Hologic (NASDAQ:HOLX) Reports Q4 In Line With Expectations But Full-Year Sales Guidance Misses Expectations

Medical technology company Hologic (NASDAQ:HOLX) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $1.02 billion. On the other hand, next quarter’s revenue guidance of $1 billion was less impressive, coming in 3.2% below analysts’ estimates. Its non-GAAP profit of $1.03 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy Hologic? Find out in our full research report .

Hologic (HOLX) Q4 CY2024 Highlights:

“Our financial results for the first quarter of 2025 were consistent with our guidance overall,” said Stephen P. MacMillan, the Company’s Chairman, President and Chief Executive Officer.

Company Overview

Founded in 1985, Hologic (NASDAQ:HOLX) develops diagnostic, medical imaging, and surgical solutions focused on women’s health, diagnostics, and gynecologic surgical products.

Medical Devices & Supplies - Imaging, Diagnostics

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

Sales Growth

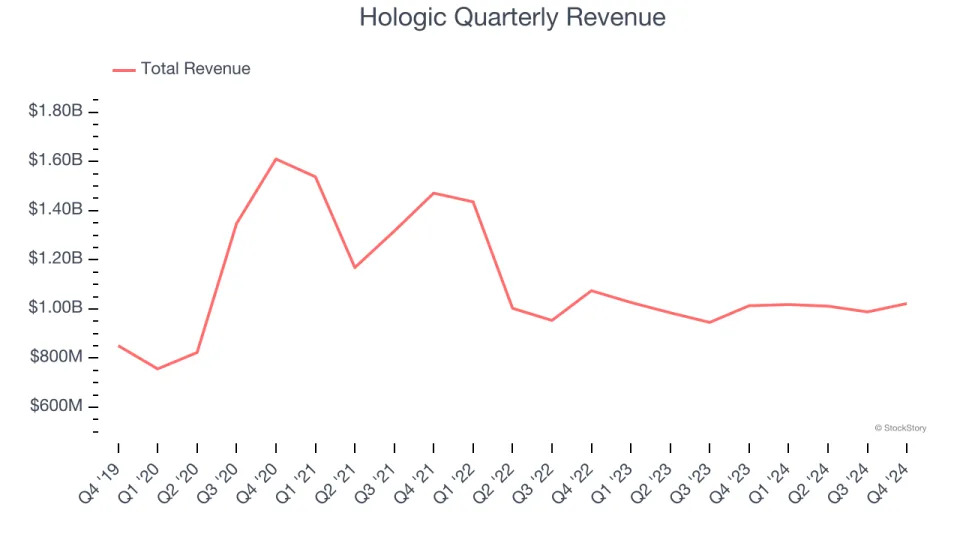

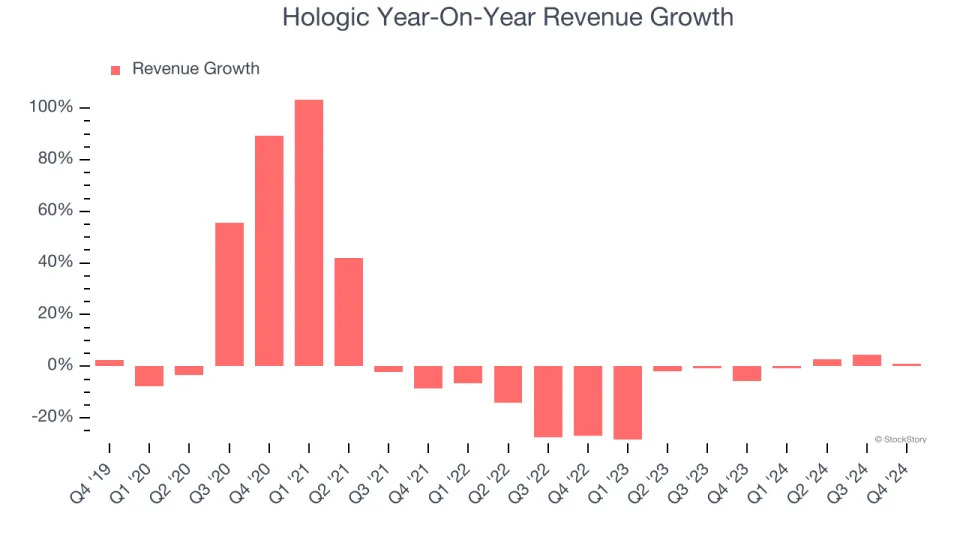

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Hologic’s sales grew at a tepid 3.6% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Hologic’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.9% annually.

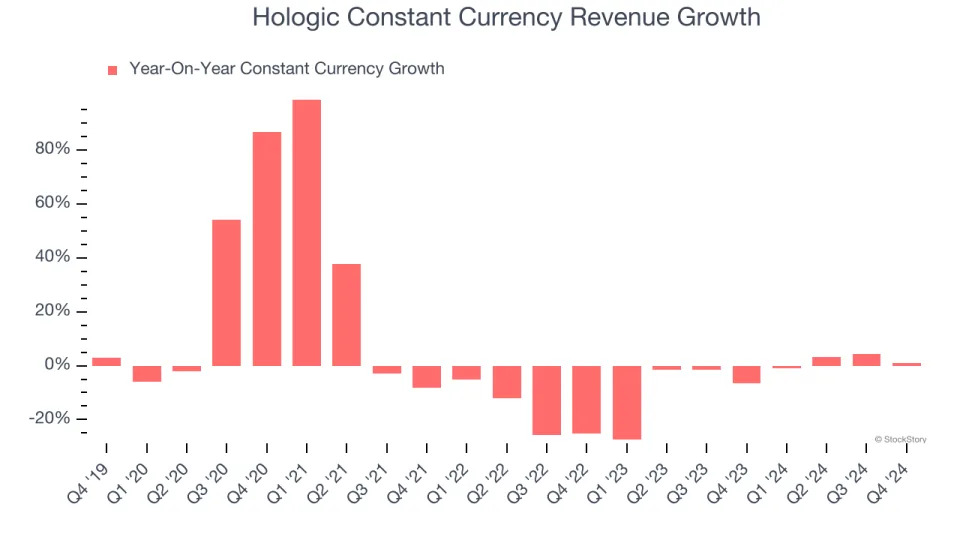

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3.7% year-on-year declines. Because this number aligns with its normal revenue growth, we can see Hologic’s foreign exchange rates have been steady.

This quarter, Hologic’s $1.02 billion of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 1.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Adjusted Operating Margin

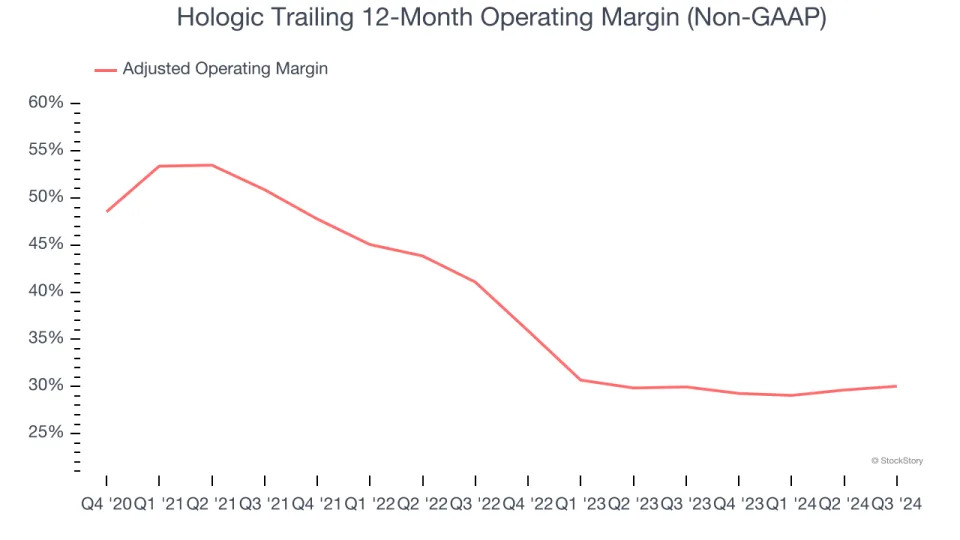

Hologic has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 39.6%.

Analyzing the trend in its profitability, Hologic’s adjusted operating margin decreased by 11.6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 6.9 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Hologic generated an adjusted operating profit margin of 31.9%, up 3.4 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

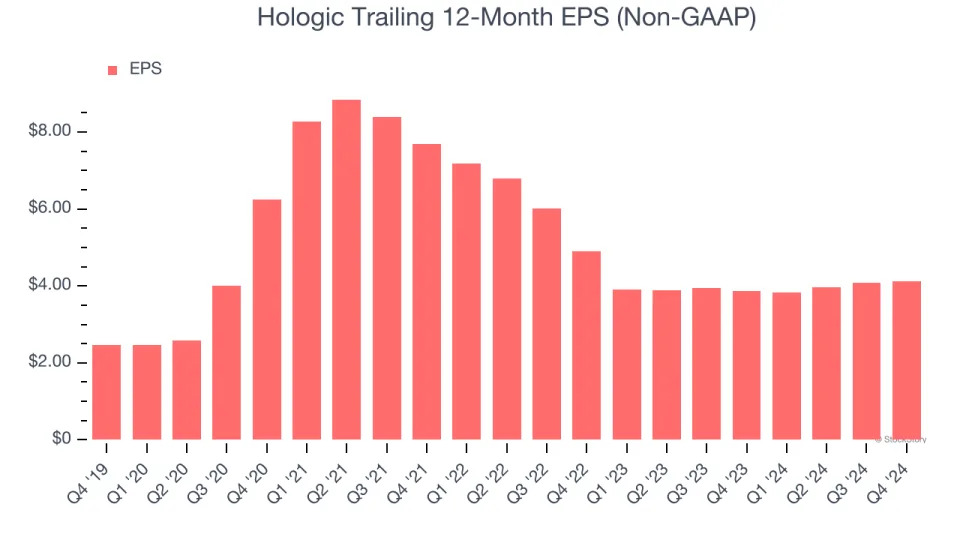

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hologic’s EPS grew at a remarkable 10.8% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t expand.

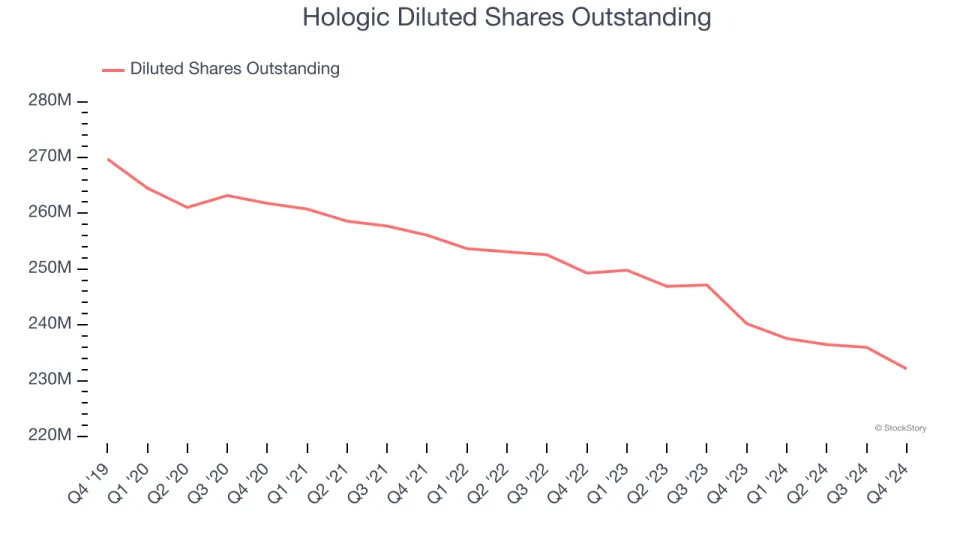

Diving into Hologic’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Hologic has repurchased its stock, shrinking its share count by 13.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Hologic reported EPS at $1.03, up from $0.98 in the same quarter last year. This print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects Hologic’s full-year EPS of $4.13 to grow 5.7%.

Key Takeaways from Hologic’s Q4 Results

It was good to see Hologic narrowly top analysts’ full-year EPS guidance expectations this quarter. On the other hand, its full-year revenue guidance missed significantly, which matters more to investors. Overall, this was a softer quarter. The stock traded down 3.4% to $70.32 immediately following the results.

The latest quarter from Hologic’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .