It’s time to take profits from our winning stock tips – and where you should put them

Questor is The Telegraph’s stockpicking column, helping you decode the markets and offering insights on where to invest.

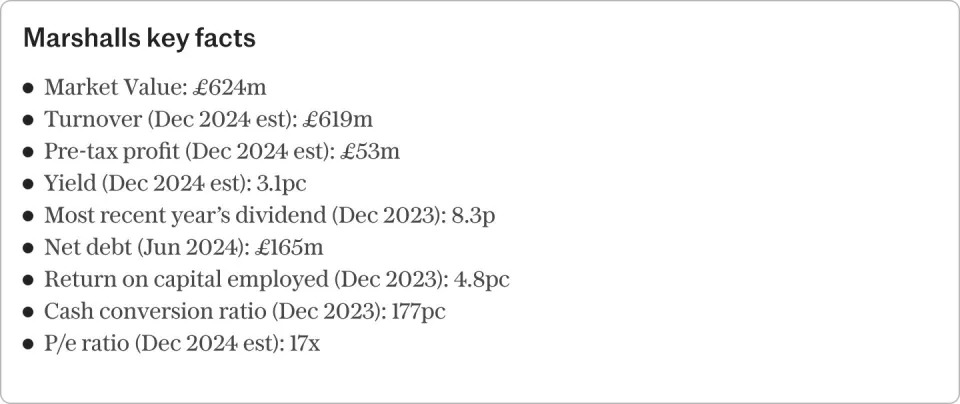

The share price may be crumbling but we believe the investment case for landscaping, building and roofing products supplier Marshalls remains solid, so we shall keep faith in the recovery potential at the West Yorkshire company.

The shares are down by almost a fifth since last spring’s initial study , which is not a comfortable position and one in which the interim dividend payment of 2.4p a share makes a small dent.

Worries over the rate at which interest rates may go down in 2025 – thanks to sticky inflation, government borrowing and ructions in the gilt market – are one issue.

Add in increased employee costs thanks to last year’s Budget changes to National Insurance contributions and wider concerns over the flaccid state of the UK economy. It is easy to see why the big, macroeconomic picture looks gloomy, especially as consensus analysts’ forecasts for revenues are down by around 10pc since last spring.

However, there are still three reasons for optimism.

First, profit forecasts for 2024 are all but unchanged, thanks to Marshalls’ ongoing cost and efficiency programmes and also business mix, as sales at the higher-margin roofing operation, Marley, show resilience.

Second, last week’s trading update proved the latter half was better than the first. Roofing sales rose by 4pc across the whole of 2025 and by 15pc year-on-year in the fourth quarter. Building products sales were flat year-on-year in the second half and even landscaping, the weakest area last year, showed lower rates of decline as the year wore on, to suggest the worst may be over.

Finally, debt continues to come down. Adjusting for leases and a pension surplus, net borrowings fell to £165m from £204m, and Matt Pullen, the chief executive, flagged a further reduction in the second half, thanks in the main to healthy free cash flow.

As regular readers are now doubtless fed up reading, this column is a great believer that less debt means less risk and less risk can lead to a higher rating, or multiple of earnings, over time, all other things being equal.

Analysts are trimming the numbers for 2025, so we must not be blind to the risks, even if they seem related to matters beyond management’s control, such as macroeconomic factors.

But the shares are no higher than they were in 2002 and are way down from even autumn’s highs, when last May’s analysis in this column looked a little more inspired than it does right now. That seems to give the company little credit for any potential recovery in profits, for reasons of either self-help or a broader cyclical upturn.

Marshalls made nearly 30p in earnings per share in 2019 just before the pandemic and the dividend reached 15.6p a share in 2022. A return to anything like those levels would leave the stock looking cheap on both an earnings and a yield basis.

Marshall’s full-year results are due on 17 March.

Questor says: buy

Ticker:MSLH

Share price: 247.5p

Update: Beazley and Lancashire

This column took a shine to Lloyd’s of London syndicate managers Lancashire and Beazley when sentiment was depressed toward non-life insurance and reinsurance, thanks to a succession of weather-related and geopolitical incidents . Rates were under pressure and dividends were skinny, with the result that valuations were low, especially relative to net asset, or book value . We have nearly doubled our money on Beazley and banked increasingly generous dividends from Lancashire and, as a result feel, it may be time to move on.

This may seem perverse when the latest outlook statements for 2024, and forecast combined ratios are well below 100pc to signify healthy profits. But strong income can mean underwriters have more capital with which to operate, which in turn can lead to increased capacity and weaker pricing – and the early signs are that reinsurance rates for property and catastrophe are starting 2025 by going gently lower.

Lancashire has more exposure here than Beazley and both may be able to mitigate this to some degree but this suggests the cycle may be turning – and the best time to invest in this sector is usually when capacity is coming out, not going in.

Moreover, Lancashire trades at 1.4 times tangible net asset value per share and Beazley 1.7 times, based on the last reported figure, ratings which could also cap upside. Both are well-run firms with strong dividend records, so we may be trying to be too clever by half, and any pullback could bring them back into our radar.

Questor says: sell

Ticker:BEZ/LRE

Share price: 832.5p/643p

Read the latest Questor column on telegraph.co.uk every weekday at 5am. Read Questor’s rules of investment before you follow our tips.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.