Crosswinds lash US industrial economy

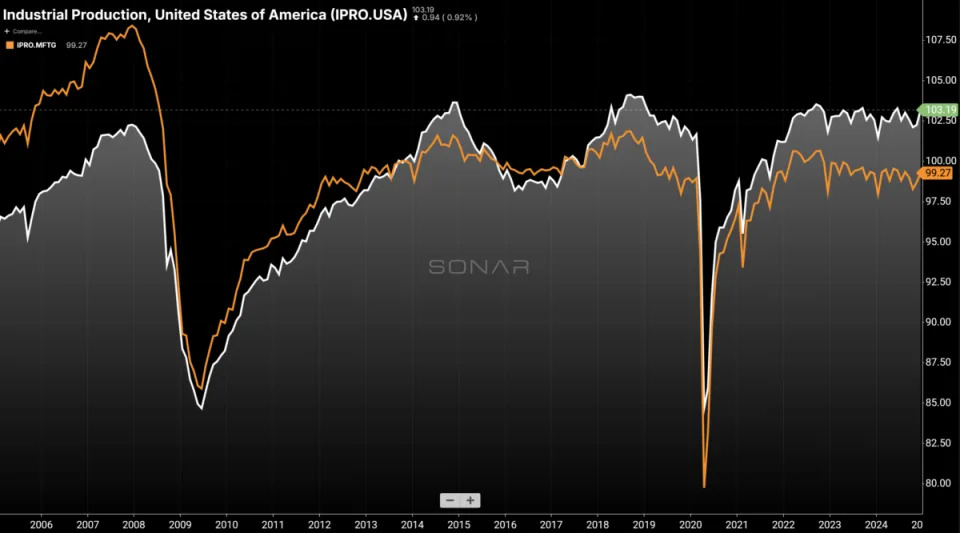

Industrial production in the United States ended 2024 on a hopeful note, surpassing economists’ expectations and suggesting that the manufacturing sector is stabilizing after two years of decline.

In December, industrial output rose by 0.9% — the largest monthly increase since last February — bolstered by an uptick in factory activity and the resolution of a prolonged strike at Boeing. This uptick not only exceeded forecasts but marked a significant rebound in manufacturing, which had previously struggled amid high borrowing costs and fluctuating demand.

The Federal Reserve’s December report highlighted that manufacturing output climbed by 0.6%, its most substantial gain since August 2024. This growth was driven largely by a 6.3% surge in aerospace equipment production following the end of Boeing’s strike. However, production in consumer goods and construction supplies also improved noticeably and played a role in the broader industrial expansion.

Excluding a dip in auto output, factory production increased by 0.7%, while mining and utilities enjoyed gains of 1.8% and 2.1%, respectively. The rise in natural gas extraction significantly boosted the utilities sector, a sign of growing demand both at home and abroad.

Retail sales data from December similarly affirmed a positive trajectory for the U.S. economy. Goods spending for gross domestic product (GDP) saw its largest increase in three months, indicating sustained consumer demand. Furthermore, housing starts accelerated to the fastest pace since early 2024. These strong performances led Goldman Sachs economists to raise their GDP tracking estimate for the fourth quarter by 0.1 percentage point to 2.6%.

There’s still a ways to go

Despite these encouraging signs, the manufacturing sector remains in its early stages of recovery. Manufacturing accounted for three-quarters of total industrial production and remained flat compared to December 2023.

December’s increase suggests the very beginning of a potential shift in the sector’s trajectory, contingent on ongoing improvements and favorable trade policies. The Fed’s release also noted that capacity utilization at factories reached a three-month high of 76.6%, though it still lags 2.1 percentage points below the long-term average.

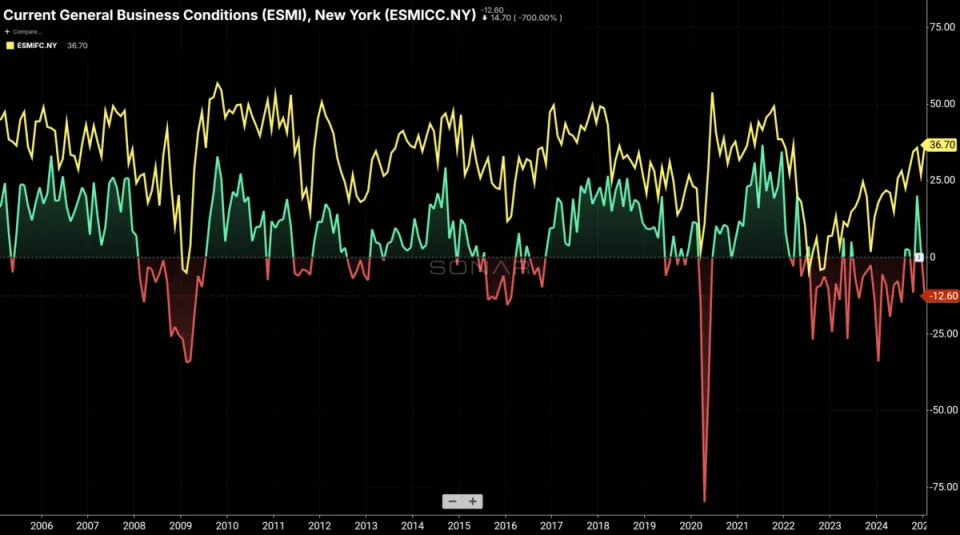

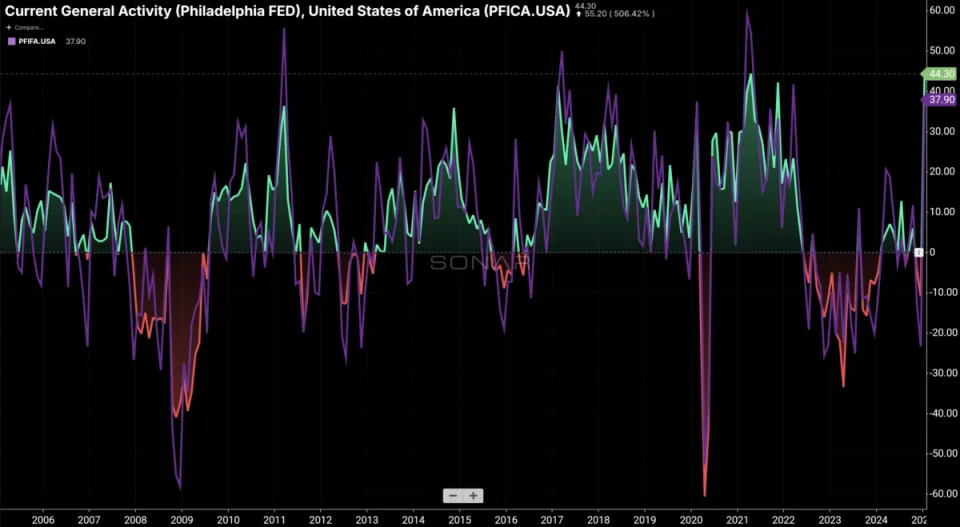

Two key sentiment surveys give further insight into the manufacturing landscape: New York’s Empire State Manufacturing Index and Philadelphia’s Manufacturing Business Outlook Survey.

The Empire State Manufacturing Survey, conducted in early January, betrayed a contraction in general business conditions. The headline index fell 14.7 points from December into the red at minus-12.6, with concurrent declines in new orders and shipments shouldering most of the blame.

Still, firms were not deterred in hoping for improvements over the next six months. The forward-looking index fell by 9.8 points to 34.2, reflecting a wary but still sizeable optimism among manufacturers. The outlook for new orders and shipments was similarly bright, with their respective indexes reading 34.2 (after a 5.9-point bump) and 28.8 (following a 4.2-point stumble).

Conversely, manufacturers’ read of the current environment was far more sunny in Philadelphia. The index for general business activity soared from December’s revised reading of minus-10.9 to 44.3 in January — the highest such reading since April 2021, and the largest monthly increase since June 2020. The new orders and shipment indexes likewise rose to their highest levels since November 2021 and October 2020, respectively.

Looking ahead, the index for future business activity rose 12.5 points to 46.3, a clear expectation for growth over the next half-year. The survey’s forecast for new orders and shipments not only increased but also reached multiyear highs, underscoring a confident stance among manufacturers about sustained demand. The outlook for labor was also favorable, as the employment index rose to its highest level since December 2021 at 40.4.

Though current conditions remain somewhat touch-and-go, the forward-looking surveys point towards a gradual stabilization and potential growth in industrial activity.

Trickle-down freightonomics

Increased manufacturing output directly translates to higher demand for freight services, especially in sectors experiencing rapid growth like aerospace and energy. As factories ramp up production, the need for transporting raw materials and finished goods intensifies, driving truckload volumes higher.

Moreover, the rise in construction supplies production is a leading indicator for a rise in construction projects, further fueling truckload demand (especially for flatbeds). As these sectors continue to recover and expand, truckload volumes are expected to follow suit, providing a positive outlook for the trucking industry.

However, challenges remain on the horizon. The Federal Reserve’s capacity utilization data suggests there is still slack in the system, with overall utilization below historical norms. This underutilization suggests constraints in scaling up operations, which could impact the ability to sustain growth in industrial production and, by extension, truckload volumes. Additionally, ongoing trade tensions and potential tariffs pose risks to manufacturers with international supply chains.

President Donald Trump’s anticipated trade policies are another wildcard to watch. His administration’s stance on tariffs could either bolster domestic manufacturing by making U.S. products more competitive or hamper exporters who may face retaliatory measures abroad. Such policy decisions — and their consequences — will play a crucial role in shaping the future dynamics of industrial demand and transportation logistics.

For more insights on trucking industry dynamics and economic outlooks, subscribe to FreightWaves’ newsletters and stay updated with the latest trends and analyses.

The post Crosswinds lash US industrial economy appeared first on FreightWaves .