Hillenbrand’s (NYSE:HI) Q4 Sales Beat Estimates But Stock Drops

Industrial processing equipment and solutions provider Hillenbrand (NYSE:HI) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 8.6% year on year to $706.9 million. On the other hand, next quarter’s revenue guidance of $695 million was less impressive, coming in 4.9% below analysts’ estimates. Its non-GAAP profit of $0.56 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Hillenbrand? Find out in our full research report .

Hillenbrand (HI) Q4 CY2024 Highlights:

"The agreement to divest a majority stake in the Milacron business reflects the continuation of Hillenbrand's transformation as we've significantly reshaped our portfolio toward less cyclical, higher-growth opportunities. Over the last few years, we have exited our secularly declining death care segment and pursued several strategic acquisitions, building scale in the attractive food, health, and nutrition end markets, which now comprise just under 30% of our total revenue mix on a pro forma basis. We believe this transaction not only delivers value for Hillenbrand and our shareholders, but also Milacron and its customers, as they have a strong partner in Bain Capital to help drive their next phase of growth," said Kim Ryan, President and Chief Executive Officer of Hillenbrand.

Company Overview

Hillenbrand, Inc. (NYSE: HI) is an industrial company that designs, manufactures, and sells highly engineered processing equipment and solutions for various industries.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

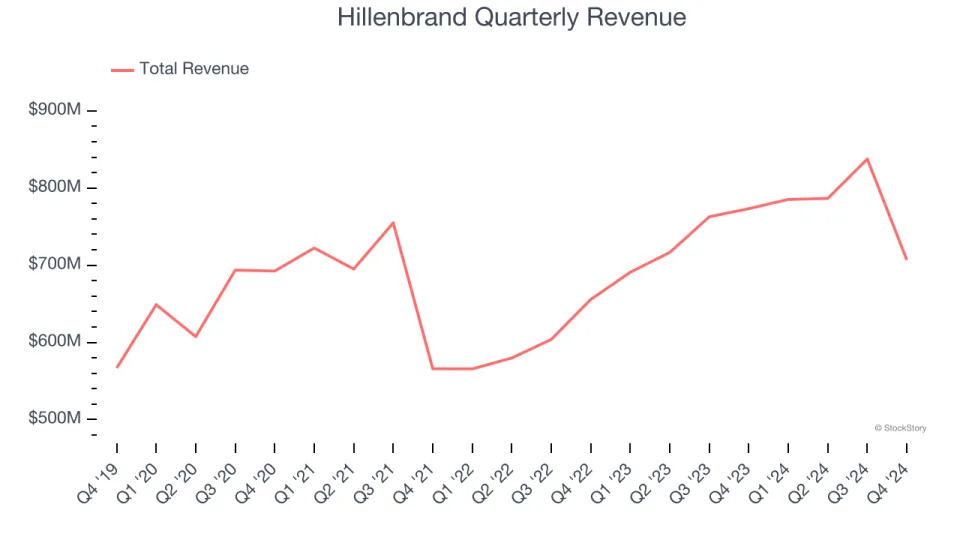

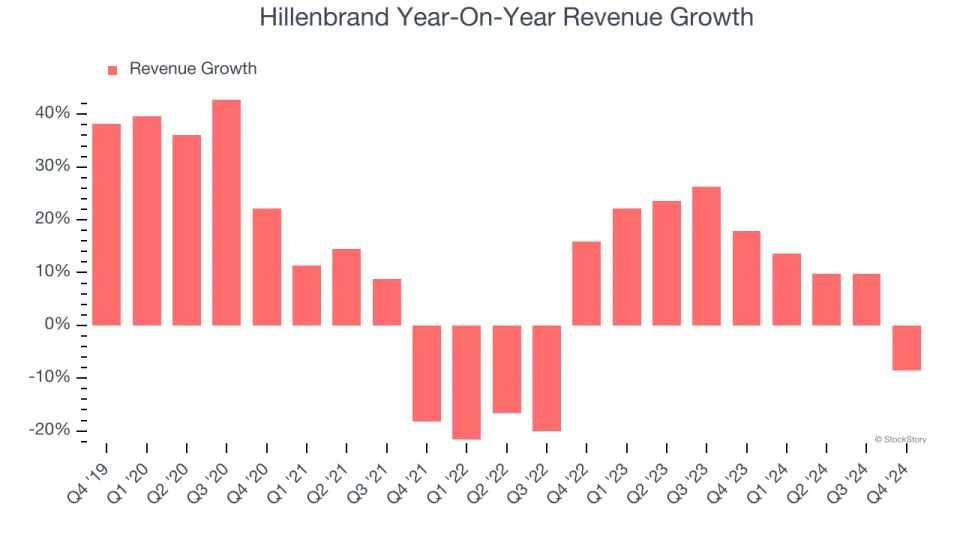

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Hillenbrand’s 9.7% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hillenbrand’s annualized revenue growth of 13.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Hillenbrand’s revenue fell by 8.6% year on year to $706.9 million but beat Wall Street’s estimates by 1.6%. Company management is currently guiding for a 11.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 2.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

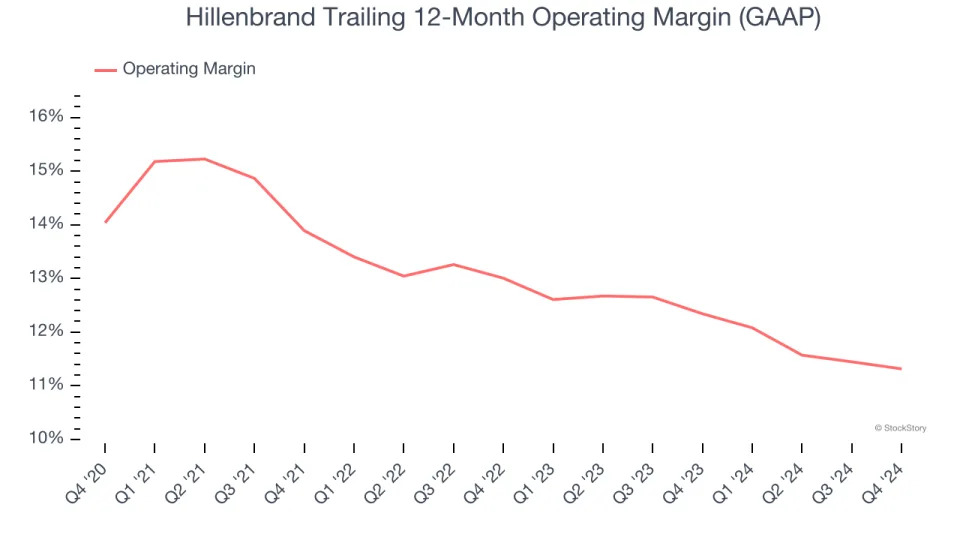

Hillenbrand has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Hillenbrand’s operating margin decreased by 2.7 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Hillenbrand become more profitable in the future.

This quarter, Hillenbrand generated an operating profit margin of 9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

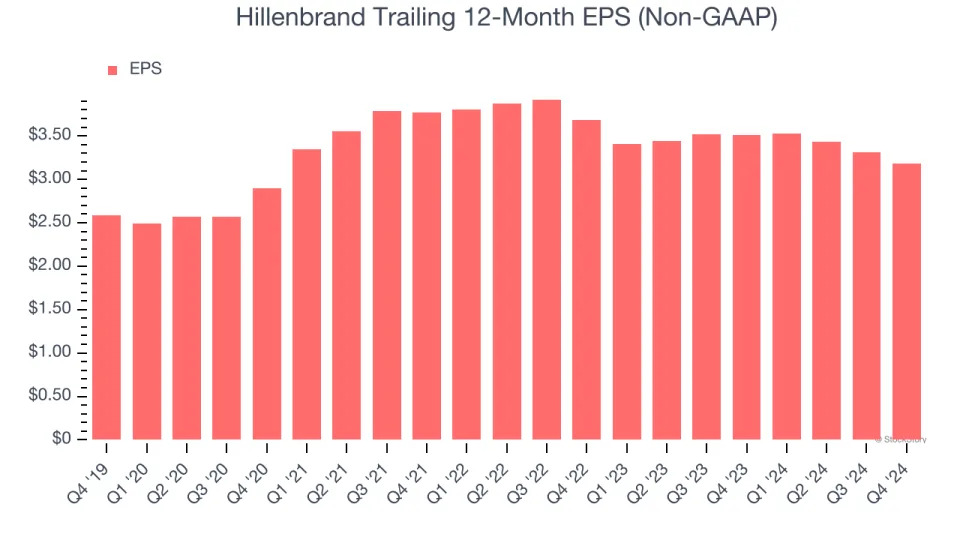

Hillenbrand’s EPS grew at an unimpressive 4.2% compounded annual growth rate over the last five years, lower than its 9.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

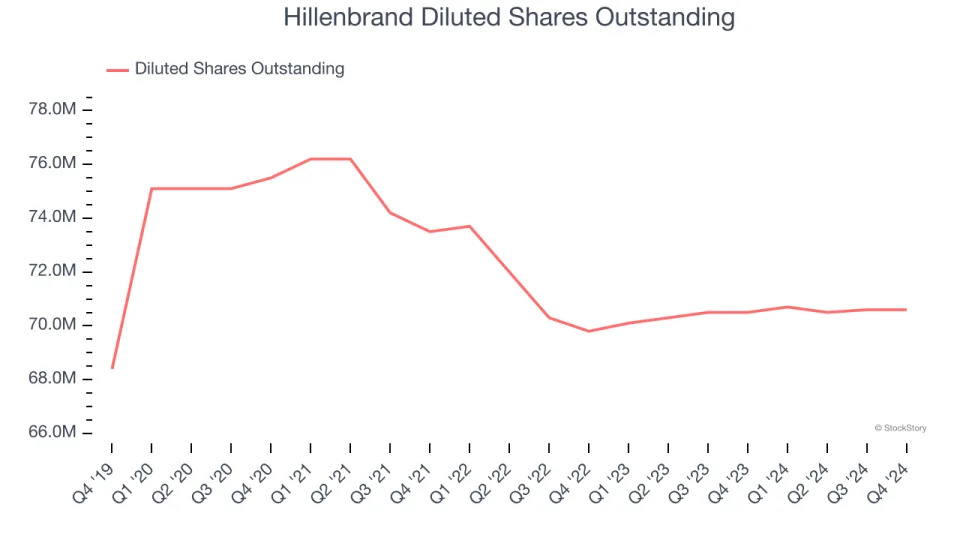

Diving into the nuances of Hillenbrand’s earnings can give us a better understanding of its performance. As we mentioned earlier, Hillenbrand’s operating margin was flat this quarter but declined by 2.7 percentage points over the last five years. Its share count also grew by 3.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Hillenbrand, its two-year annual EPS declines of 7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Hillenbrand reported EPS at $0.56, down from $0.69 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Hillenbrand’s full-year EPS of $3.18 to shrink by 2.7%.

Key Takeaways from Hillenbrand’s Q4 Results

It was encouraging to see Hillenbrand beat analysts’ revenue and EPS expectations this quarter. On the other hand, its full-year revenue, EPS, and EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter due to the outlook. The stock traded down 7.9% to $31.25 immediately after reporting.

Hillenbrand’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .