Waste Management Stocks Q3 Highlights: Perma-Fix (NASDAQ:PESI)

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how waste management stocks fared in Q3, starting with Perma-Fix (NASDAQ:PESI).

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 8 waste management stocks we track reported a softer Q3. As a group, revenues missed analysts’ consensus estimates by 2.1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.3% since the latest earnings results.

Perma-Fix (NASDAQ:PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

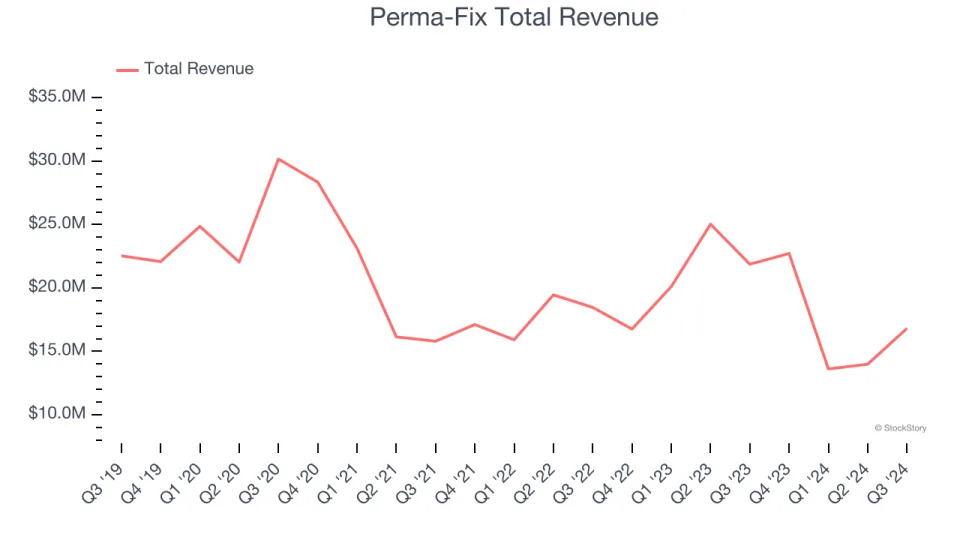

Perma-Fix reported revenues of $16.81 million, down 23.2% year on year. This print fell short of analysts’ expectations by 2.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Mark Duff, President and CEO of the Company, commented, “During the third quarter, we continued to experience temporary weakness, partly due to ongoing delays in service starts and waste shipments.”

Perma-Fix delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 31.9% since reporting and currently trades at $10.

Read our full report on Perma-Fix here, it’s free .

Best Q3: Republic Services (NYSE:RSG)

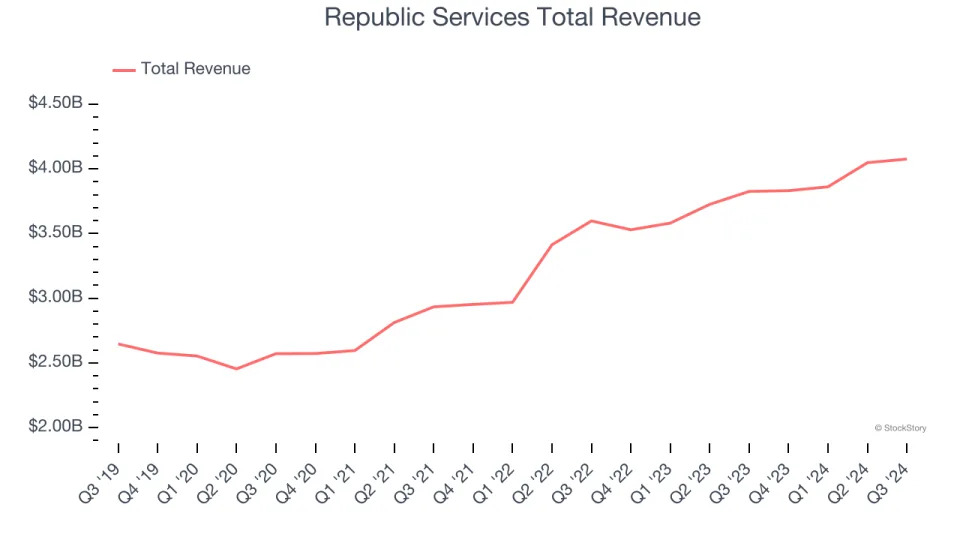

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

Republic Services reported revenues of $4.08 billion, up 6.5% year on year, falling short of analysts’ expectations by 1.1%. The business performed better than its peers, but it was unfortunately a mixed quarter with an impressive beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ sales volume estimates.

The market seems happy with the results as the stock is up 8.4% since reporting. It currently trades at $221.57.

Is now the time to buy Republic Services? Access our full analysis of the earnings results here, it’s free .

Quest Resource (NASDAQ:QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $72.77 million, up 3.3% year on year, falling short of analysts’ expectations by 5.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 32.3% since the results and currently trades at $5.57.

Read our full analysis of Quest Resource’s results here.

Montrose (NYSE:MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE:MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $178.7 million, up 6.4% year on year. This number missed analysts’ expectations by 3.7%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ organic revenue estimates.

Montrose delivered the highest full-year guidance raise among its peers. The stock is down 13.8% since reporting and currently trades at $20.97.

Read our full, actionable report on Montrose here, it’s free.

Waste Management (NYSE:WM)

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.89 billion, up 13% year on year. This print beat analysts’ expectations by 0.9%. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is up 6.7% since reporting and currently trades at $223.79.

Read our full, actionable report on Waste Management here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .