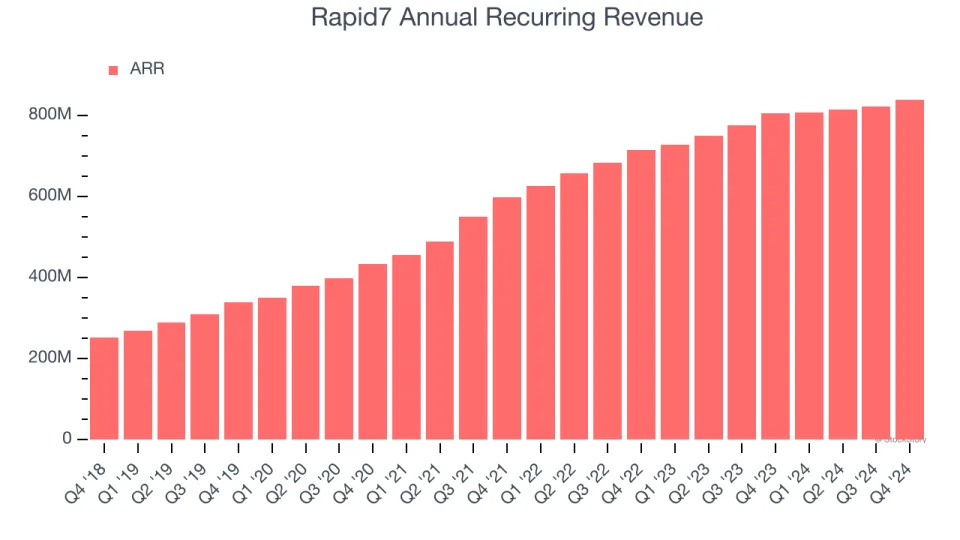

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Rapid7’s ARR came in at $839.8 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 7.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

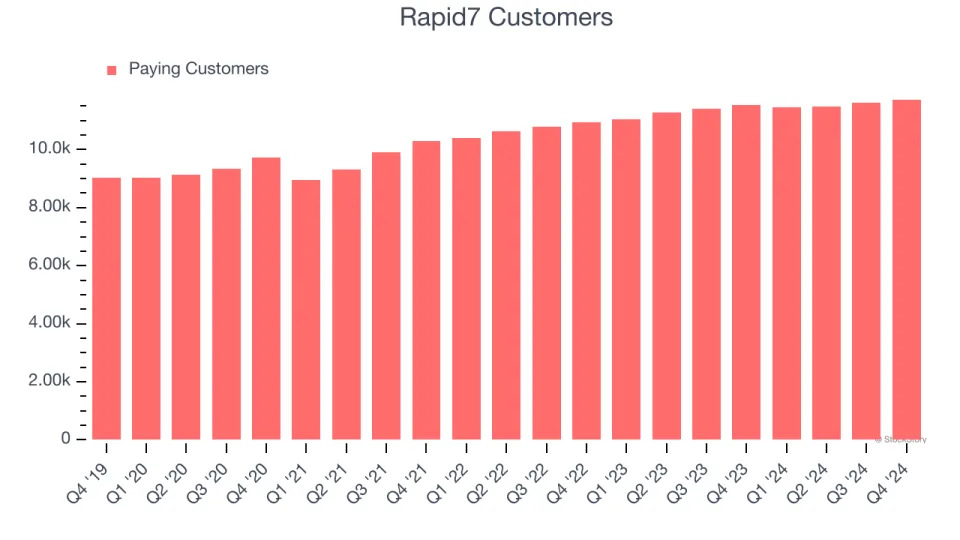

Customer Base

Rapid7 reported 11,727 customers at the end of the quarter, a sequential increase of 108. That’s a little worse than last quarter but quite a bit above what we’ve observed over the last 12 months. Furthermore, Rapid7 actually added more annualized recurring revenue (ARR) this quarter than it did last quarter, demonstrating its ability to either win more valuable customers or more efficiently upsell existing customers.

Key Takeaways from Rapid7’s Q4 Results

We were impressed by how significantly Rapid7 blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.8% to $35 immediately after reporting.

Rapid7 didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .