Hub Group (NASDAQ:HUBG) Misses Q4 Sales Targets

Logistics solutions provider Hub Group (NASDAQ:HUBG) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 1.2% year on year to $973.5 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $4.15 billion at the midpoint. Its GAAP profit of $0.40 per share was 17.4% below analysts’ consensus estimates.

Is now the time to buy Hub Group? Find out in our full research report .

Hub Group (HUBG) Q4 CY2024 Highlights:

“I am proud of the team’s performance in 2024 as our disciplined market approach resulted in Intermodal volume growth of 14% and ITS adjusted operating margin of 3.1% in the quarter, a 50-basis point improvement over Q4 2023. We closed on the joint venture with EASO to enhance solutions for our customers and add significant scale to our Intermodal capabilities in Mexico. We continue to implement our key strategic priorities that position us for growth in the long term. We are excited to continue the momentum and deliver for our customers and shareholders in 2025,” said Phil Yeager, Hub Group’s President, Chief Executive Officer and Vice Chairman.

Company Overview

Started with $10,000, Hub Group (NASDAQ:HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

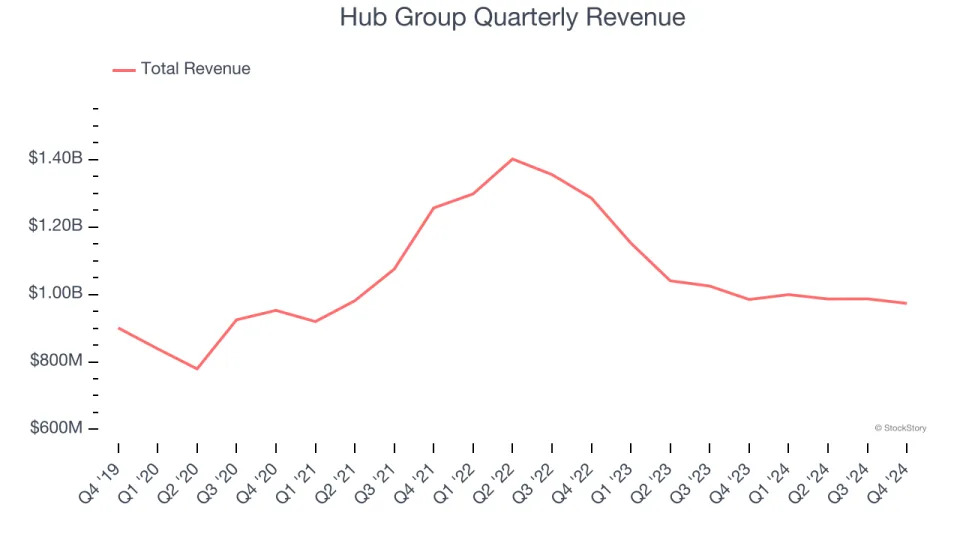

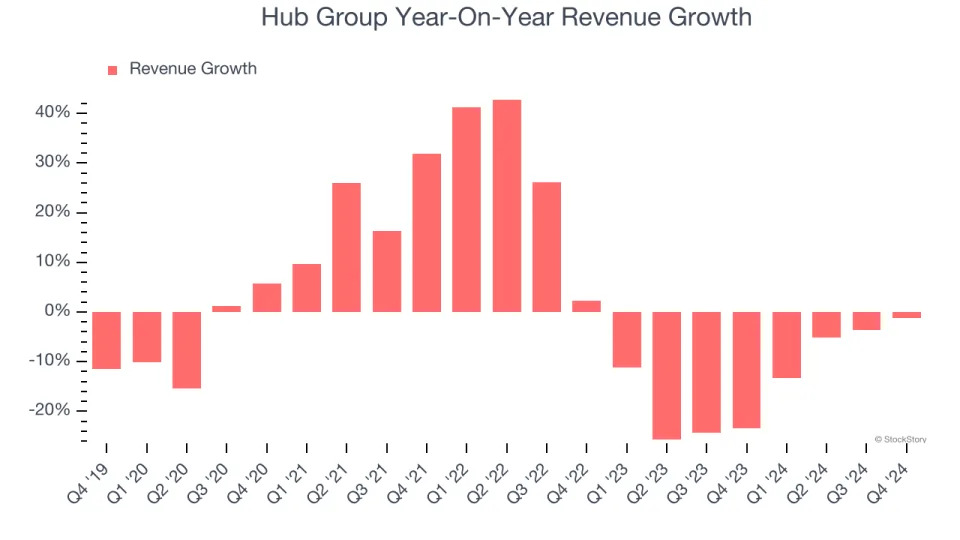

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Hub Group’s 1.5% annualized revenue growth over the last five years was weak. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hub Group’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 14% annually. Hub Group isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Hub Group missed Wall Street’s estimates and reported a rather uninspiring 1.2% year-on-year revenue decline, generating $973.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Operating Margin

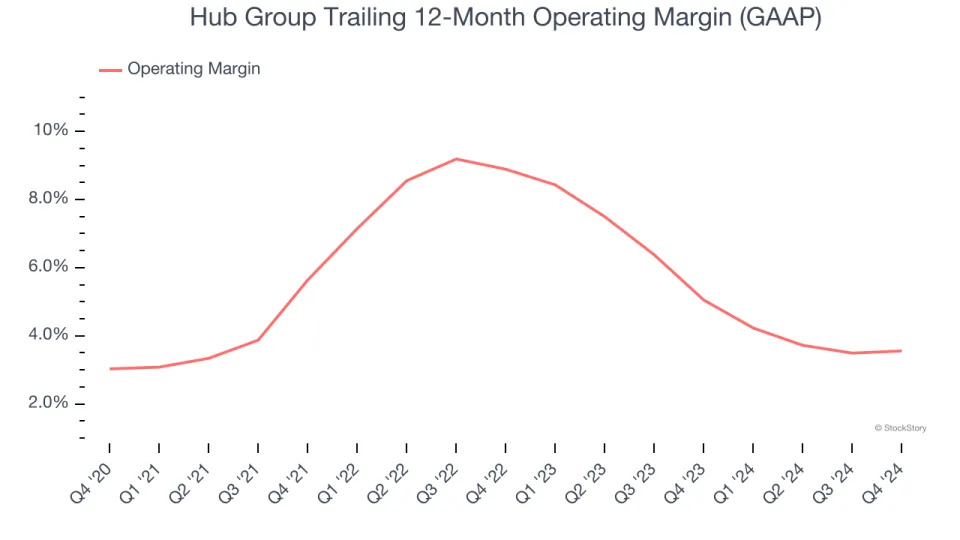

Hub Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Hub Group’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q4, Hub Group generated an operating profit margin of 3.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

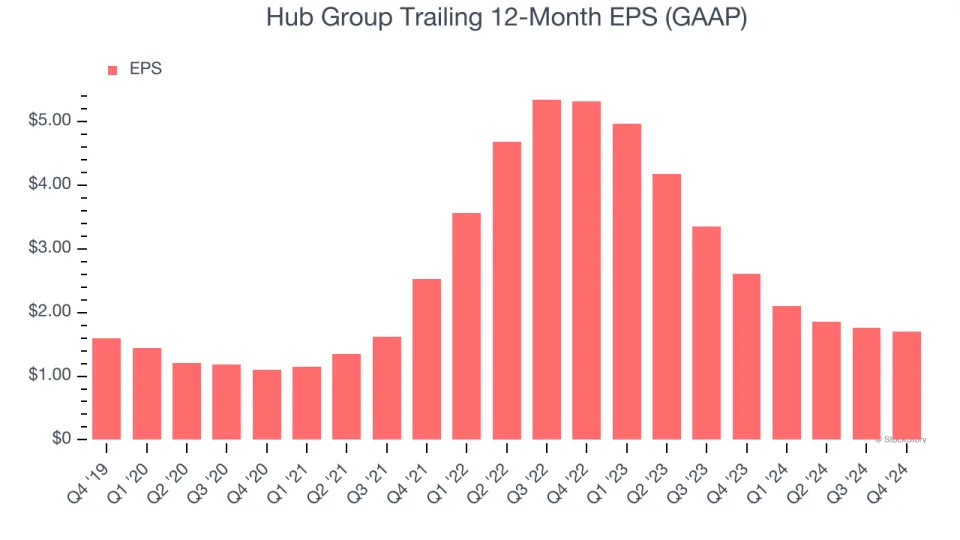

Hub Group’s weak 1.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Hub Group’s two-year annual EPS declines of 43.4% were bad and lower than its two-year revenue performance.

In Q4, Hub Group reported EPS at $0.40, down from $0.46 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hub Group’s full-year EPS of $1.70 to grow 39.3%.

Key Takeaways from Hub Group’s Q4 Results

We enjoyed seeing Hub Group exceed analysts’ EBITDA expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $43.28 immediately after reporting.

Is Hub Group an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .