CVS Health’s (NYSE:CVS) Q4 Sales Top Estimates, Stock Soars

Diversified healthcare company CVS Health (NYSE:CVS) announced better-than-expected revenue in Q4 CY2024, with sales up 4.2% year on year to $97.71 billion. Its non-GAAP profit of $1.19 per share was 29.6% above analysts’ consensus estimates.

Is now the time to buy CVS Health? Find out in our full research report .

CVS Health (CVS) Q4 CY2024 Highlights:

Company Overview

Founded in 1963 as a chain of health and beauty stores, CVS Health (NYSE:CVS) is best known for its retail pharmacies today, but the company also has a health insurance arm (Aetna), and a pharmacy benefits management service as well.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Sales Growth

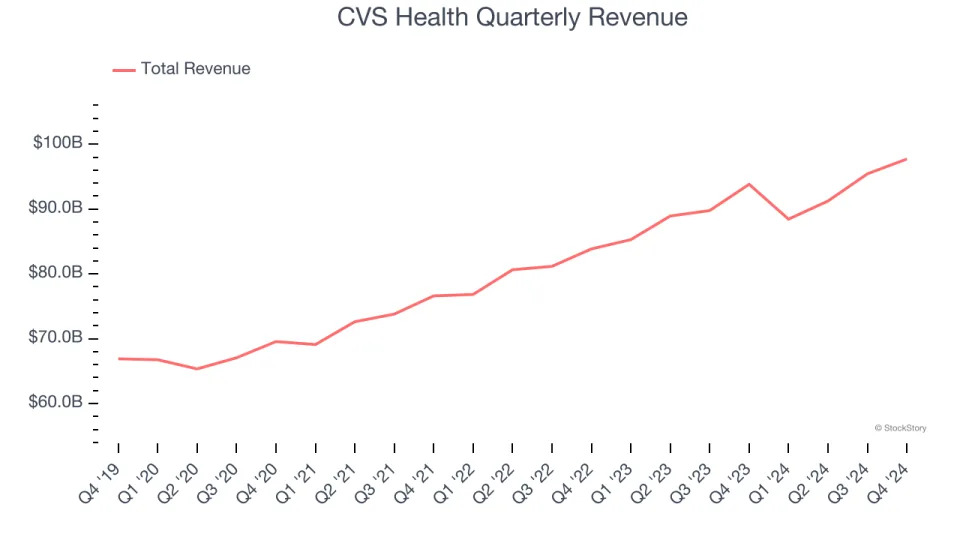

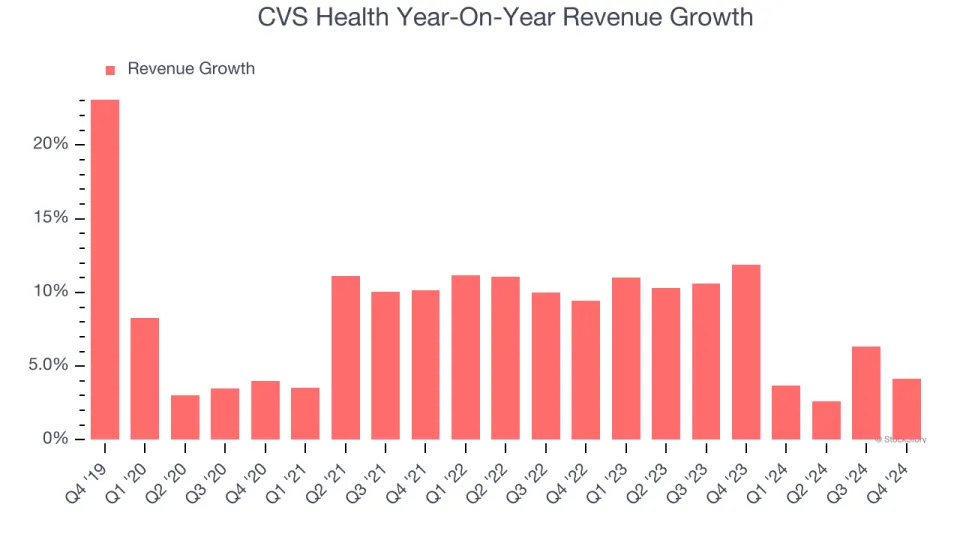

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, CVS Health’s sales grew at a decent 7.7% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. CVS Health’s annualized revenue growth of 7.5% over the last two years aligns with its five-year trend, suggesting its demand was stable.

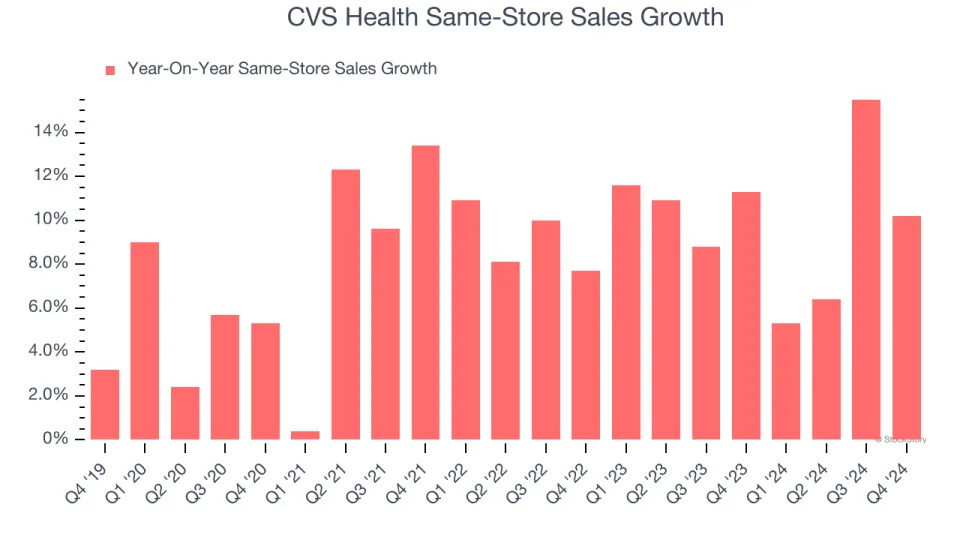

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, CVS Health’s same-store sales averaged 10% year-on-year growth. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, CVS Health reported modest year-on-year revenue growth of 4.2% but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

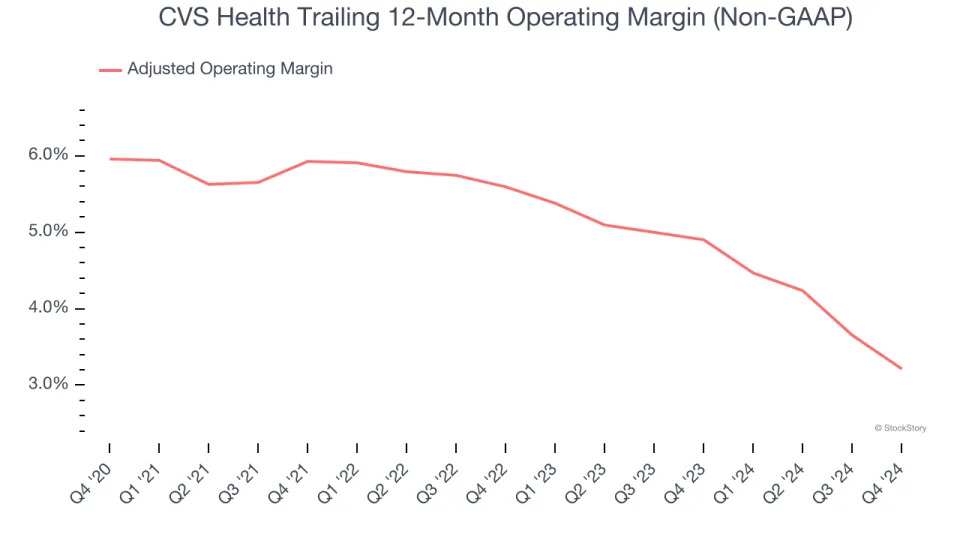

CVS Health was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 5% was weak for a healthcare business.

Analyzing the trend in its profitability, CVS Health’s adjusted operating margin decreased by 2.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.4 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, CVS Health generated an adjusted operating profit margin of 2.8%, down 1.7 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

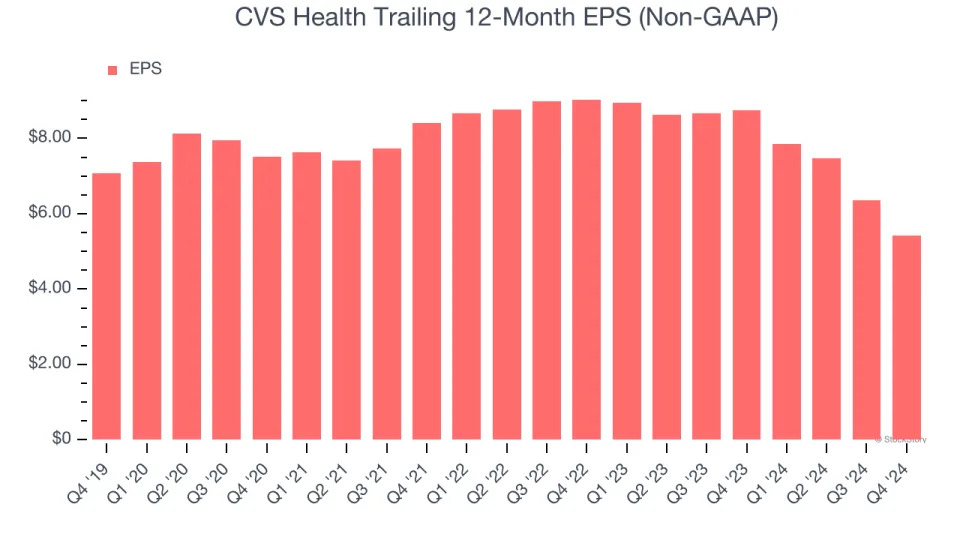

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for CVS Health, its EPS declined by 5.2% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into CVS Health’s earnings to better understand the drivers of its performance. As we mentioned earlier, CVS Health’s adjusted operating margin declined by 2.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, CVS Health reported EPS at $1.19, down from $2.12 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects CVS Health’s full-year EPS of $5.42 to grow 9.4%.

Key Takeaways from CVS Health’s Q4 Results

We were impressed by how significantly CVS Health blew past analysts’ same-store sales expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance missed. Overall, we think this was a decent quarter with some key metrics above expectations, and the market is rewarding the positives. The stock traded up 9.9% to $60.46 immediately following the results.

Sure, CVS Health had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .