8 ways investors can play a possible Trump-driven inflation shock that deprives the market of rate cuts

Just when things were beginning to settle on the economic front, inflation could make a comeback or, at the least, surprise to the upside.

An America-first, Trumponomics era, marked by tax cuts , deregulation, and protectionist policies , sounds like a deal for the domestic economy. But it could also upset some things, especially inflation. The big question is, by how much?

On top of modeling traditional indicators, market forecasters must consider what Washington may do. Since no one has a crystal ball, everyone is taking it one day at a time while making a few swings at forecasting the numbers.

Christophe Barraud, the chief economist at Market Securities Monaco with a winning track record for accurate economic outlooks, has a base case for 2025's consumer price index averaging 2.7%, above the consensus of 2.6%, with the risk that it actually ends up higher. Christian Chan, the chief investment officer at AssetMark, says if pro-inflation policies were enacted in full force, that forecast could be higher at around 3.5%.

Layers of inflation

For now, Trump's seemingly pro-growth policies mean optimism, especially among smaller domestic companies that would benefit most. The outcome could result in increased hiring and an uptick in labor demand. It's good news for those looking for a job, but it also comes at a time when immigration restrictions are expected to tighten labor supply further.

December's already strong labor readings suggest there's not much wiggle room before upsetting the balance of supply and demand. The unemployment rate ticked down to 4.1% from 4.2% the previous month, while 256,000 jobs were added. The combination could cause even further upward pressure on wage growth, Barraud said.

In the shorter term, Barraud points to a few transitory factors that may give CPI an additional bump up. They include the California wildfires and hurricanes that could increase rebuilding costs and homeowners and auto insurance premiums.

Then, there are tariffs, which add a layer of complication. Consumers are likely to pick up the bill on imports as a form of consumption tax. Goldman Sachs forecasts tariffs will lead to a one-time 0.3% boost to inflation, a number that's not enough to take rate cuts off the table but could spook FOMC participants from making them. Economic uncertainty combined with a desire to avoid taking the blame for inflation's return may cause the central bank to refrain from further cuts in a wait-and-see approach, said Goldman Chief Economist Jan Hatzius in a recent note. The investment bank maintains expectations of two 25-basis-point cuts in June and December.

But Barraud believes rate cuts could be off the table entirely this year mainly because domestic growth is strong and will likely stay that way. His forecast for US GDP 2025 is 2.3%, above the consensus of 2.2%. While he is inclined to increase it, he's waiting for further details about Washington's policy changes and whether consumer spending remains robust.

Chan says further economic growth is also showing on the manufacturing front. December's new orders for the Purchasing Managers' Index rose into positive territory for the second month at 52.5%, an early indicator that the overall PMI, which sat at 49.3%, could rise above 50, the threshold for expansion.

Other areas, like consumer spending and household net worth, are also up, suggesting that the consumer is in pretty good shape, which supports stickier inflation, Chan said. Finally, rents remain high as more would-be homeowners turn to short-term solutions amid elevated mortgage rates, he added.

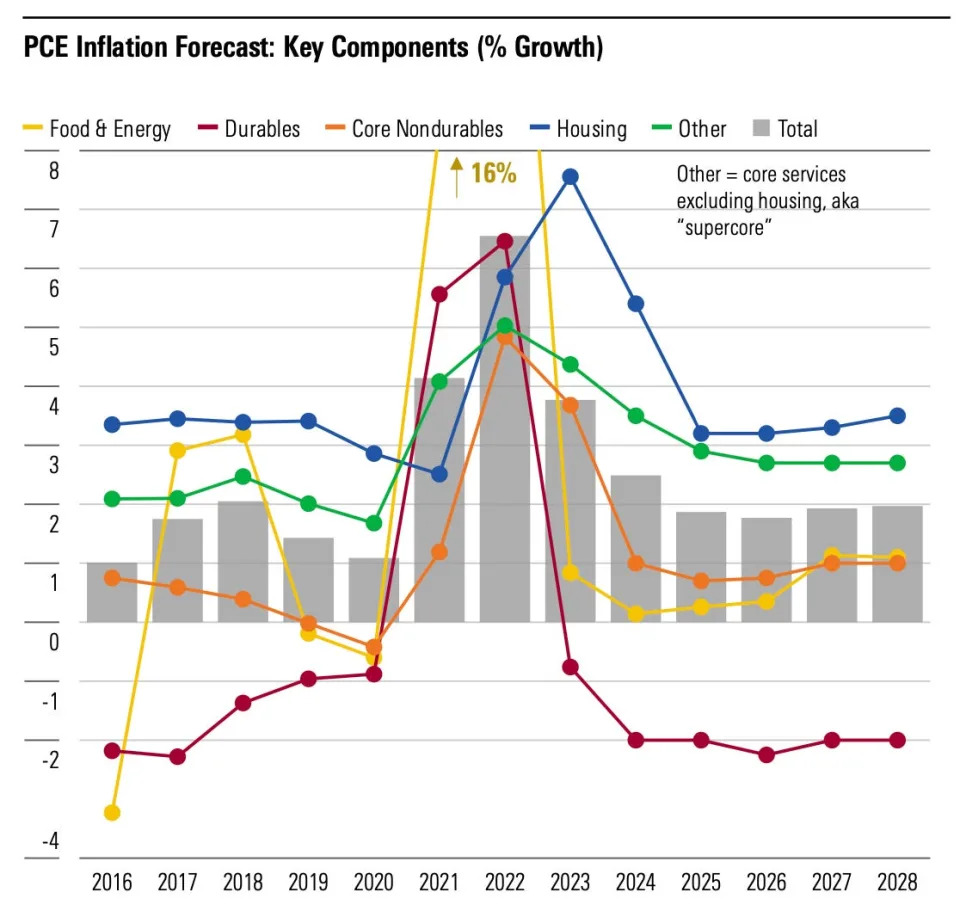

Below is a chart from Morningstar that reflects projected personal consumption expenditures (PCE), a measure of household spending on goods and services. It shows expectations of housing costs sharply dropping along with food and energy costs. Morningstar projects an average inflation rate of 1.9% over 2025-28, adding 0.2% for the impact of additional tariffs, noting that full implementation of tariffs would result in another increase of 1%-2%.

How to invest

Investors looking for some balance and safety should consider industrials , materials , and energy stocks , all of which should hold up if inflation returns, Chan said. In 2022, these sectors outperformed the broad market amid the inflation spike, he added. Exchange-traded funds that track these sectors include the Vanguard Industrials , Materials Select Sector SPDR Fund , and Energy Select Sector SPDR Fund .

He also suggests balancing Big Tech with cyclical growth stocks because the latter are cheaper and have lower earnings expectations baked into their prices. And in general, they are less interest-rate sensitive relative to high-growth stocks. In the event inflation pushes rates higher, they should hold up better than their higher-P/E tech peers, Chan said.

He further recommends a barbell strategy in the fixed-income portion of the portfolio: a combination of bonds at opposite ends of the risk spectrum with short-duration Treasuries and high-yield bonds. Keep in mind that high-yield bonds can be much more volatile than Treasuries in the short term, he said.

Since late last year, Goldman Sachs strategists have recommended owning real, cash-flowing growth assets such as real estate and infrastructure (including the utilities and telecom sectors) because these historically perform well when inflation starts to reheat.

" Commodities performed best in periods of high and rising inflation, providing an imminent hedge — in part this is due to their direct link to inflation but also as they are less driven by expectations," added a team including Guillaume Jaisson in a recent note.

Read the original article on Business Insider