Doximity (NYSE:DOCS) Reports Upbeat Q4, Stock Jumps 22.5%

Healthcare professional network Doximity (NYSE:DOCS) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 24.6% year on year to $168.6 million. On top of that, next quarter’s revenue guidance ($133 million at the midpoint) was surprisingly good and 4.7% above what analysts were expecting. Its non-GAAP profit of $0.45 per share was 34% above analysts’ consensus estimates.

Is now the time to buy Doximity? Find out in our full research report .

Doximity (DOCS) Q4 CY2024 Highlights:

“We’re proud to deliver another quarter of record engagement in Q3, with over 610,000 unique providers using our clinical workflow tools,” said Jeff Tangney, co-founder and CEO of Doximity.

Company Overview

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Healthcare And Life Sciences Software

The coronavirus pandemic has underscored the importance of high-quality health infrastructure in times of crisis. Coupled with intense competition between drugmakers and the growing volume of data in the health care sector, demand for data management solutions in the healthcare space is expected to remain strong in the years ahead.

Sales Growth

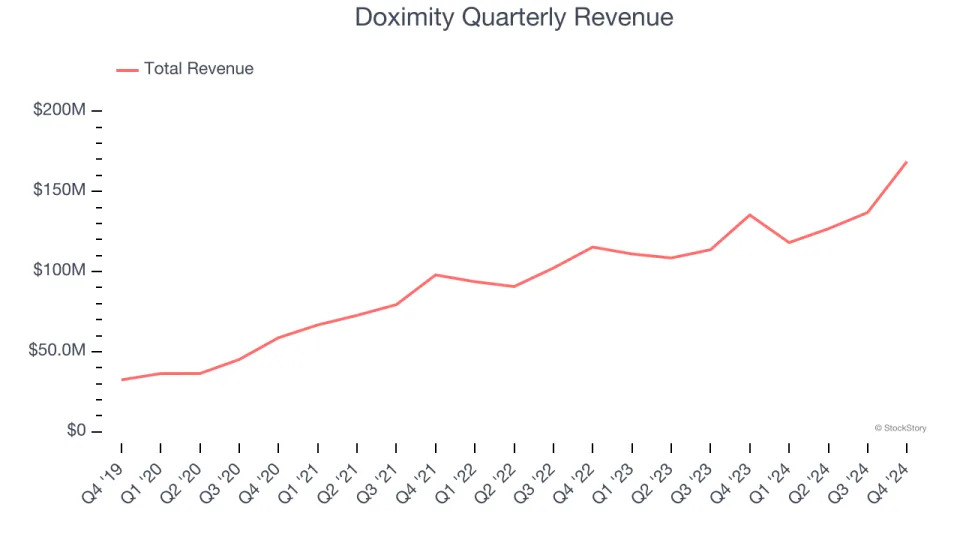

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Doximity’s sales grew at a decent 20.2% compounded annual growth rate over the last three years. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Doximity reported robust year-on-year revenue growth of 24.6%, and its $168.6 million of revenue topped Wall Street estimates by 9.6%. Company management is currently guiding for a 12.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Doximity is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Doximity more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Doximity’s Q4 Results

We liked how the company handily beat on the revenue, EBITDA, and EPS lines. We were also impressed by Doximity’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. Zooming out, we think this was a very good quarter with some key areas of upside. The stock traded up 22.4% to $71.50 immediately after reporting.

Doximity had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .