In a weak quarter for brokerages, RXO’s stock price takes a pounding after earnings

(A quick summary of some key points of RXO’s earnings can be found here. )

With four publicly-traded freight brokerages now having reported earnings for the fourth quarter, the overall picture was not pretty.

C.H. Robinson (NASDAQ: CHRW) did better on a year-on-year basis, but its sequential performance was mostly down. Uber Freight (NYSE: UBER) continued its streak, now more than two years, of EBITDA losses . Guidance at Landstar (NASDAQ: LSTR) was described as disappointing .

RXO (NYSE: RXO), with an earnings report that now fully integrates the performance of the legacy Coyote Logistics business, saw several negative numbers that led Brandon Oglenski from Barclays to pivot away from talk about the Coyote integration and the company’s optimistic outlook on the call. Instead, he focused on current financial performance.

“I think at the end of the day, what a lot of investors are trying to figure out here is that your EBITDA or your operating earnings look pretty low here on a consolidated basis, especially going into the first quarter,” Oglenski said.

Although the call took place before equity markets opened for the day, those investors Oglenski referred to made their verdict clear about the earnings report: they didn’t like it.

RXO’s stock fell 14.92% on the day, a drop of $3.77, landing at $21.49. That is still a decent gap between the Wednesday price and the 52-week low of $18.75 recorded April 30. But it’s also well below the 52-week high of $32.82, set on July 31.

“There’s a fear that there’s been a deterioration in the core business,” Oglenski said.

The numbers Oglenski was referring to include the fact that truck brokerage gross margin as a percent of revenue was 13.2% in the fourth quarter, down from 14.8% a year ago and 13.7% in the third quarter, and an overall adjusted EBITDA margin of 2.5% compared to 3.2% in each of those other two comparison quarters.

Net income per share was minus 12 cents in the quarter compared to 2 cents a year earlier.

Sequential data was mixed. While the Q4 EBITDA of $42 million was improved from $33 million in the third quarter, the third quarter figure has only a few weeks’ worth of Coyote financials. Meanwhile, the fourth quarter operating loss of $24 million was worse than the $20 million in the third quarter.

Wilkerson: it went as we predicted

RXO CEO Drew Wilkerson, in response to Oglenski, said the company’s management had been forecasting “some sort of recovery” in the freight market, “and if that did not happen, that we would sacrifice a little bit of volume and potentially a little bit of EBITDA as well. And that is what played out.”

RXO’s downturn in earnings, Wilkerson said, was driven primarily by a deterioration in gross profit per load. (RXO does not disclose a specific figure for that key performance indicator.) Wilkerson talked about market conditions that were likely to have tripped up other 3PLs, whether their results are publicly known or not.

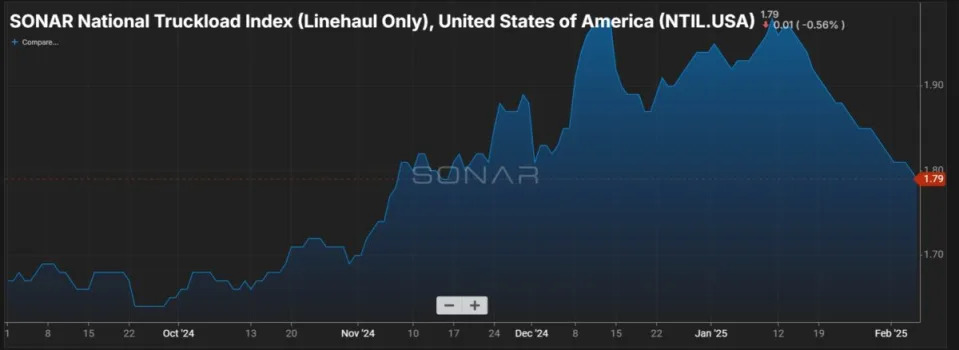

“That is what has happened with the cost of purchased transportation growing up and sales rates that have come down over the last 1 ½ years,” Wilkerson said. “We’re entering into a period where rates are going up for the first time in 2 ½ years on a year-to-year basis.”

Comparisons on the cost of transportation year-on-year are far from perfect; the fourth quarter data from 2023 doesn’t include Coyote. But the figure overall was almost doubled, to $1.1 billion from $519 million.

In his opening remarks, Wilkerson noted that the RXO adjusted EBITDA in the fourth quarter of $42 million was within the company’s guidance that had been provided in the prior quarter.

Upping the projections on Coyote synergies

Wilkerson had kicked off the call with analysts by discussing RXO’s announcement that it was raising its estimate on synergies with the Coyote acquisition to $50 million from $40 million just one quarter ago. That estimate earlier had been $25 million.

Wilkerson cited two key areas that have produced stronger than expected savings: the cost of purchased transportation and, “the impact of our cross-selling efforts.”

Jamie Harris, the company’s CFO, also said real estate consolidation had been a key factor in the series of higher estimates on the value of synergies in the company. He also cited procurement, not necessarily of purchased transportation but also, “if you look at these two companies (there have been) often the same type of vendors, so we’re getting some scale out of our contract spend.”

He added that the fixture does not include synergies from, “improved transportation spend.”

A benefit that is more difficult to measure financially but which was cited by Wilkerson is that, “there’s a lot of excitement now working for what’s the third largest broker in North America and one that has gained share over the long term through the cycle. There’s excitement about being able to serve our customers and offer them more services than what we were able to offer them before.”

The quarterly earnings were the first three-month period to fully include the financial results from the legacy Coyote business. Jared Weisfeld, the company’s chief strategy officer, said RXO management “is really viewing this as one combined business right now.”

Ravi Shanker of Morgan Stanley noted on the call that truckload carriers in their earnings calls were seeing the possibility of double digit rate increases this year whereas RXO was more modest, calling for a low to mid-single digit set of rates this year.

“What we’re seeing and what we’re hearing from customers gives us confidence that we’re talking about low to mid-single-digit increases for 2025,” Weisfeld said in response. “But to your point, to the extent that cycle develops here, and we start seeing a stronger recovery and it is that type of V-shape, we will absolutely be able to go ahead and see those kinds of price increases that you’re talking about.”

Wilkerson said the cross-selling opportunities it is seeing with Coyote customers who can now more easily purchase services such as freight forwarding from RXO are shaping up to be a significant gain for the company.

“There’s a lot going on within the business that you may not see right now with the gross profit per load being compressed at the bottom of the cycle,” Wilkerson said. “But the actions that we’re taking right now, we’re confident in what they’re going to do for the long-term piece of the business.”

More articles by John Kingston

Senators seek answers from Ford about Jack Cooper contract cancellation

Georgia-based RSTZ, with operations also in New England, files for bankruptcy protection

Trucking-backed suit may be arena for dumping Biden independent contractor rule

The post In a weak quarter for brokerages, RXO’s stock price takes a pounding after earnings appeared first on FreightWaves .