Reddit (NYSE:RDDT) Posts Better-Than-Expected Sales In Q4 But Stock Drops 15.1%

Online community and discussion platform Reddit (NYSE:RDDT) reported Q4 CY2024 results topping the market’s revenue expectations , with sales up 71.3% year on year to $427.7 million. Guidance for next quarter’s revenue was better than expected at $365 million at the midpoint, 1.3% above analysts’ estimates. Its GAAP profit of $0.36 per share was 44.3% above analysts’ consensus estimates.

Is now the time to buy Reddit? Find out in our full research report .

Reddit (RDDT) Q4 CY2024 Highlights:

“It was another strong quarter as we accomplished exciting milestones across revenue and international growth,” said Steve Huffman, Co-Founder and CEO of Reddit.

Company Overview

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE:RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Sales Growth

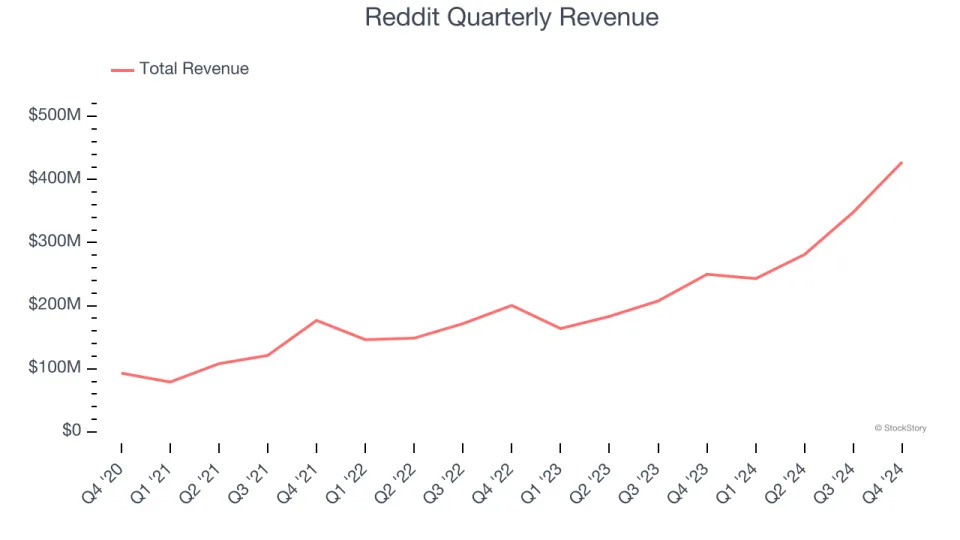

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Reddit grew its sales at an incredible 38.9% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Reddit reported magnificent year-on-year revenue growth of 71.3%, and its $427.7 million of revenue beat Wall Street’s estimates by 4.6%. Company management is currently guiding for a 50.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 37% over the next 12 months, a slight deceleration versus the last three years. Despite the slowdown, this projection is healthy and indicates the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Domestic Daily Active Visitors

User Growth

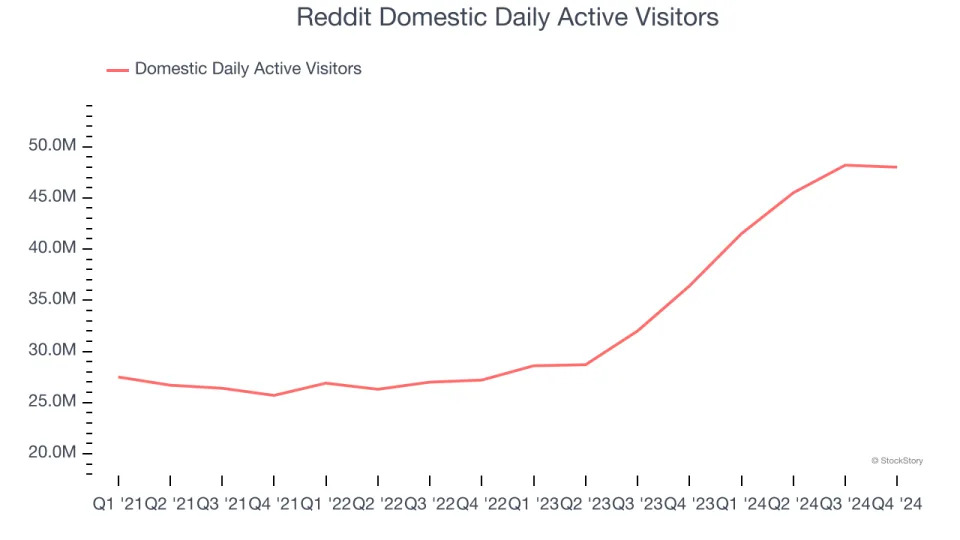

As a social network, Reddit generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Reddit’s domestic daily active visitors, a key performance metric for the company, increased by 31.7% annually to 48 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Reddit added 11.6 million domestic daily active visitors, leading to 31.9% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

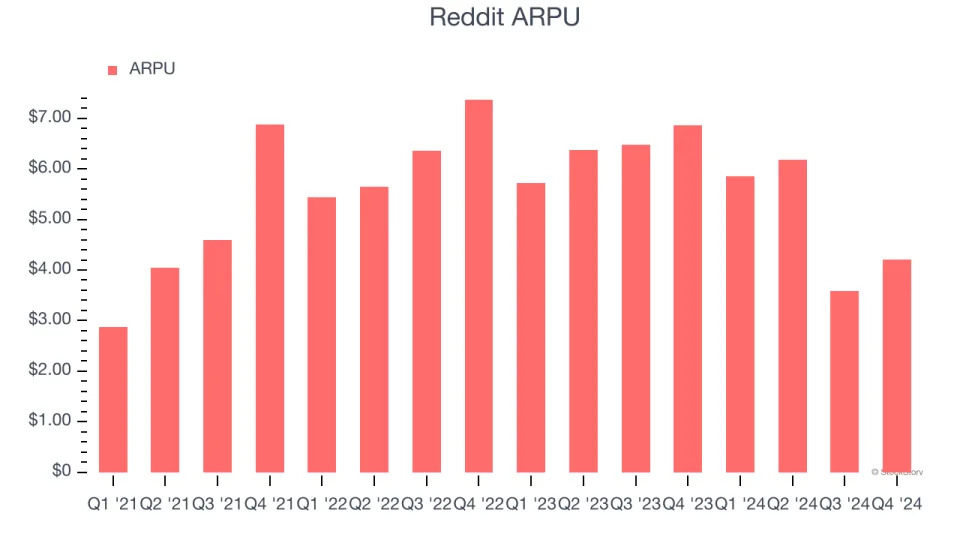

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Reddit because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Reddit’s audience and its ad-targeting capabilities.

Reddit’s ARPU fell over the last two years, averaging 8.9% annual declines. This isn’t great, but the increase in domestic daily active visitors is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Reddit tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Reddit’s ARPU clocked in at $4.21. It declined 38.6% year on year, worse than the change in its domestic daily active visitors.

Key Takeaways from Reddit’s Q4 Results

We were impressed by Reddit’s optimistic revenue and EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its revenue, EPS, and EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its number of domestic daily active visitors missed significantly. Overall, was a decent quarter with its GAAP financial metrics above expectations, but the lower-than-anticipated domestic user additions are sending shares lower. The stock traded down 15.1% to $183.80 immediately following the results.

So should you invest in Reddit right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .