Institutional investors buy the crypto dip for fifth straight week

Institutional investors appear to be buying the dip in crypto prices.

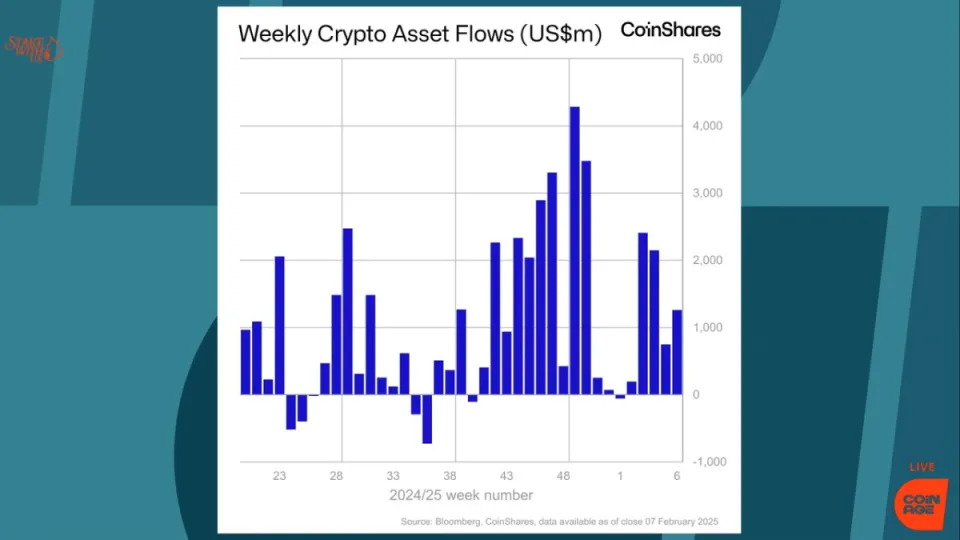

Inflows into crypto investment products, like Bitcoin and Ethereum ETFs, notched total inflows for the fifth straight week as CoinShares counted $1.3 billion in total inflows in their latest report .

In fact, nearly $800 billion poured into Ethereum investment products last week after the crypto's recent 20% selloff. That was enough to pass Bitcoin inflows on a weekly clip for the first time this year.

As the year continues, it will be interesting to see if altcoins can mount any sort of break in Bitcoin's rising dominance. As more people come to see the original cryptocurrency as a store of value, Bitcoin has grown to account for more than 60% of the total crypto market cap.

Companies like Strategy (formerly known as MicroStrategy) continue to buy more Bitcoin to hold as a treasury asset. On Monday, Strategy CEO Michael Saylor announced another purchase after the company took a week off to break its streak of 12 consecutive weekly Bitcoin purchases. Strategy said it bought about $740 million worth of Bitcoin.

Last week, there was a spike in optimism among Bitcoiners that the U.S. government could be getting closer to figuring out a way to emulate the Strategy playbook. AI and crypto Czar David Sacks mentioned that an answer on ideas around a strategic Bitcoin reserve are still among the administration's top priorities.

"That's one of the first things we're going to look at as part of the internal working group in the administration," Sacks said last Tuesday. "We're still in the very early stages of this."