3 Reasons to Avoid KMT and 1 Stock to Buy Instead

Over the past six months, Kennametal’s stock price fell to $23.77. Shareholders have lost 7% of their capital, which is disappointing considering the S&P 500 has climbed by 10.4%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Kennametal, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in Kennametal. Here are three reasons why there are better opportunities than KMT and a stock we'd rather own.

Why Do We Think Kennametal Will Underperform?

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE:KMT) is a provider of industrial materials and tools for various sectors.

1. Slow Organic Growth Suggests Waning Demand In Core Business

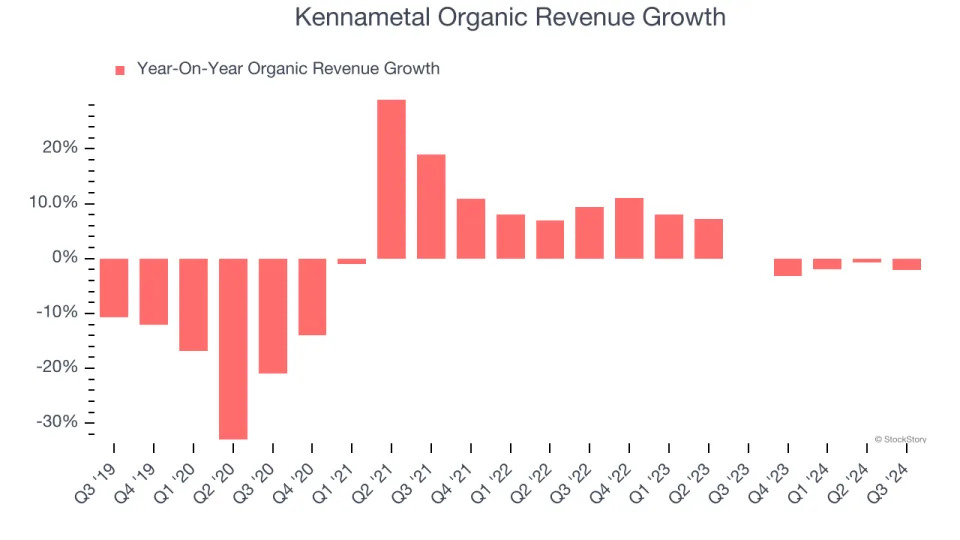

In addition to reported revenue, organic revenue is a useful data point for analyzing Professional Tools and Equipment companies. This metric gives visibility into Kennametal’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Kennametal’s organic revenue averaged 2.3% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. EPS Trending Down

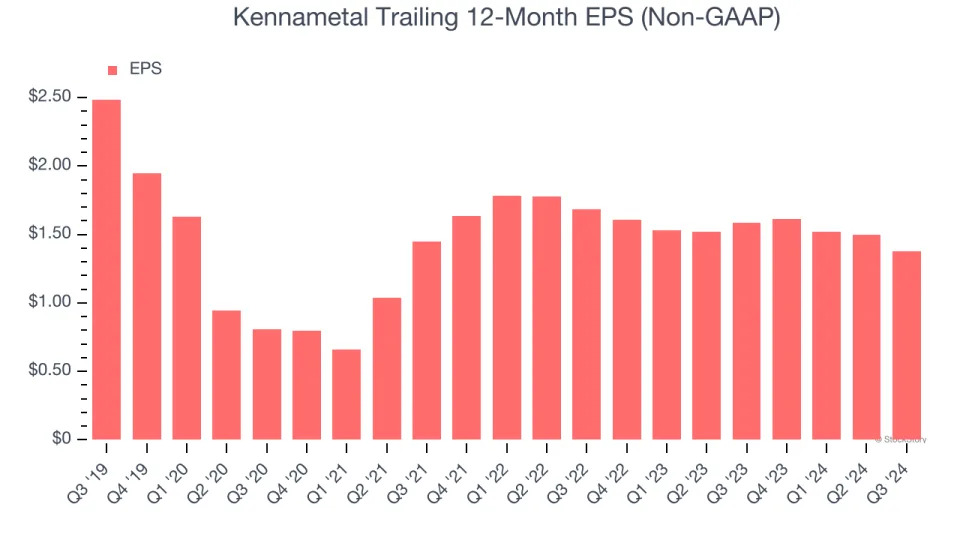

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Kennametal, its EPS declined by more than its revenue over the last five years, dropping 11.2% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Previous Growth Initiatives Haven’t Paid Off Yet

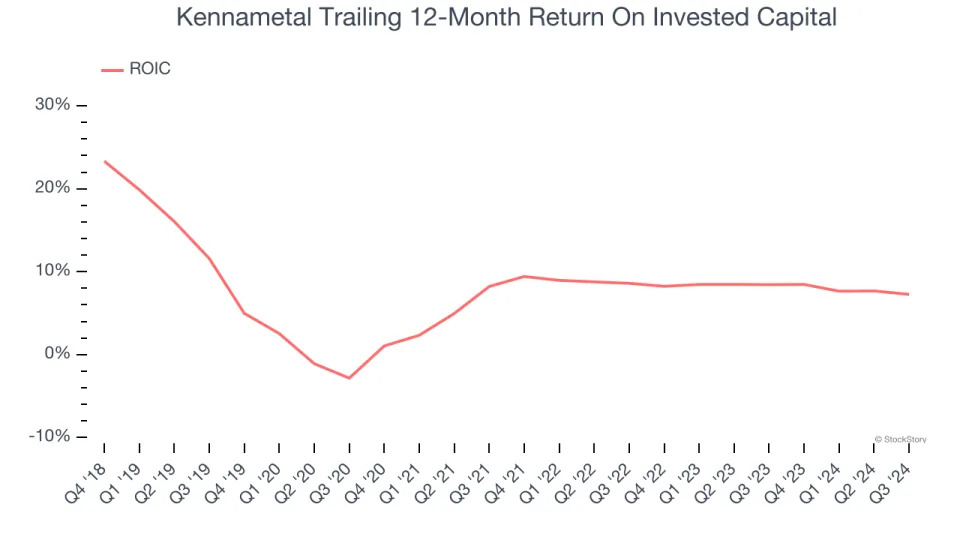

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kennametal historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Kennametal doesn’t pass our quality test. Following the recent decline, the stock trades at 14.8× forward price-to-earnings (or $23.77 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy .

Stocks We Would Buy Instead of Kennametal

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free .