Amtech’s (NASDAQ:ASYS) Q4 Sales Top Estimates But Quarterly Revenue Guidance Significantly Misses Expectations

Semiconductor production equipment provider Amtech Systems (NASDAQ:ASYS) announced better-than-expected revenue in Q4 CY2024, but sales fell by 2.1% year on year to $24.39 million. On the other hand, next quarter’s revenue guidance of $22 million was less impressive, coming in 14.1% below analysts’ estimates. Its non-GAAP profit of $0.02 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Amtech? Find out in our full research report .

Amtech (ASYS) Q4 CY2024 Highlights:

“I'm pleased to report a strong first quarter that exceeded the high end of our guidance, with $24.4 million in revenue and $1.9 million in adjusted EBITDA. While industry softness remains a headwind, we continue to make progress on our operational excellence and cost optimization initiatives, evidenced by the $1.8 million year-over-year increase in adjusted EBITDA. With strong long-term growth drivers that include AI infrastructure investments and our initiatives to grow our consumables, parts and services revenue, we are well positioned to deliver profitable growth that should result in meaningful value creation for shareholders,” commented Mr. Bob Daigle, Chief Executive Officer of Amtech.

Company Overview

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales Growth

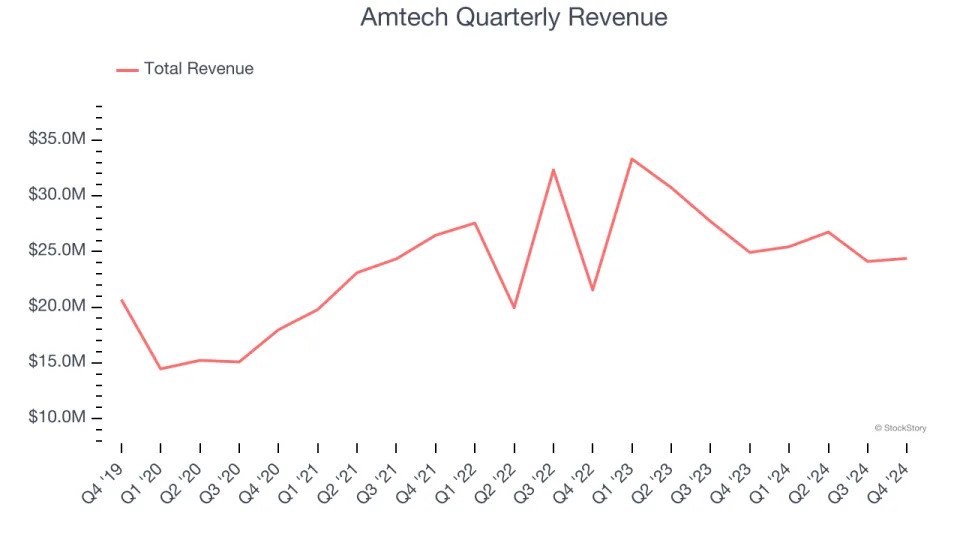

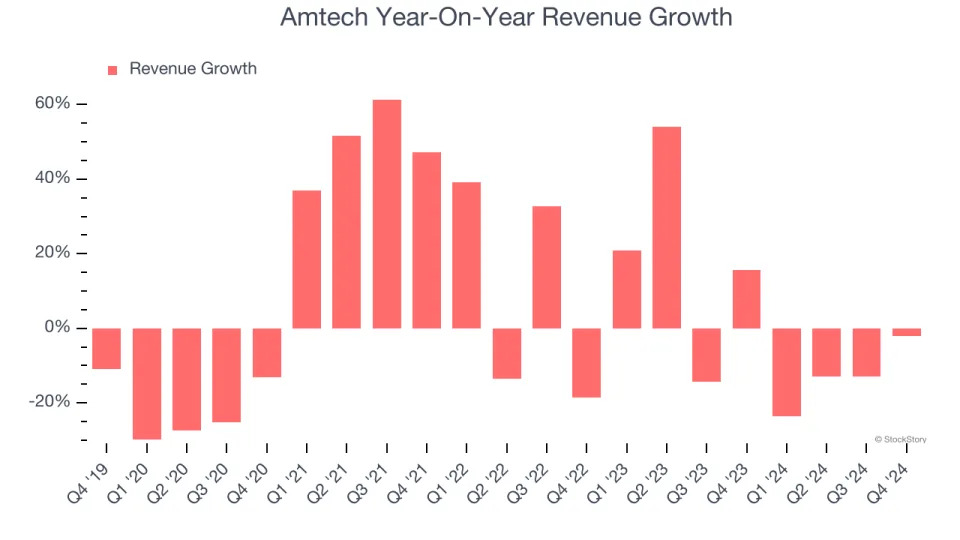

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Amtech’s 4.1% annualized revenue growth over the last five years was sluggish. This was below our standard for the semiconductor sector and is a poor baseline for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Amtech’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Amtech’s revenue fell by 2.1% year on year to $24.39 million but beat Wall Street’s estimates by 4.9%. Company management is currently guiding for a 13.5% year-on-year decline in sales next quarter.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Product Demand & Outstanding Inventory

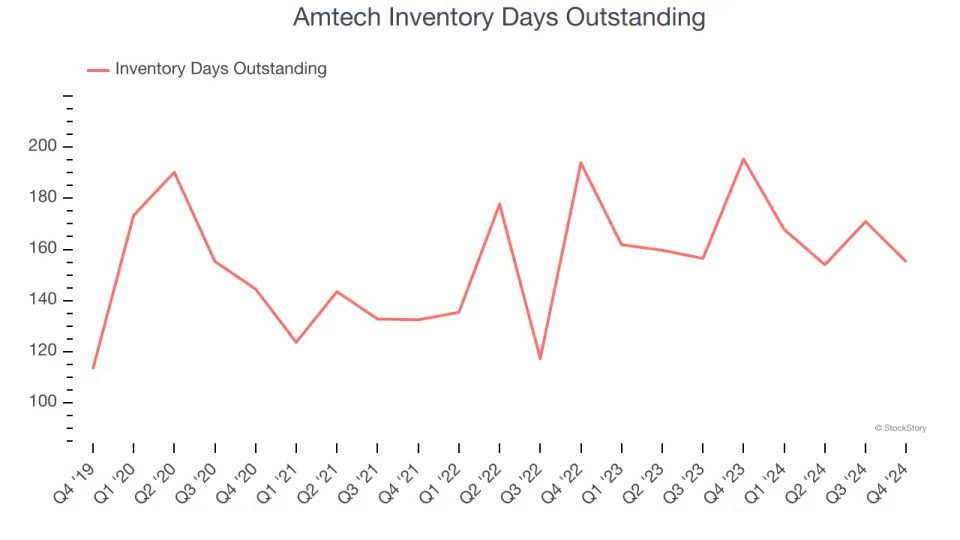

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amtech’s DIO came in at 155, which is 2 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Amtech’s Q4 Results

We were impressed by Amtech’s strong improvement in inventory levels. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly. Although not a perfect quarter, we think this was a decent quarter especially considering the uneven results in the sector this quarter. The stock traded up 3.8% to $5.44 immediately after reporting.

So do we think Amtech is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .